I have been witnessing people, especially the younger generation, working really hard and late hours in order to live a luxurious and content life. When I ask them about investments, most of them satisfactorily tell me that they are saving 20-30% of their monthly income. They seem very happy about it.

If you are one individual who saves 20-30% of your income and feel content about it, I have a game for you. Imagine you are sitting in a time machine and carrying a hundi in which you have put all your savings. Now, this machine has taken you to the future where you have just got retired.

Open your hundi now and look at what you have got. Consider a 6% inflation rate while making these calculations. You will see some amount as your retirement fund, right? Determine how you are going to manage your expenses post-retirement. Do you see what you hoped to see? Nope, right? You will also understand that this is definitely not sufficient to live even a normal life.

So, what went wrong? Why is there is a significant difference in retirement funds? Let me explain it further. Foremost among all, you must understand the difference between saving and investing? I can hear you asking, is there REALLY a difference between saving and investing? Well, read ahead to learn it appropriately.

Table of Contents

- What is saving?

- Is saving important?

- How to start saving?

- What is investing?

- Why should one give too much importance to investing?

- Benefits of investing

- A financial plan to achieve your long term goals

What is saving?

The difference between your monthly income and expenses is referred as ‘savings’. Include all the expenses like food, leisure activities, and school fees, salaries to the maid, driver, rent, bills, maintenance and everything. The balance you have is what you save.

Is Saving important?

Yes, it is important as it helps in times of an emergency. Savings further leads to investment. Hence acts as a ladder to investment.

How to start saving?

If you feel “Saving” to be a big task, then start with a small sum, maybe Rs.500 on a purchase. Then slowly start increasing this amount. You may also make changes to your lifestyle. Say for eg: You live in a costly apartment, you can shift to a more affordable house. These small steps will help you save more.

Read: 3 secret keys to achieving success with saving money

Now that you know how to save smarter, let’s talk about investing.

What is investing?

Investing is nothing but growing your savings by means of various processes like fixed deposits, stock market, mutual funds and buying various investment instruments and products.

Still, feeling confused? Let me explain it with a simple example.

Have you seen the women who have small scale homemade pickle businesses? They save a little from their day jobs, buy seasonable fruits and vegetables in bulk and make pickles and Jam. If they keep the money as it is, it is not going to grow. Even these small scale businesses include processes and procedures to follow, to keep the products carefully and achieve a decent return. Likewise, instead of keeping your savings as it is, investing them appropriately will yield a huge return.

Let me put it more clearly now. Consider your savings as raw materials and investing as a process with which you will grow your money.

“Save to invest, don’t save to save. The only reason to save money is to invest it.” – Grant Cardone

Why should one give too much importance to investing?

Is this the question still running in your mind? Consider you have a son who wants to become a doctor in 15 years down the lane. You would need approximately 50-60 lakhs to complete the basic medical education in today’s scenario. So, you will need to save approximately 4 lakhs every year in order to accomplish your son’s ambition.

Fine, you do save the said amount now sincerely. Did you know how much money you would ‘really’ need for your son to complete medical education 15 years down the lane? It will be around 1 crore. You must always add the inflation of about 6% which will determine the right value of money at any given time. Merely with saving ‘X’ amount every month or every year, you won’t be able to achieve your long term goals.

Hope you understood the importance of adding the inflation rate while saving for a long term goal.

Now let’s see what the benefits of investing are.

Benefits of Investing

- Investing helps beat inflation.

- It gives you higher returns.

- It also helps you reach your long term financial goals.

- Investing also saves on taxes.

