Is Bandhan Life iIncome Wealth Plan a reliable “income + protection” combo — or a compromise that may underdeliver compared to dedicated income or investment products?

Is the Bandhan Life iIncome Wealth Plan really a long-term income solution — or just a short-term payout gimmick?

Can the Bandhan Life iIncome Wealth Plan genuinely serve both as a short-term income solution and a long-term wealth vehicle — or does it try to do too much without excelling at either?

This review breaks down the plan’s options, features, benefits, and drawbacks to help you understand how it works and decide whether it fits your financial goals.

Table of Contents:

What is the Bandhan Life iIncome Wealth?

What are the features of the Bandhan Life iIncome Wealth?

Who is eligible for the Bandhan Life iIncome Wealth?

What are the plan options of the Bandhan Life iIncome Wealth?

What are the benefits of the Bandhan Life iIncome Wealth?

Grace Period, Discontinuance and Revival of the Bandhan Life iIncome Wealth

Free Look Period for the Bandhan Life iIncome Wealth

Surrendering the Bandhan Life iIncome Wealth

What are the advantages of the Bandhan Life iIncome Wealth?

What are the disadvantages of the Bandhan Life iIncome Wealth?

Research Methodology of Bandhan Life iIncome Wealth

Benefit Illustration – IRR Analysis of Bandhan Life iIncome Wealth

Bandhan Life iIncome Wealth Vs. Other Investments

Bandhan Life iIncome Wealth Vs. Pure-term + Equity Mutual Fund

Final Verdict on the Bandhan Life iIncome Wealth

What is the Bandhan Life iIncome Wealth?

Bandhan Life iIncome Wealth is a Non-linked Participating Life Insurance Individual Savings Plan. A highly flexible plan designed to help you achieve your financial goals with ease.

It’s the smart way to plan for tomorrow while protecting those who matter the most today. With options tailored to your needs, you can plan confidently and take control of your financial future

What are the features of the Bandhan Life iIncome Wealth?

- Long-term life insurance coverage available up to 100 years of age.

- Secure Policy Benefit ensures your loved ones’ dreams are protected in the event of your unfortunate demise.

- Flexibility to choose between income-focused or wealth-building options based on your needs.

- Option to receive Cash Bonus (if declared) and Guaranteed Income as early as the first policy month or after a chosen deferment period.

- Freedom to accumulate your income payouts and build a wealth corpus for future financial goals.

- Premium Offset feature allows you to use income payouts to offset future premium payments.

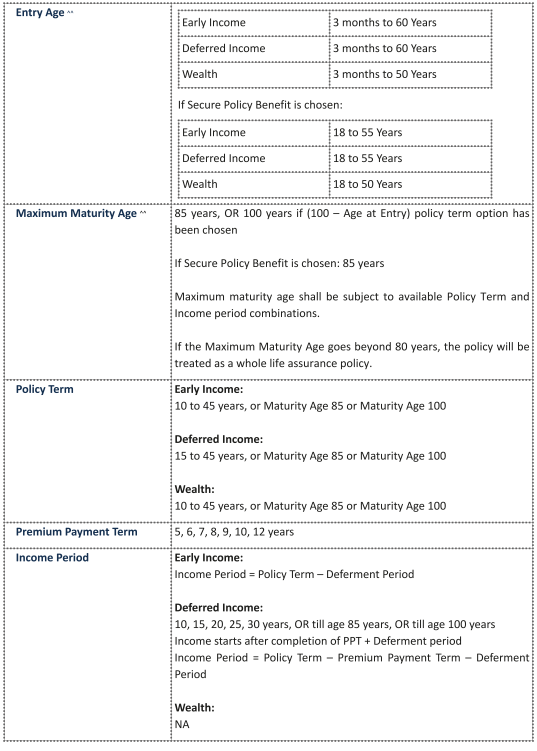

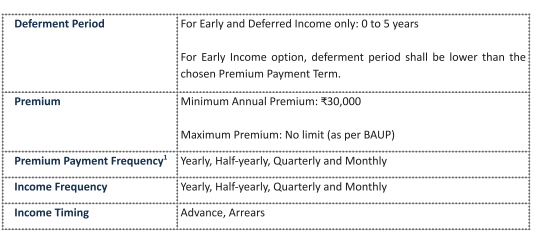

Who is eligible for the Bandhan Life iIncome Wealth?

What are the plan options of the Bandhan Life iIncome Wealth?

1. Early Income

This option provides an income from the 1st policy year (or after Deferment Period, if chosen) in the form of Guaranteed Income and Cash Bonus (if declared).

2. Deferred Income

This option provides income starting after the end of the Premium Payment Term (plus Deferment Period, if chosen). The income will be in the form of Guaranteed Income and Cash Bonus (if declared).

