Does the Ageas Federal Magic Savings Plan really create “magic” with your money — or are the returns too modest to impress?

Is the Ageas Federal Magic Savings Plan best suited for conservative investors seeking safety — or unsuitable for those chasing real wealth creation?

Is the Ageas Federal Magic Savings Plan a smart way to ensure disciplined savings — or just another traditional endowment policy in modern clothing?

This article explores the different plan options and payout patterns of the Ageas Federal Magic Savings Plan, providing an analysis to help you assess its suitability for your financial goals.

Table of Contents:

What is the Ageas Federal Magic Savings Plan?

What are the features of the Ageas Federal Magic Savings Plan?

Who is eligible for the Ageas Federal Magic Savings Plan?

What are the plan options and the benefits of the Ageas Federal Magic Savings Plan?

Grace Period, Discontinuance and Revival of the Ageas Federal Magic Savings Plan

Free Look Period for the Ageas Federal Magic Savings Plan

Surrendering the Ageas Federal Magic Savings Plan

What are the advantages of the Ageas Federal Magic Savings Plan?

What are the disadvantages of the Ageas Federal Magic Savings Plan?

Research Methodology of Ageas Federal Magic Savings Plan

Benefit Illustration – IRR Analysis of Ageas Federal Magic Savings Plan

Ageas Federal Magic Savings Plan Vs. Other Investments

Ageas Federal Magic Savings Plan Vs. Pure-term + Equity Mutual Fund

Final Verdict on Ageas Federal Magic Savings Plan

What is the Ageas Federal Magic Savings Plan?

Ageas Federal Magic Savings Plan is a Non-linked, Non-Participating, Individual, Savings, Life Insurance Plan. This plan offers five variants, each tailored to meet your specific financial goals and requirements, with all benefits guaranteed.

What are the features of the Ageas Federal Magic Savings Plan?

- Life cover that safeguards your family throughout the chosen Ageas Federal Magic Savings Plan policy term

- Flexibility to choose from different plan variants, premium payment terms, and policy durations as per your needs

- Guaranteed benefits to support savings for future goals

- Option to decide your preferred income period and payout frequency

- Potential tax benefits on premiums paid and benefits received, as per current tax laws

Who is eligible for the Ageas Federal Magic Savings Plan?

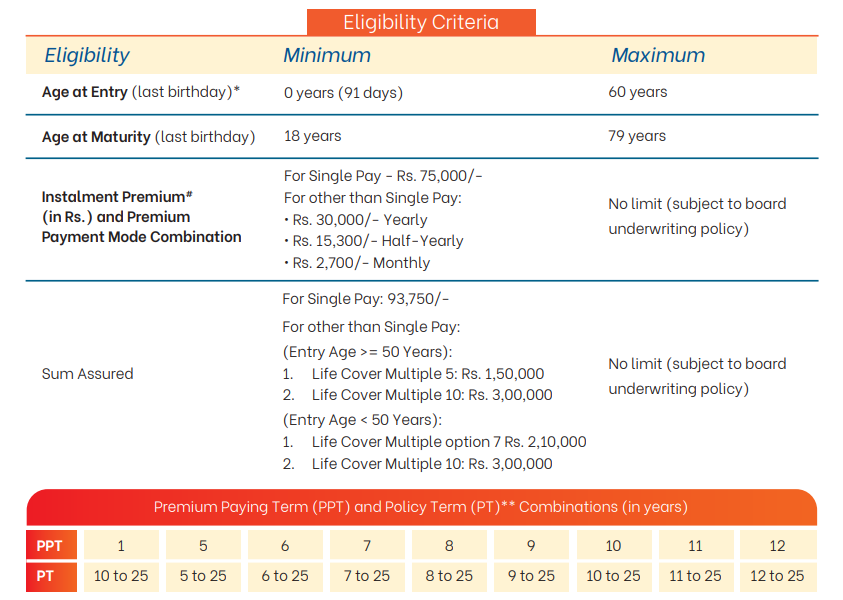

The following is the eligibility criteria for Mega Lump Sum, Absolute Income, Guaranteed Income with Lump Sum

