Is the Bharti AXA Life Grow Wealth Plan truly a wealth-building tool, or just another expensive ULIP in disguise?

Is Bharti AXA Life Grow Wealth Plan the right choice for your financial goals, or could better alternatives deliver more value?

Is the Bharti AXA Life Grow Wealth Plan your gateway to long-term wealth, or are smarter alternatives available?

This article examines the Bharti AXA Life Grow Wealth Plan in detail, analysing its features, advantages, and limitations, supported by a clear illustration.

Table of Contents

What is the Bharti AXA Life Grow Wealth?

What are the features of the Bharti AXA Life Grow Wealth?

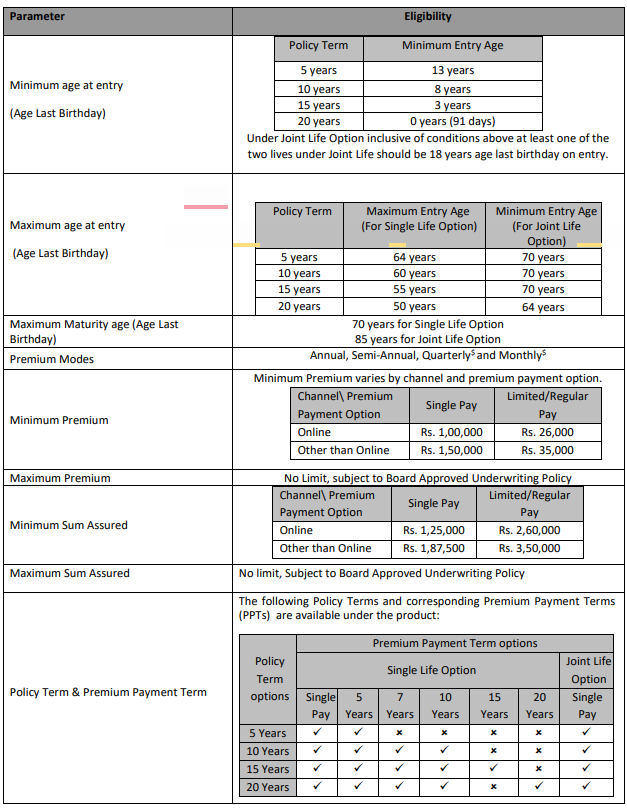

Who is eligible for the Bharti AXA Life Grow Wealth?

What are the benefits of the Bharti AXA Life Grow Wealth?

What are the fund options in the Bharti AXA Life Grow Wealth?

What are the charges in the Bharti AXA Life Grow Wealth?

Grace Period, Discontinuance and Revival of the Bharti AXA Life Grow Wealth

Free Look Period for the Bharti AXA Life Grow Wealth

Surrendering the Bharti AXA Life Grow Wealth

What are the advantages of the Bharti AXA Life Grow Wealth?

What are the disadvantages of the Bharti AXA Life Grow Wealth?

Research Methodology of Bharti AXA Life Grow Wealth

Benefit Illustration – IRR Analysis of Bharti AXA Life Grow Wealth

Bharti AXA Life Grow Wealth Vs. Other Investments

Bharti AXA Life Grow Wealth Vs. Pure-term + Equity Mutual Fund

Final Verdict on Bharti AXA Life Grow Wealth

What is the Bharti AXA Life Grow Wealth?

Bharti AXA Life Grow Wealth is a Unit Linked, Non-Participating, Individual Life Insurance Plan. It offers you flexibility on how to invest while providing you with a life insurance cover to protect your family in case of any unfortunate event.

It also provides additional benefits in the form of loyalty additions.

What are the features of the Bharti AXA Life Grow Wealth?

- Provides financial protection for your family in the event of the Bharti AXA Life Grow Wealth Plan policyholder’s untimely demise.

- Offers the flexibility to choose between Single Life and Joint Life coverage options.

- Allows you to opt for enhanced life cover of up to 10 times the annualised premium, even under the single premium variant.

- Provides flexibility in selecting both the Bharti AXA Life Grow Wealth Plan policy term and the premium payment term.