3. Wealth

This option provides a lump sum benefit at the end of the Bandhan Life iIncome Wealth Plan policy term.

What are the benefits of the Bandhan Life iIncome Wealth?

A. Survival Benefit

Early Income Option

Income will be payable in the form of Guaranteed Income and Cash Bonus (if declared) from the 1st policy year till the end of Bandhan Life iIncome Wealth Plan policy term; or until the death of the Life Assured or policy surrender, whichever is earlier.

Deferred Income Option

Income will be payable in the form of Guaranteed Income and Cash Bonuses (if declared) after the end of the premium payment term till the end of the Bandhan Life iIncome Wealth Plan policy term; or until the death of the Life Assured or policy surrender, whichever is earlier.

Guaranteed Income = Guaranteed Income factor of 4% * Benefit Sum Assured.

Cash Bonus = Declared Cash Bonus Rate * Benefit Sum Assured. You can choose to defer your income by up to 5 years.

Wealth Option

Survival benefit does not apply to this option.

B. Maturity Benefit

Early Income Option and Deferred Income Option

If the Bandhan Life iIncome Wealth Plan policy is in force and the Life Assured survives till the date of maturity, the maturity benefit shall be payable as a lump sum amount equal to the sum of:

- Sum Assured on Maturity, i.e. 105% of Total Premiums Paid plus

- Terminal Bonus (if declared)

Accumulated income (if any), if not paid earlier, will also be paid along with the above-mentioned maturity benefit.

Wealth Option

If the policy is in force and the Life Assured survives till the date of maturity, the maturity benefit shall be payable as a lump sum amount equal to the sum of:

- Sum Assured on Maturity, i.e. 105% of Total Premiums Paid plus

- Accrued Simple Reversionary Bonus (if declared)

- Terminal Bonus (if declared)

C. Death Benefit

For all three options

If Secure Policy Benefit has not been opted for, on the death of the Life Assured during the Bandhan Life iIncome Wealth Plan policy term when the policy is in force, the Death Benefit payable shall be equal to:

- Sum Assured on Death, plus

- 105% of Accumulated Income Benefits, if any, plus

- Interim Cash Bonus (if declared), plus

- Terminal Bonus (if declared)

Grace Period, Discontinuance and Revival of the Bandhan Life iIncome Wealth

Grace Period

The Grace Period is thirty (30) days for premium payment frequencies other than monthly and fifteen (15) days for monthly frequency, during which the Policy is considered to be in force with the risk cover.

Discontinuance

If you have not paid at least one (1) full year’s premium, your Bandhan Life iIncome Wealth Plan policy will immediately and automatically lapse at the expiry of the grace period.

There shall be no benefits payable in this scenario, except accumulated income, if any and if not paid earlier. All other benefits under the policy shall cease, and nothing is payable on death, maturity, survival or surrender.

If at least one (1) full year’s premium has been paid and subsequent premiums are not paid, then the policy shall not lapse; instead, the policy will be immediately and automatically converted to a reduced paid-up policy at the expiry of the grace period.

Revival

You can revive your lapsed or paid-up policy within five (5) consecutive complete years from the due date of the first unpaid premium and before the end of the Bandhan Life iIncome Wealth Plan policy term.

Free Look Period for the Bandhan Life iIncome Wealth

If you are not satisfied with any of the terms and conditions of the policy, or otherwise and have not made any claim, then you may request the company for cancellation of the Policy within 30 days (Thirty Days) from the date of receipt of the Policy document, whether received electronically or otherwise.

Surrendering the Bandhan Life iIncome Wealth

You can surrender the policy at any time during the Bandhan Life iIncome Wealth Plan policy term after completion of the first policy year, provided one full year’s premium has been paid.

The surrender benefit payable will be the highest of the guaranteed surrender value (GSV) and special surrender value (SSV) as on the date of surrender.

What are the advantages of the Bandhan Life iIncome Wealth?

- The Secure Policy Benefit (SPB) protects your long-term financial goals by continuing income and maturity benefits in the event of the Life Assured’s unfortunate demise during the policy term.

- Under both Early and Deferred Income options, you can choose to receive income payouts on any date of your choice, not just on the Policy Anniversary.

- By default, income benefits are paid in arrears, but you can opt to receive them in advance.

- You can select your preferred income payout frequency — yearly, half-yearly, quarterly, or monthly

- During the premium payment term, you have the flexibility to change your premium payment frequency.

- You can combine product options, such as Early Income with Wealth or Deferred Income with Wealth, based on your needs.

- Policy loans are allowed, up to a maximum of 80% of the available Surrender Value.

What are the disadvantages of the Bandhan Life iIncome Wealth?

- The life insurance coverage provided under the plan is insufficient.

- Survival benefit cash payouts may not adequately meet real-world financial requirements.

- The overall returns from the plan are comparatively low.