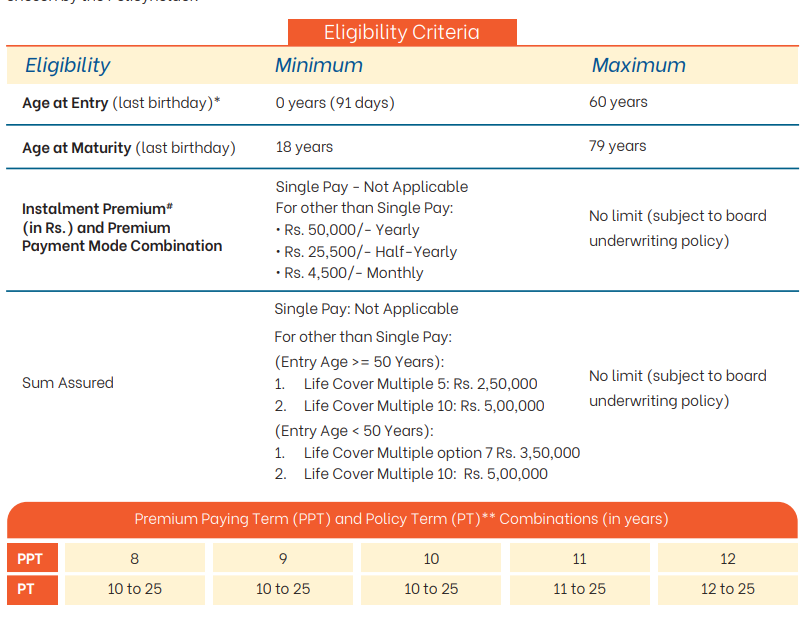

The following is the eligibility criteria for Immediate Income

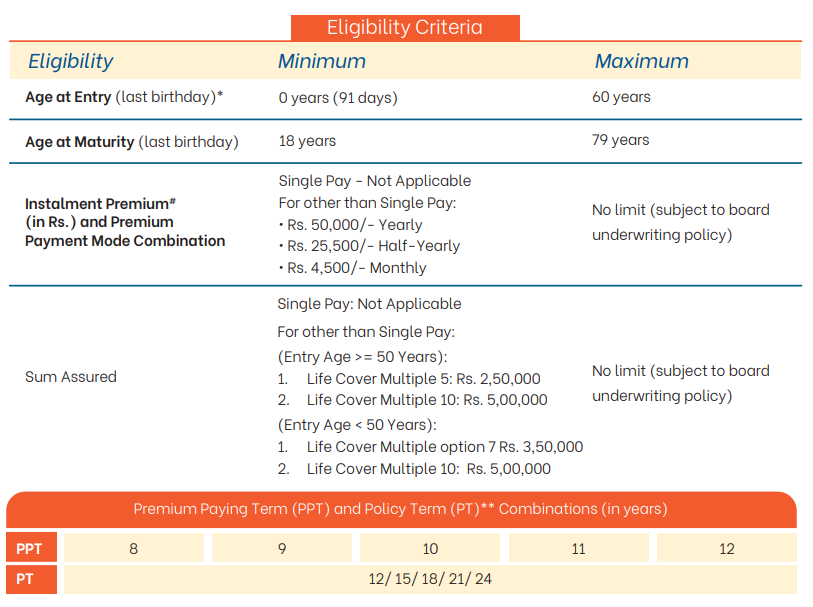

The following is the eligibility criteria for Consistent Income Back

What are the plan options and the benefits of the Ageas Federal Magic Savings Plan?

1. Survival Benefit

i. Mega Lump Sum

NIL

ii. Absolute Income

NIL

iii. Guaranteed Income with a Lump Sum

NIL

iv. Immediate Income

You will get Guaranteed Immediate Income (GII) at the end of each chosen Income Payout Frequency during the policy term, provided the Ageas Federal Magic Savings Plan policy is in force.

