Feeling uneasy seeing your equity funds in the red lately?

You’re not alone. Many investors are wondering if this is the time to stay invested—or to step aside.

But here’s the truth most forget:

Every strong bull run in history was born during a phase of doubt.

Table of Contents:

- The pause before the leap

- A reality check in numbers

- What happens when prices fall?

- Valuations are improving quietly

- Why optimism makes sense now

- The investor’s edge: patience

- The bottom line

The pause before the leap

Over the past year, Indian equities have lagged behind their global peers.

Trade tensions. Weak rupee. Foreign fund outflows.

Yes, the headlines sound gloomy.

But markets aren’t reacting to the past—they’re quietly preparing for the future.

In the last two decades, the NIFTY 50 has delivered negative one-year returns only 18% of the time.

And in most of those cases?

The next 1 to 3 years produced powerful comebacks—with returns often exceeding 15% CAGR in the following years.

History doesn’t repeat itself exactly. But it often rhymes.

A reality check in numbers

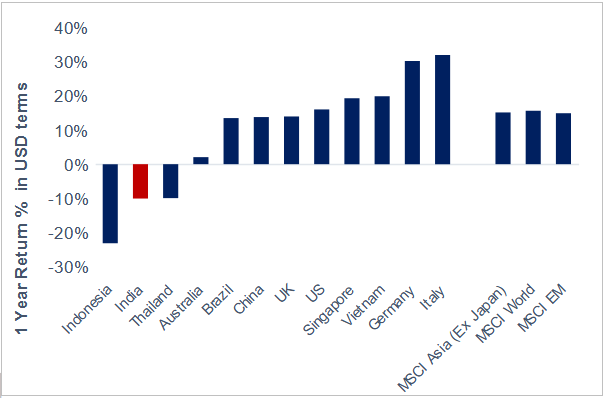

Source: Bloomberg, MSCI indices | Data in USD terms (as of Sep 2025)

The chart above shows how India underperformed several global markets over the past year.

While markets like Italy, Germany, and the MSCI World Index surged, Indian equities (in USD terms) delivered negative one-year returns, largely due to trade uncertainties, rupee depreciation, and foreign capital outflows.

However, this isn’t a sign of weakness—it’s a sign of consolidation after a powerful multi-year rally.

Just as runners slow down to catch their breath before the next sprint, markets too need pauses to build strength.

What happens when prices fall?

Let’s look at it through your SIP lens.

When markets correct, your SIP doesn’t stop—it shines.

Each instalment now buys more mutual fund units.

You’re accumulating wealth at a discount, quietly building the foundation for your next growth phase.

Think of it as a “Sale Season” for long-term investors.

Would you skip a sale on something valuable?

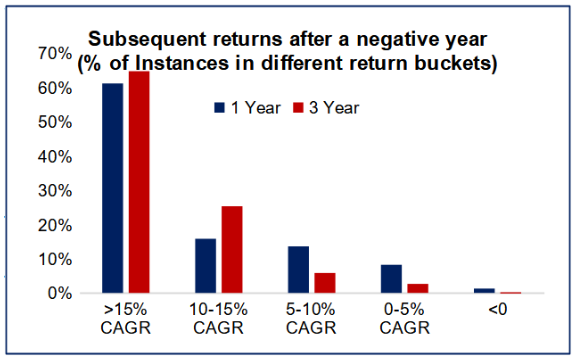

In fact, data shows that after every negative year, NIFTY 50, Mid Cap 150 and Small Cap 250 indices have historically delivered exceptional returns:

- In over 60% of cases, the NIFTY 50 generated 15%+ CAGR returns in the following 1 and 3 years.

- In 90% of such instances, 3-year returns exceeded 10% CAGR.

- Even Mid and Small Cap indices showed 81% and 76% chances respectively of delivering over 15% CAGR post such phases.

So, if your SIP feels slow right now—it’s actually building momentum.

Valuations are improving quietly

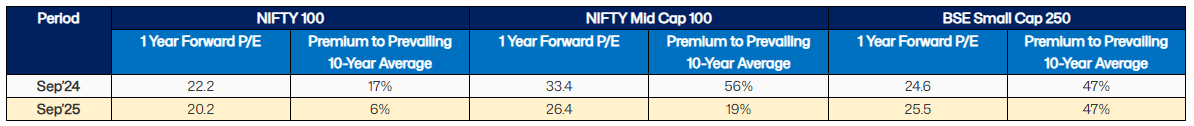

With the recent correction, valuations across market caps have moderated.

Large-caps now trade much closer to their 10-year averages.

Mid-caps, after a steep run, have also cooled off meaningfully.

Even small-caps—though still priced higher—show wide divergence within the segment, creating selective opportunities for skilled investors.

Interpretation:

- NIFTY 100: Forward P/E has eased from 22.2x to 20.2x, premium down from 17% to 6% versus its 10-year average.

- NIFTY Mid Cap 100: Valuation premium dropped sharply from 56% to 19%.

- BSE Small Cap 250: Premium steady at 47%, but with vast differences across individual stocks.

This valuation reset gives long-term investors a more attractive entry point—especially in large and mid-caps.

Why optimism makes sense now

Valuations have cooled off.

Corporate earnings are rebounding.

Inflation is easing.

Consumption is improving.

The Indian economy remains one of the strongest engines of growth in the world.

The premium that Indian markets used to command over other emerging economies has narrowed.

That’s good news—it means you’re entering at fairer prices, with better room for upside.

The investor’s edge: patience

Every correction feels uncomfortable when you’re living through it.

But every correction also plants the seeds of the next wealth-creating phase.

The question is—will you stay invested long enough to harvest it?

The best investors don’t time the market.

They trust the process.

They continue their SIPs when others pause.

And when the tide turns—and it always does—they emerge quietly, confidently ahead.

The bottom line

This is not a time to withdraw in fear.

It’s a time to lean in—with wisdom, discipline, and optimism.

Your SIPs are working harder than ever.

Your patience is compounding quietly.

And your future self will thank you for staying the course when others didn’t.

In the dullness of today, the brilliance of tomorrow is being built.

Leave a Reply