- A specified percentage of the fund value is added at the end of each policy year, starting from the 6th policy year until the end of the policy term.

- Enables you to choose from eight different fund options based on your risk appetite and return expectations.

- Policy administration charges are levied only for a limited period—up to 5 years for the single premium variant and up to 10 years for the limited and regular premium variants.

- Premiums paid and benefits received may be eligible for tax benefits, subject to prevailing income tax laws.

Who is eligible for the Bharti AXA Life Grow Wealth?

What are the benefits of the Bharti AXA Life Grow Wealth?

Death benefit

Single life

In case of the death of the Life Insured during the Bharti AXA Life Grow Wealth Plan Policy Term, the Sum Assured on Death will be payable to the Nominee or the Policyholder, as the case may be, subject to the Bharti AXA Life Grow Wealth Plan Policy being in force.

The Death Benefit will be the highest of:

- Sum Assured less all Partial Withdrawals made in the two-year period immediately preceding the death of the Life Insured.

- 105% of all premiums paid as on date of death

- Policy Fund Value (including any Loyalty Additions) as on the date of death of the Life Insured

Joint Life

In case of the simultaneous death of both the Life Insured during the Policy Term, the Sum Assured on death will be payable to the Nominee or the Bharti AXA Life Grow Wealth Plan Policyholder, as the case may be, subject to the Policy being in force. The Death Benefit will be the highest of:

- The sum assured is equal to 10 times the single premium, less Partial Withdrawals made in the two-year period immediately preceding the death of the Life Insured.

- 105% of all premiums paid as on date of death

- Policy Fund Value (including any Loyalty Additions) as on the date of death of the Life Insured

In case of the first death, the Fund Value shall be set to be the higher of the sum assured equal to 125% of the single premium or Policy Fund Value (including any Loyalty Additions) as on the date of death.

In case of death of the second life, provided the Bharti AXA Life Grow Wealth Plan policy is in-force and all due premiums till the date of death have been paid, the Death Benefit will be payable immediately on death.

Death Benefit, which is the highest of:

- Sum assured equal to 10 times the single premium, less all partial withdrawals made during the two-year period immediately preceding the date of death of the Life Assured

- Policy Fund Value (including any Loyalty Additions) as on the date of death

- 105% of all premiums paid as on date of death

Maturity Benefit

For Single Life option – In case the Life Insured survives till maturity, and all due premiums have been paid till the date of maturity, Subject to the Policy being in force, the Policy Fund Value, including loyalty additions, shall be payable on the maturity date.

For Joint Life option – In case either or both of the Lives Insured survive till maturity, and all due premiums have been paid till the date of maturity, subject to the Bharti AXA Life Grow Wealth Plan Policy being in force, the Policy Fund Value, including loyalty additions, shall be payable on the Maturity Date.

Loyalty Addition

Subject to the Bharti AXA Life Grow Wealth Plan Policy being in force, Loyalty Additions will be credited to the Policy at the end of each Policy Year starting from the end of the sixth Policy Year up to (and including) the Maturity Date.

End of Policy Year 6 till one year before Maturity – 0.7% of Policy Fund Value as at the end of Policy Year

At Maturity – 1.4% of Policy Fund Value as at the end of Policy Year

Settlement Option

On Maturity, you may choose to receive the Bharti AXA Life Grow Wealth Plan Policy Fund Value as:

- A lump sum payment

- At regular intervals chosen by the Bharti AXA Life Grow Wealth Plan Policyholder, during the Settlement Period as defined below

- A combination of the above

What are the fund options in the Bharti AXA Life Grow Wealth?

Depending on your financial objectives, you have the choice of investing your premiums in any or all of the following investment funds mentioned below:

| Asset Allocation | |||||

| S.no | Fund Name | Debt | Money Market Instruments | Equities | Risk Profile |

| 1 | Growth Opportunities Plus Fund | – | 0-20% | 80-100% | High |

| 2 | Grow Money Plus Fund | – | 0-20% | 80-100% | High |

| 3 | Build India Fund | 0-20% | 0-20% | 80-100% | High |

| 4 | Save ‘n’ grow Money Fund | 0-90% | 0-40% | 0-60% | Moderate |

| 5 | Steady Money Fund | 60-100% | 0-40% | – | Low |

| 6 | Safe Money Fund | 60-100% | 0-40% | – | Low |

| 7 | Stability Plus Money Fund | 55-100% | 0-20% | 0-25% | Moderate |

| 8 | Emerging Equity Fund | – | 0-35% | 65-100% | High |

| Money Market securities | Government securities | ||||

| Discontinued Policy Fund | 0-40% | 0-60% | |||

What are the charges in the Bharti AXA Life Grow Wealth?