GII is defined as:

- 15% x Annualised Premium, during the first 5 years, and

- 30% x Annualised Premium, thereafter till the end of the policy term

v. Consistent Money Back

Guaranteed Consistent Income (GCI) shall be payable at the end of every third policy year during the Ageas Federal Magic Savings Plan policy term, provided the policy is in force and all Premiums due to date have been paid.

GCI is defined as: 60% x Annualised Premium

2. Maturity Benefit

A. Mega Lump Sum

On survival of the Life Assured till the end of the Ageas Federal Magic Savings Plan policy term, Maturity Benefit shall be payable as a lump sum at the end of the policy term, provided the policy is in force.

Maturity benefit = Total Premiums Paid to date, excluding modal loadings + Sum of Accrued GA(s)

B. Absolute Income

On survival of the Life Assured till the end of the policy term, Maturity Benefit shall be payable in equal instalments as Regular Income (RI), at the end of each chosen Income Payout Frequency during the Income Period, provided the Ageas Federal Magic Savings Plan policy is in force.

RI is defined as: Total Premiums Paid till date excluding modal loadings + Sum of Accrued GA(s) + Income Booster / Income Period

C. Guaranteed Income with a Lump Sum

On survival of the Life Assured till the end of the policy term, Maturity Benefit shall be payable in equal instalments as Regular Income (RI), at the end of each chosen Income Payout Frequency during the Income Period and lump sum equal to 110% of Total Premiums paid excluding model loadings till date, at the end of Income Period, provided the policy is in-force

RI is defined as: Sum of Accrued GA(s) + Income Booster / Income Period

D. Immediate Income

On survival of the Life Assured till the end of the Ageas Federal Magic Savings Plan policy term, Maturity Benefit shall be payable in equal instalments as Regular Income (RI), at the end of each chosen Income Payout Frequency during the Income Period, provided the policy is in force.

RI is defined as: Total Premiums Paid till date excluding modal loadings + Sum of Accrued GA(s) + Income Booster / Income Period

E. Consistent Money Back

Maturity Benefit shall be payable in equal instalments as Regular Income (RI) at the end of every three years during the Income Period, provided the policy is in force at the end of the Ageas Federal Magic Savings Plan policy term.

RI is defined as: Total Premiums Paid till date excluding modal loadings + Sum of Accrued GA(s) + Income Booster / No. of Income payouts (Income period/3)

3. Death benefit

For all Plan Variants

On the death of Life Assured during the Ageas Federal Magic Savings Plan policy term, the Death Benefit shall be payable as lump sum, provided the policy is in force and all Premiums due till date have been paid.

Death Benefit shall be the higher of:

- Sum Assured on Death

- Life Cover Multiple * Single Premium or Annual Premium (as applicable)

- Sum of Total Premiums Paid till date, excluding modal loadings and Sum of Accrued GA(s)

Where, Sum Assured on Death = Life Cover Multiple * Single Premium or Annualised Premium (as applicable)

| Premium Paying Policies | Life Cover Multiple Options |

| Single | 1.25 |

| Other than Single | For Entry Age >= 50 years: 5 or 10 For Entry Age < 50 years: 7 or 10 |

Grace Period, Discontinuance and Revival of the Ageas Federal Magic Savings Plan

For other than Single Pay

Grace Period

You get a grace period of 30 days for Yearly and Half-Yearly mode and 15 days for Monthly mode from the date of the first unpaid premium.

Discontinuance

Lapse: In case of non-payment of due Premiums within the grace period for the first full policy year, the policy shall lapse, and no benefits are payable.

Paid-up: The Ageas Federal Magic Savings Plan policy shall acquire a Surrender Value after completion of the first policy year, provided one full year’s premium has been received.