- Receiving early cash payouts diminishes the compounding potential of your investment.

Research Methodology of Bandhan Life iIncome Wealth

Bandhan Life iIncome Wealth Plan promises regular income either from the first policy year or after the premium-paying term, with survival benefits linked to bonuses.

Before investing, it is important to evaluate the potential returns by calculating the IRR using the benefit illustration provided in the Bandhan Life iIncome Wealth Plan policy brochure.

Benefit Illustration – IRR Analysis of Bandhan Life iIncome Wealth

A 30-year-old male chooses the plan with a sum assured of ₹9.37 lakhs, a 30-year policy term, and a 10-year premium-paying term. The annual premium is ₹75,000, and he opts for the Wealth option.

| Male | 30 years |

| Sum Assured | ₹ 9,37,500 |

| Policy Term | 30 years |

| Premium Paying Term | 10 years |

| Annualised Premium | ₹ 75,000 |

For illustration, assumed investment returns are 4% p.a. and 8% p.a., though actual returns may differ.

Under the Wealth option, there are no yearly survival benefits; all payouts come as a lump sum at maturity.

| At 4% p.a. | At 8% p.a. | ||||

| Age | Year | Annualised premium / Maturity benefit | Death benefit | Annualised premium / Maturity benefit | Death benefit |

| 30 | 1 | -75,000 | 9,35,700 | -75,000 | 9,35,700 |

| 31 | 2 | -75,000 | 9,35,700 | -75,000 | 9,35,700 |

| 32 | 3 | -75,000 | 9,35,700 | -75,000 | 9,35,700 |

| 33 | 4 | -75,000 | 9,35,700 | -75,000 | 9,35,700 |

| 34 | 5 | -75,000 | 9,35,700 | -75,000 | 9,35,700 |

| 35 | 6 | -75,000 | 9,35,700 | -75,000 | 9,35,700 |

| 36 | 7 | -75,000 | 9,35,700 | -75,000 | 9,35,700 |

| 37 | 8 | -75,000 | 9,35,700 | -75,000 | 9,35,700 |

| 38 | 9 | -75,000 | 9,35,700 | -75,000 | 9,35,700 |

| 39 | 10 | -75,000 | 9,35,700 | -75,000 | 9,35,700 |

| 40 | 11 | 0 | 9,35,700 | 0 | 9,35,700 |

| 41 | 12 | 0 | 9,35,700 | 0 | 9,35,700 |

| 42 | 13 | 0 | 9,35,700 | 0 | 9,35,700 |

| 43 | 14 | 0 | 9,35,700 | 0 | 9,35,700 |

| 44 | 15 | 0 | 9,35,700 | 0 | 9,35,700 |

| 45 | 16 | 0 | 9,35,700 | 0 | 9,35,700 |

| 46 | 17 | 0 | 9,35,700 | 0 | 9,35,700 |

| 47 | 18 | 0 | 9,35,700 | 0 | 9,35,700 |

| 48 | 19 | 0 | 9,35,700 | 0 | 9,35,700 |

| 49 | 20 | 0 | 9,35,700 | 0 | 9,35,700 |

| 50 | 21 | 0 | 9,35,700 | 0 | 9,35,700 |

| 51 | 22 | 0 | 9,35,700 | 0 | 9,35,700 |

| 52 | 23 | 0 | 9,35,700 | 0 | 9,35,700 |

| 53 | 24 | 0 | 9,35,700 | 0 | 9,35,700 |

| 54 | 25 | 0 | 9,35,700 | 0 | 9,35,700 |

| 55 | 26 | 0 | 9,35,700 | 0 | 9,35,700 |

| 56 | 27 | 0 | 9,35,700 | 0 | 9,35,700 |

| 57 | 28 | 0 | 9,35,700 | 0 | 9,35,700 |

| 58 | 29 | 0 | 9,35,700 | 0 | 9,35,700 |

| 59 | 30 | 0 | 9,35,700 | 0 | 9,35,700 |

| 60 | 21,15,999 | 39,63,196 | |||

| IRR | 4.12% | 6.67% | |||

At the 4% scenario, the maturity value (including accumulated cash bonuses) is ₹21.15 lakhs, giving an IRR of 4.12% as per the Bandhan Life iIncome Wealth Plan maturity calculator.

At the 8% scenario, the maturity value is ₹39.63 lakhs, resulting in an IRR of 6.67% as per the Bandhan Life iIncome Wealth Plan maturity calculator.

Since this example uses the Wealth option—where benefits are received at the end of the term—the IRR is already modest. If you choose yearly cash payouts instead, the IRR will be even lower because early withdrawals weaken compounding.

While the plan offers flexibility through Early Income and Deferred Income options, the overall returns remain underwhelming. Such low-yielding products are unlikely to help you meet long-term financial goals effectively.