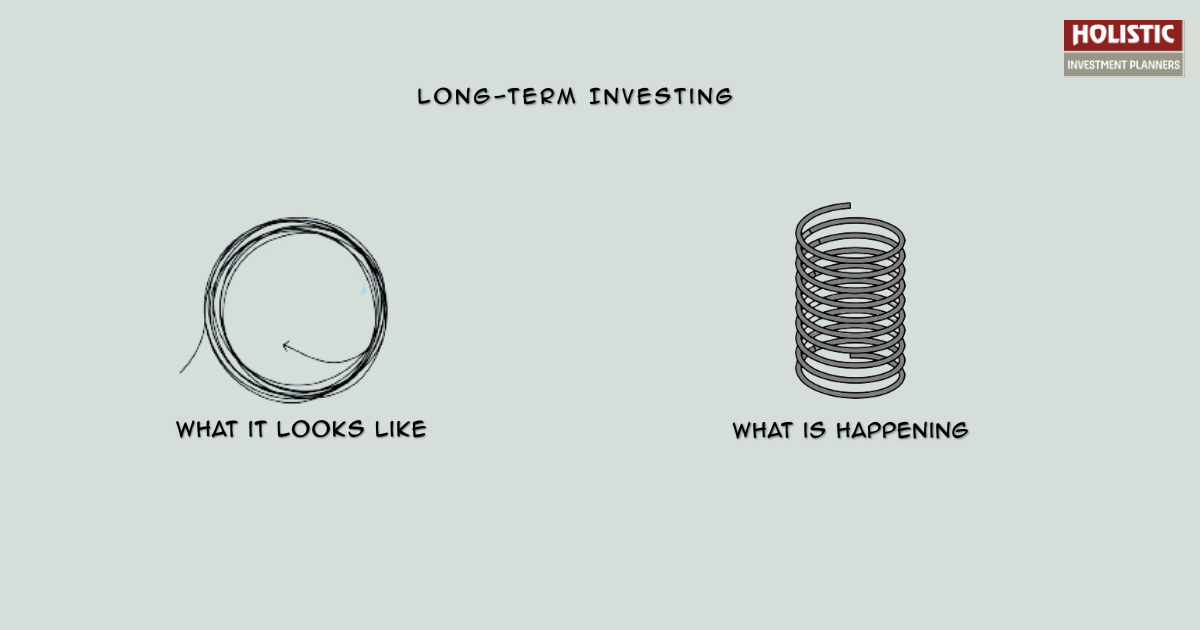

- You can have the benefits of compounding.

“Save and Invest as if you were to live forever”.

Now let’s see some of the key differences between Saving and Investing.

Now let’s see how to achieve long term financial goals.

Now let’s see how to achieve long term financial goals.

A Financial plan to achieve your long term goals

You must remember the following points to make financial plans which will help in achieving long term goals.

Disciplined Investment Model

You need to be extremely patient while investing regularly and religiously to retrieve huge returns. Remember, savings and investing are the two sides of the coin. Savings will help in creating your future goals confidently, but remember, investing is what will take you to achieve these goals. Merely saving a percentage from your income will not yield any results. Create a disciplined investment model and follow it religiously.

Control Expenses to Generate Savings

Monitor and control your expenses. You can control expenses by limiting the usage of credit cards, paying bills on time and using the resources appropriately. Cut down unnecessary expenditure which will generate more revenue for your savings. Further when you invest more from your savings, you will be able to grow and achieve huge returns.

Save regularly and keep investing for a long period of time

It is very important for you to save regularly, that too, for a long period of time. For example, decide about buying a house in 5 years down the lane as soon as you start earning. Invest wisely during the interim period to yield the money you want at the end of five years. Remember to consider inflation and invest wisely. Once the house is bought, set a goal for the next big investment and continue with saving and investing in order to achieve your goal.

Now, go back to the game we played initially. Get inside the time machine and go to the imaginary world of your retirement period now. Make the same calculations as we did earlier. Isn’t it looking, smelling and feeling great? Yes, saving and investing wisely, religiously and appropriately will lead you to a great future and retired life. To get this financial stability and security, to understand our unique Holistic Financial Planning Process we offer

If you have any comments or questions, write them in the comment box below.

Or are you interested in creating a Comprehensive Financial Plan for your financial goals?

Skip the queue by registering for your 30 Minute FREE Financial Plan Consultation. Click the ‘‘BOOK YOUR SLOT NOW!’’ button below.

Leave a Reply