After the acquisition of Surrender Value, in case of non-payment of due Premiums within the Grace Period, the policy shall become paid-up with reduced benefits.

Revival

A policy in lapse or paid up status may be revived for full benefits within five consecutive complete years from the due date of the first unpaid Premium.

Free Look Period for the Ageas Federal Magic Savings Plan

In case you do not agree to any of the policy terms and conditions, or otherwise and have not made any claim, you have the option to return the policy within a free look period of 30 days beginning from the date of receipt of the policy document (whether received electronically or otherwise).

Surrendering the Ageas Federal Magic Savings Plan

For a Single Premium policy, the Ageas Federal Magic Savings Plan policy acquires Surrender Value immediately on payment of the Single Premium.

For other than a Single Premium policy, the policy shall acquire Surrender Value after completion of the first policy year, provided one full year’s premium has been received.

Surrender Value = Maximum [Guaranteed Surrender Value (GSV), Special Surrender Value (SSV)]

What are the advantages of the Ageas Federal Magic Savings Plan?

- Loan facility of up to 75% of the Guaranteed Surrender Value

- “Save the Date” option to receive income on a special date of your choice

- Optional riders to enhance protection as per your needs

- Assurance of guaranteed benefits throughout the Ageas Federal Magic Savings Plan policy term

What are the disadvantages of the Ageas Federal Magic Savings Plan?

- The Income Benefit is primarily utilised for discretionary expenses rather than essential needs.

- The plan does not provide loyalty additions.

- While the benefits are guaranteed, the overall returns remain on the lower side.

- The sum assured may be inadequate to fully meet long-term financial requirements.

Research Methodology of Ageas Federal Magic Savings Plan

The Ageas Federal Magic Savings Plan provides various benefit options—Income Benefit and Lump Sum Benefit—available across five different variants. When choosing a variant, it is important to align your cash flow needs with the potential returns offered.

Benefit Illustration – IRR Analysis of Ageas Federal Magic Savings Plan

To illustrate, let’s consider a 35-year-old male who selects the Mega Lump Sum Benefit option. He opts for a sum assured of ₹7.5 lakhs with a policy term and premium-paying term of 12 years, paying an annual premium of ₹75,000.

| Male | 35 years |

| Sum Assured | ₹ 7,50,000 |

| Policy Term | 12 years |

| Premium Paying Term | 12 years |

| Annualised Premium | ₹ 75,000 |

Under this option, the maturity benefit is paid as a lump sum at the end of the Ageas Federal Magic Savings Plan policy term.

At maturity, he receives ₹12.68 lakhs, which translates into an Internal Rate of Return (IRR) of just 5.18% as per the Ageas Federal Magic Savings Plan maturity calculator. For a long-term investment horizon, this return is quite unattractive.

| Age | Year | Annualised premium / Maturity benefit | Death benefit |

| 35 | 1 | -75,000 | 7,50,000 |

| 36 | 2 | -75,000 | 7,50,000 |

| 37 | 3 | -75,000 | 7,50,000 |

| 38 | 4 | -75,000 | 7,50,000 |

| 39 | 5 | -75,000 | 7,50,000 |

| 40 | 6 | -75,000 | 7,50,000 |

| 41 | 7 | -75,000 | 7,50,000 |

| 42 | 8 | -75,000 | 7,50,000 |

| 43 | 9 | -75,000 | 7,50,000 |

| 44 | 10 | -75,000 | 7,50,000 |

| 45 | 11 | -75,000 | 7,50,000 |

| 46 | 12 | -75,000 | 7,50,000 |

| 47 | 12,68,550 | ||

| IRR | 5.18% |

Since the Lump Sum Benefit itself yields a low IRR, it can be inferred that the other payout options, which distribute benefits periodically, are likely to generate even lower returns.

Overall, the Ageas Federal Magic Savings Plan falls short as a long-term wealth-building tool, making it unsuitable for individuals aiming to achieve significant financial goals.