Premium Allocation Charge:

There is no premium allocation charge

Mortality Charge:

This charge is levied to provide you with a life insurance benefit. This charge is applied to the Sum at Risk and is deducted proportionately by cancellation of units on a monthly basis.

Policy Administration Charge:

This charge is deducted by cancellation of units on a monthly basis.

| Channel \ Premium Payment Term | Single Premium Payment Policy | Limited/Regular Premium Payment Policy |

| Online | 0.10% | 0.40% |

| Other than Online | 0.15% | 0.45% |

Fund Management Charge:

| S.no | Fund | Fund Management Charge |

| 1 | Growth Opportunities Plus Fund | 1.35% per annum |

| 2 | Grow Money Plus Fund | 1.35% per annum |

| 3 | Build India Fund | 1.35% per annum |

| 4 | Emerging Equity Fund | 1.35% per annum |

| 5 | Save ‘nʼ grow Money Fund | 1.25% per annum |

| 6 | Steady Money Fund | 1.00% per annum |

| 7 | Safe Money Fund | 1.00% per annum |

| 8 | Stability Plus Money Fund | 0.80% per annum |

| Discontinued Policy Fund | 0.50% per annum |

Discontinuance Charge:

The Discontinuance Charge shall be levied at the time of surrender or on Discontinuance of Premium, whichever is earlier. It depends on the premium amount and the year of discontinuance.

Inference from Charges: In general, ULIPs levy multiple charges before your premium is actually invested. These charges represent overhead costs borne by the investor and significantly reduce the amount deployed in the market.

Over the long term, this erosion adversely impacts compounding and results in lower overall returns.

Grace Period, Discontinuance and Revival of the Bharti AXA Life Grow Wealth

For other than single premium policies

Grace Period

The Bharti AXA Life Grow Wealth Plan Policyholder gets a grace period of Fifteen (15) days in case of Monthly Premium Payment Mode and Thirty (30) days in case of Annual/ Semi Annual/ Quarterly Premium Payment mode.

Discontinuance

Discontinuance of Premium during lock-in period: the fund value after deducting the applicable discontinuance charges shall be credited to the discontinued policy fund, and the risk cover and rider cover, if any, shall cease.

At the end of the lock-in period, the proceeds of the discontinuance fund shall be paid to the Bharti AXA Life Grow Wealth Plan Policyholder, and the Policy shall terminate

Discontinuance of Policy after the lock-in Period: the Bharti AXA Life Grow Wealth Plan Policy shall be converted into a reduced paid-up policy with the paid-up sum assured, i.e. original sum assured multiplied by the total number of premiums paid to the original number of premiums payable as per the terms and conditions of the Policy.

Revival

The revival period for this product is three years from the date of the first unpaid premium.

Free Look Period for the Bharti AXA Life Grow Wealth

If you disagree with any of the terms and conditions of the Bharti AXA Life Grow Wealth Plan Policy, you can return the original Policy along with a letter stating the reason/s within 30 days of receipt of the Policy.

Surrendering the Bharti AXA Life Grow Wealth

For other than single premium policies

Surrender during the lock-in period: the Bharti AXA Life Grow Wealth Plan Policyholder has an option to surrender the Policy anytime, and proceeds of the discontinued policy shall be payable at the end of the lock-in period or date of surrender, whichever is later.

Surrender after the lock-in period: the Bharti AXA Life Grow Wealth Plan Policyholder has an option to surrender the Policy anytime, and the proceeds of the policy fund shall be payable.

For Single premium policies

Surrender during the lock-in period: The Bharti AXA Life Grow Wealth Plan Policyholder has an option to surrender at any time during the lock-in period.