Bandhan Life iIncome Wealth Vs. Other Investments

Comparing the Bandhan Life iIncome Wealth Plan with alternative investment strategies offers better clarity on its effectiveness. Using the same benefit illustration figures, let’s split the annual premium of ₹75,000 between life insurance and investments.

Bandhan Life iIncome Wealth Vs. Pure-term + Equity Mutual Fund

A pure term insurance policy with a sum assured of ₹25 lakhs (equivalent to the base cover plus bonuses under Bandhan Life iIncome Wealth) costs ₹16,600 annually for a 30-year term with a 10-year premium-paying period.

The remaining ₹58,400 is invested in an equity mutual fund.

| Pure Term Life Insurance Policy | |

| Sum Assured | ₹ 25,00,000 |

| Policy Term | 30 years |

| Premium Paying Term | 10 years |

| Annualised Premium | ₹ 16,600 |

| Investment | ₹ 58,400 |

| Term insurance + Equity Mutual Fund | |||

| Age | Year | Term Insurance premium + Equity Mutual Fund | Death benefit |

| 30 | 1 | -75,000 | 9,35,700 |

| 31 | 2 | -75,000 | 9,35,700 |

| 32 | 3 | -75,000 | 9,35,700 |

| 33 | 4 | -75,000 | 9,35,700 |

| 34 | 5 | -75,000 | 9,35,700 |

| 35 | 6 | -75,000 | 9,35,700 |

| 36 | 7 | -75,000 | 9,35,700 |

| 37 | 8 | -75,000 | 9,35,700 |

| 38 | 9 | -75,000 | 9,35,700 |

| 39 | 10 | -75,000 | 9,35,700 |

| 40 | 11 | 0 | 9,35,700 |

| 41 | 12 | 0 | 9,35,700 |

| 42 | 13 | 0 | 9,35,700 |

| 43 | 14 | 0 | 9,35,700 |

| 44 | 15 | 0 | 9,35,700 |

| 45 | 16 | 0 | 9,35,700 |

| 46 | 17 | 0 | 9,35,700 |

| 47 | 18 | 0 | 9,35,700 |

| 48 | 19 | 0 | 9,35,700 |

| 49 | 20 | 0 | 9,35,700 |

| 50 | 21 | 0 | 9,35,700 |

| 51 | 22 | 0 | 9,35,700 |

| 52 | 23 | 0 | 9,35,700 |

| 53 | 24 | 0 | 9,35,700 |

| 54 | 25 | 0 | 9,35,700 |

| 55 | 26 | 0 | 9,35,700 |

| 56 | 27 | 0 | 9,35,700 |

| 57 | 28 | 0 | 9,35,700 |

| 58 | 29 | 0 | 9,35,700 |

| 59 | 30 | 0 | 9,35,700 |

| 60 | 97,76,872 | ||

| IRR | 10.42% | ||

At maturity, the equity mutual fund value—after accounting for capital gains tax—comes to ₹97.76 lakhs (pre-tax value: ₹1.10 crore). The combined IRR of this strategy (term insurance + mutual fund investment) works out to 10.42%.

| Equity Mutual Fund Tax Calculation | |

| Maturity value after 30 years | 1,10,72,282 |

| Purchase price | 5,84,000 |

| Long-Term Capital Gains | 1,04,88,282 |

| Exemption limit | 1,25,000 |

| Taxable LTCG | 1,03,63,282 |

| Tax paid on LTCG | 12,95,410 |

| Maturity value after tax | 97,76,872 |

This alternative approach delivers higher returns, better liquidity, and inflation-beating growth. It strengthens your ability to meet future goals. In contrast, the Bandhan Life iIncome Wealth Plan falls short in terms of return potential.

Final Verdict on the Bandhan Life iIncome Wealth

Bandhan Life iIncome Wealth Plan offers survival benefits that can be taken early or deferred. These payouts include bonuses, but the bonus rates are non-guaranteed, making them unreliable for meeting planned expenses.

Since the cash bonus cannot be earmarked for specific financial needs, it can disrupt your cash flow.

Even if you choose to accumulate bonuses and receive them at maturity under the Wealth option, the overall returns remain unimpressive.

As a traditional life insurance plan offering survival and maturity benefits, the Bandhan Life iIncome Wealth Plan delivers returns that are lower than inflation, making it unsuitable as an investment product.

The core issue is the combination of insurance and investment, which typically leads to poor returns and it also has a high agent commission.

Instead, ensure you have adequate term insurance to protect your family and invest separately based on your long-term goals. Always assess your risk tolerance before choosing investment products.

Do Quora, Facebook, and Twitter have the final say when it comes to financial advice?

If you need help designing a diversified investment portfolio, consider consulting a Certified Financial Planner. Their guidance can elevate your financial planning journey.

Leave a Reply