Ageas Federal Magic Savings Plan Vs. Other Investments

Evaluating cash flows and comparing returns across various investment options is key to making sound financial decisions. For a fair comparison, it is important to use consistent metrics, as shown in the earlier illustration.

The Ageas Federal Magic Savings Plan combines life insurance with guaranteed benefits. However, a more efficient strategy is to separate insurance and investment to optimise outcomes.

Ageas Federal Magic Savings Plan Vs. Pure-term + Equity Mutual Fund

For instance, a pure-term insurance policy with a sum assured of ₹7.5 lakhs costs only ₹3,600 annually for a 12-year policy term with the same premium-paying duration. This leaves ₹71,400 per year available for investment.

| Pure Term Life Insurance Policy | |

| Sum Assured | ₹ 7,50,000 |

| Policy Term | 12 years |

| Premium Paying Term | 12 years |

| Annualised Premium | ₹ 3,600 |

| Investment | ₹ 71,400 |

| Age | Year | Term Insurance premium + Equity Mutual Fund | Death benefit |

| 35 | 1 | -75,000 | 7,50,000 |

| 36 | 2 | -75,000 | 7,50,000 |

| 37 | 3 | -75,000 | 7,50,000 |

| 38 | 4 | -75,000 | 7,50,000 |

| 39 | 5 | -75,000 | 7,50,000 |

| 40 | 6 | -75,000 | 7,50,000 |

| 41 | 7 | -75,000 | 7,50,000 |

| 42 | 8 | -75,000 | 7,50,000 |

| 43 | 9 | -75,000 | 7,50,000 |

| 44 | 10 | -75,000 | 7,50,000 |

| 45 | 11 | -75,000 | 7,50,000 |

| 46 | 12 | -75,000 | 7,50,000 |

| 47 | 18,11,369 | ||

| IRR | 10.38% |

Depending on risk appetite, investments can be tailored—equity for high-risk investors or debt for conservative investors. For this comparison, let’s assume the amount is invested in an Equity Mutual Fund.

Over 12 years, the corpus grows to ₹19.29 lakhs. After accounting for capital gains tax, the post-tax value is ₹18.11 lakhs, giving a post-tax IRR of 10.38%.

| Equity Mutual Fund Tax Calculation | |

| Maturity value after 12 years | 19,29,878 |

| Purchase price | 8,56,800 |

| Long-Term Capital Gains | 10,73,078 |

| Exemption limit | 1,25,000 |

| Taxable LTCG | 9,48,078 |

| Tax paid on LTCG | 1,18,510 |

| Maturity value after tax | 18,11,369 |

This approach not only delivers higher returns but also ensures flexibility in withdrawals, allowing adjustments based on changing financial needs.

In contrast, the Ageas Federal Magic Savings Plan lags behind on both returns and liquidity, making it less effective for long-term wealth creation.

Final Verdict on Ageas Federal Magic Savings Plan

The Ageas Federal Magic Savings Plan comes with five different variants that combine survival and lump sum benefits, offering flexibility to align with your cash flow needs. However, the returns are relatively low, making it an unattractive choice from an investment perspective.

In addition, the sum assured may not be sufficient to provide adequate financial protection for your family in unforeseen circumstances.

Since both the insurance and investment components are weak, the plan does not hold strong merit for inclusion in a well-structured investment portfolio and it also has a high agent commission.

The multiple variants often add to investor confusion and still fail to fully meet financial requirements. A blend of periodic payouts and lump sum benefits, packaged with life cover, is not the most effective approach.

A better strategy is to separate insurance and investment.

Opting for a pure-term insurance policy ensures robust financial protection for your family, while building a diversified investment portfolio—based on your risk tolerance—can deliver higher returns and superior liquidity for long-term goals.

Do Quora, Facebook, and Twitter have the final say when it comes to financial advice?

For a more personalised roadmap, it is advisable to consult a Certified Financial Planner (CFP) who can align your plan with your risk profile and financial objectives.

Leave a Reply