Upon receipt of a request for surrender, the fund value, after deducting the applicable discontinuance charges, shall be credited to the discontinued policy fund.

Surrender after the lock-in period: The Bharti AXA Life Grow Wealth Plan Policyholder has an option to surrender the Policy at any time. Upon receipt of a request for surrender, the fund value as on the date of surrender shall be payable.

What are the advantages of the Bharti AXA Life Grow Wealth?

- The Bharti AXA Life Grow Wealth Plan policyholder can opt for partial withdrawals after the completion of the lock-in period, subject to policy terms and conditions.

- Provides flexibility to manage investments through fund switching and premium redirection facilities.

- Additional protection can be enhanced by opting for riders on payment of an extra premium.

- Premiums can be paid in Monthly, Quarterly, Semi-Annual, or Annual modes, as per your convenience.

What are the disadvantages of the Bharti AXA Life Grow Wealth?

- Access to funds is restricted during the initial five policy years of the Bharti AXA Life Grow Wealth Plan policy term.

- The plan does not offer the facility of a loan against the policy.

- The net premium is invested only after applicable charges are deducted.

Research Methodology of Bharti AXA Life Grow Wealth

In this section, we evaluate the Internal Rate of Return (IRR) of the Bharti AXA Life Grow Wealth Plan. Since a portion of the premium is invested in market-linked instruments, assessing the return potential before committing funds is essential.

This analysis helps determine the plan’s effectiveness and enables a comparison with other market-linked investment options.

Benefit Illustration – IRR Analysis of Bharti AXA Life Grow Wealth

Consider a 35-year-old male who purchases the Bharti AXA Life Grow Wealth Plan with a policy term of 10 years and pays a single premium of ₹20,00,000. The sum assured is fixed at ₹2 crore, which is 10 times the single premium.

| Male | 35 years |

| Sum Assured | ₹ 2,00,00,000 |

| Policy Term | 10 years |

| Premium Paying Term | Single Pay |

| Annualised Premium | ₹ 20,00,000 |

On maturity, the Bharti AXA Life Grow Wealth Plan policyholder receives the fund value, which depends on the assumed rate of return. The illustrative return assumptions of 4% and 8% are not guaranteed and do not represent the upper or lower limits of returns under the policy.

| At 4% p.a. | At 8% p.a. | ||||

| Age | Year | Annualised premium / Maturity benefit | Death benefit | Annualised premium / Maturity benefit | Death benefit |

| 35 | 1 | -20,00,000 | 2,00,00,000 | -20,00,000 | 2,00,00,000 |

| 36 | 2 | 0 | 2,00,00,000 | 0 | 2,00,00,000 |

| 37 | 3 | 0 | 2,00,00,000 | 0 | 2,00,00,000 |

| 38 | 4 | 0 | 2,00,00,000 | 0 | 2,00,00,000 |

| 39 | 5 | 0 | 2,00,00,000 | 0 | 2,00,00,000 |

| 40 | 6 | 0 | 2,00,00,000 | 0 | 2,00,00,000 |

| 41 | 7 | 0 | 2,00,00,000 | 0 | 2,00,00,000 |

| 42 | 8 | 0 | 2,00,00,000 | 0 | 2,00,00,000 |

| 43 | 9 | 0 | 2,00,00,000 | 0 | 2,00,00,000 |

| 44 | 10 | 0 | 2,00,00,000 | 0 | 2,00,00,000 |

| 45 | 23,60,614 | 35,16,325 | |||

| IRR | 1.67% | 5.80% | |||

Under the 4% return scenario, the maturity fund value is ₹23.60 lakh, translating into an IRR of 1.67% as per the Bharti AXA Life Grow Wealth Plan maturity calculator. This indicates negligible wealth creation, as the returns barely keep pace with inflation.

In the 8% return scenario, the fund value at maturity increases to ₹35.16 lakh, resulting in an IRR of 5.80% as per the Bharti AXA Life Grow Wealth Plan maturity calculator. Even at this higher assumed rate, the returns remain lower than those typically available from debt instruments.

