Managing your personal finance is the key to a happy and stable life. But it is not that easy in these uncertain times. There are many issues that complicate the matter further. And financial goals and needs are not same for everyone. So it is not possible to draw universal financial ratios that work for everyone.

Though there are few basic ratios that can help you on the task. These ratios are not perfect but can be useful in checking if your spending, saving, debt and money management is in the acceptable ballpark range.

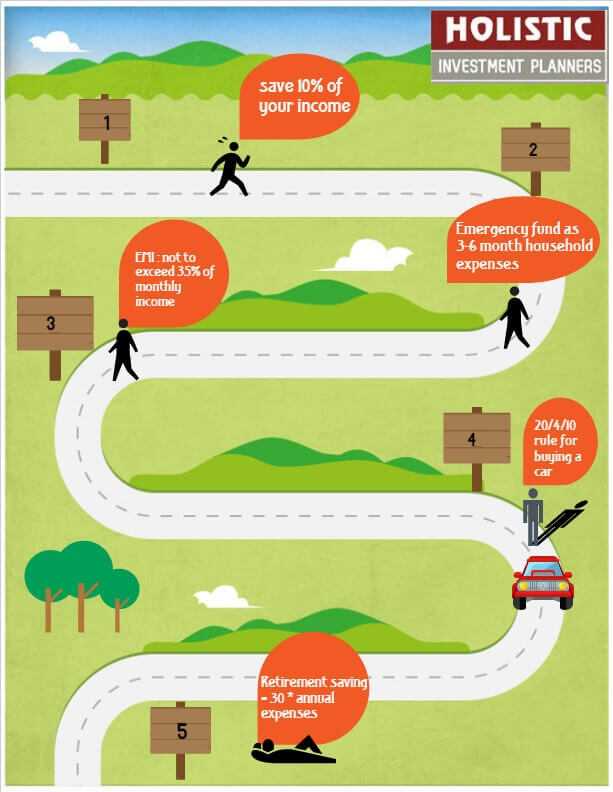

What follows here are financial ratios that you should abide by while managing your personal finance:

Save 10% of your income :

Pay yourself first is the first general rule of saving money. Before you pay your bills, debts and use money for other things set aside your savings every month. The standard rule of thumb dictates that you should save at least 10% of your monthly income in addition to your savings for retirement . This savings will stand you in good stead in case of unexpected expenses like college fee, medical care etc.

Set aside an emergency fund of 3-6 months worth of household expenses :

It is prudent to have some emergency funds to deal with unexpected circumstances like sudden loss of job, health problems , breakdown of your car or high-value house appliances. You must have an emergency fund of three to six month worth of your household expenses. If your monthly expenditure is Rs 25000, you should keep aside between Rs 75,000 and Rs 1, 50,000 as emergency fund.

Debt should not exceed 35% of your monthly income :

The ideal situation would be if you have no debts. But that sounds implausible in the current economy. There are many instances where borrowing money is requisite but within a limit. The maximum debt payments should not be more than 36% of your gross monthly salary, and over time you should try to bring it down to be in control of your life.

The 20/4/10 rule for buying a car:

If you are going to buy a car, you should make a down payment of 20%, finance the car for 4 years and car loan should exceed the 10% of your gross monthly income. The first rule keeps you from paying more EMI, while second and third rule don’t allow you to own more car than you can afford.

Retirement savings should be thirty times your annual expenses:

For a comfortable retirement , you must save thirty times your annual expenses. So if your annual expenses are Rs 15 lac per year, you should save up to 4.5 crores for your retirement. Those early in their careers should save 10% for their retirement, while those closer to retirement should set aside 20% of their income.

These ratios are generic and indicate the approximate financial health of a person. If you would like to check your financial health completely and comprehensively with more accuracy, it is better to design a customized financial plan.

To create a financial plan for a better prosperity, you may want to check our financial planning process. If you want to check our own distinctive complete and comprehensive financial planning process will be suitable to you or not, then you may register for

Leave a Reply