The IRR analysis clearly highlights that the Bharti AXA Life Grow Wealth Plan fails to deliver meaningful returns. For investors aiming to grow their savings, there are more efficient investment avenues available that offer superior returns along with greater flexibility.

Bharti AXA Life Grow Wealth Vs. Other Investments

The Bharti AXA Life Grow Wealth Plan reflects a clear mismatch between risk and return. To highlight this, let us compare its outcomes with an alternative strategy using the same assumptions as those applied in the benefit illustration.

This comparative approach demonstrates how a different allocation can deliver higher returns along with greater flexibility.

Bharti AXA Life Grow Wealth Vs. Pure-term + Equity Mutual Fund

A pure-term life insurance policy offering a sum assured of ₹2 crore for a 10-year tenure can be purchased with a single premium of approximately ₹1.51 lakh. This leaves a balance of ₹18.49 lakh available for investment.

| Pure Term Life Insurance Policy | |

| Sum Assured | ₹ 2,00,00,000 |

| Policy Term | 10 years |

| Premium Paying Term | Single Pay |

| Annualised Premium | ₹ 1,51,000 |

| Investment | ₹ 18,49,000 |

Based on the investor’s risk profile, this surplus can be allocated to debt or equity-oriented products. For this comparison, we assume investment in an equity mutual fund.

| Age | Year | Term Insurance premium + Equity Mutual Fund | Death benefit |

| 35 | 1 | -20,00,000 | 2,00,00,000 |

| 36 | 2 | 0 | 2,00,00,000 |

| 37 | 3 | 0 | 2,00,00,000 |

| 38 | 4 | 0 | 2,00,00,000 |

| 39 | 5 | 0 | 2,00,00,000 |

| 40 | 6 | 0 | 2,00,00,000 |

| 41 | 7 | 0 | 2,00,00,000 |

| 42 | 8 | 0 | 2,00,00,000 |

| 43 | 9 | 0 | 2,00,00,000 |

| 44 | 10 | 0 | 2,00,00,000 |

| 45 | 52,71,624 | ||

| IRR | 10.18% |

- Maturity value (pre-tax): ₹57.42 lakh

- Post-tax value (after capital gains): ₹52.71 lakh

- IRR (combined term insurance + mutual fund strategy): 10.18%

| Equity Mutual Fund Tax Calculation | |

| Maturity value after 10 years | 57,42,713 |

| Purchase price | 18,49,000 |

| Long-Term Capital Gains | 38,93,713 |

| Exemption limit | 1,25,000 |

| Taxable LTCG | 37,68,713 |

| Tax paid on LTCG | 4,71,089 |

| Maturity value after tax | 52,71,624 |

This comparison clearly illustrates the advantage of separating insurance and investment.

While the Bharti AXA Life Grow Wealth Plan confines investors to relatively low returns and limited liquidity, a combination of a pure-term insurance policy and equity mutual fund investment delivers substantially better returns and far greater financial flexibility.

Final Verdict on Bharti AXA Life Grow Wealth

The Bharti AXA Life Grow Wealth Plan is a conventional ULIP that combines market-linked investments with life insurance coverage.

However, the relatively high charges significantly erode the investible portion of the premium, which in turn impacts the maturity value and it also has a high agent commission.

The resulting returns are unimpressive and insufficient to meet long-term family responsibilities and financial goals.

The Internal Rate of Return (IRR) analysis further reinforces this concern, as the returns do not justify the level of risk involved. Despite being positioned as a “Grow Wealth” plan, it does not effectively facilitate wealth creation.

ULIPs of this nature are generally inefficient instruments for building a robust long-term financial foundation.

For protection, a pure-term life insurance policy remains the most effective solution, offering adequate coverage at a reasonable cost with greater flexibility.

For wealth creation, it is more prudent to construct a diversified investment portfolio across appropriate asset classes rather than committing funds to insurance-cum-investment products.

Do Quora, Facebook, and Twitter have the final say when it comes to financial advice?

By selecting suitable investment avenues—and ideally with the support of a trusted financial advisor—you can pursue your financial goals with greater clarity, confidence, and efficiency.

Leave a Reply