Your salary date is on 1st of the month and you pay the house rent on 5th, the electricity bill goes on 16th and the car EMI goes on 18th. What is your house rent, electricity bill and EMI doing in your savings account from 1st of every month until the due date? Nothing but sleeping. There is a way to make more money out of it while still sleeping!

Some desires will not let you sleep until you acquire it – like that cosy sofa you saw while window shopping, a vacation to Shimla, a brand new LED-TV, or anything that your heart wants badly. Financial planners group them into short-term goals. To win such a short-term goal, there is a unique investment option which gives more return than a bank savings account!

Venkat has an emergency fund in cash. As you know that an emergency fund is created for unexpected situations and thus it needs a place of safety and accessibility. Where would you suggest Venkat keep the cash?

A Bank savings account…? Probably it’s the choice anyone would pick as of today’s economical awareness.

I bet you won’t say the same answer after reading this article. The solution for all these problems already exists but just hidden. We will uncover the solution and discuss it in detail.

Alternate for a savings account

You may ask, why do I need an alternate for a bank savings account? To understand, let’s see the way you spend the salary through a savings account in super zoom.

Suppose your salary is Rs 1 Lakh and your essential expense is around Rs 30,000. The balance Rs 70,000 remains idle in your bank savings account. Now, during the weekend shopping, your mind would prickle your hand to buy many unwanted things that come into your sight. Because the mind just knows that there is some extra money in the wallet to spend.

To trick your mind from doing this unnecessary expense, you can take a part of the idle cash from the savings account and make a small investment.

Say Rs 50,000 and drop it in an investment that can generate an interest of 6 – 8% which is far higher than the interest of any savings account. At the same time if it gives you the freedom to withdraw cash from the fund anytime you need without any charges like a bank savings account. Don’t you doubt if there is such an investment? No doubt. It is Liquid Funds.

Mutual fund investments have a scheme called Liquid funds, which gives higher interest than bank savings account even for a 1-day investment. You can withdraw the money from the scheme at any time you wish. On comparison with a bank savings account, liquid funds prove to be more efficient. With the recently added attractions like Debit card for a liquid fund scheme, you will feel good on moving from a savings account to a liquid fund scheme that gives more interest and high liquidity.

Liquid funds

Liquid funds invest in high-quality short term debt mutual fund instruments with high liquidity. The purpose of liquid funds is to generate reasonable income in a very short-term with the safety of capital. It also focuses on providing freedom of withdrawal or in other terms known as liquidity which any other investment platform cannot give at this degree.

How liquid funds work?

Your fund manager will invest your money in high credit quality short term debt instruments or money market instruments. The average maturity period of the instruments in the scheme is within 91 days.

However, there is no exit load for liquid funds. You can invest for even 1 day and get returns for your money. This gives you the freedom to withdraw your money whenever you wish.

The purpose of liquid funds is to provide liquidity and returns simultaneously for investors more than the bank savings account.

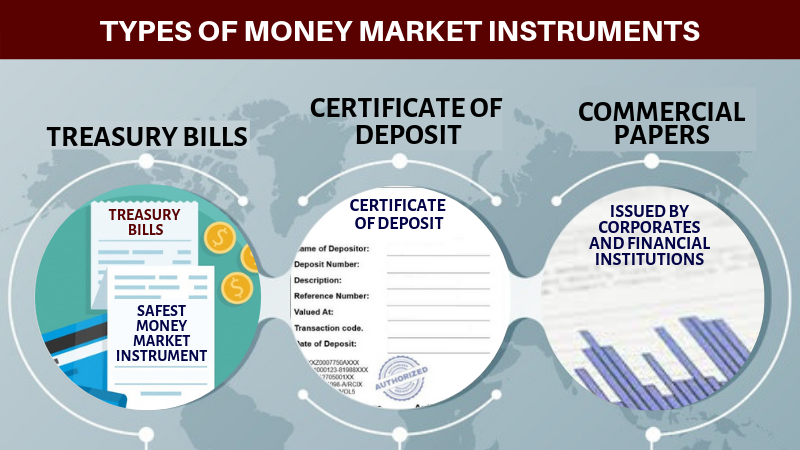

Types of money market instruments

It is necessary to know about money market instruments as an investor while investing in liquid funds.

Treasury bills:

Are issued by the Government of India which is the safest money market instrument comes with a maturity period of 91 days, 182 days, and 364 days.

Certificate of deposit:

Is issued by certain commercial banks with a maturity period ranging from 3 months to 5 years.

Commercial papers:

Are issued by corporates and financial institutions with a maturity period ranging from 1 day to 270 days.

Who can invest in Liquid funds?

The question ‘who’ will elaborate what kind of people should invest in a liquid fund or it defines a person in a particular situation who should invest. Liquid funds are the right choice for investors with

Short-term Goal:

Liquid funds are the best fit for Short-term goals since they have minimal risk. As a general fact, fluctuation in interest rates is higher if the length of tenure is more. Liquid funds are short tenure investment. This makes liquid funds a low-risk investment platform for short term investors.

A large annual expense:

There are some huge annual expenses like school fee of your children, a family vacation, or may be an expensive purchase. These annual expenses might sometimes become a heavy-duty.

So if you have to pay the school fee by June of next year, then you could start an SIP on June of this year and invest a small amount every month in liquid funds. This way you can manage to create reasonable returns with the safety of capital.

Temporary Parking:

Do you have a hesitation to invest a lump amount in equity due to the risk for your capital investment? If yes, then we’ve got a solution for you to conservatively invest in equity through liquid funds.

You can park the idle cash in liquid funds and prescribe for a Systematic Transfer Plan (STP) to an equity fund. This will potentially reduce the vulnerability of your capital investment in equity and makes way for a conservative investment in equity through liquid funds.

Windfall money:

Sometimes you get surplus money flow unexpectedly. Like an incentive amount or any kind of surprise inflow. In this case, you can park the money into liquid funds until you figure out what you are going to do with that money. It will grow by itself in a short time while you are still busy planning about the corpus.

Why should you choose liquid funds?

The question word WHY gives justification for an action. I would not simply say it a justification. It has some unique benefits which will convince you or anyone who is literally just eligible for liquid funds.

The question word WHY gives justification for an action. I would not simply say it a justification. It has some unique benefits which will convince you or anyone who is literally just eligible for liquid funds.

1. Returns:

Are higher than the returns generated by a savings account. The Short Term Capital Gains for less than 3 years from liquid funds are taxable as per your income tax slab and the Long Term Capital Gains are 20% after indexation. But however, debt mutual funds have some favourable tax treatments which help in producing more returns. Overall return produced by liquid funds is much better than a savings account. The average rate of returns produced by Liquid fund are 6 – 8%. It is way far higher than the 4% return from your bank savings account.

2. Temporary Halt:

If you’ve got a considerable amount of idle cash and looking for a short term investment, then liquid funds are the place to park your funds. For example, if you are planning for your anniversary which is in the next two months then you can place the money in liquid funds rather than in bank savings account. Because return produced by liquid funds (6 – 8%) is double the size of returns produced by a bank savings account (3.5 – 4%).

3. Grow your Emergency fund:

You can use the liquid funds to park a piece of your emergency fund for growing at ease. Most of the liquid funds do not have an exit load, so you can redeem your money anytime required. The money is credited to your account in less than 24 hours even through offline redemption. This will grow the size of your emergency fund considerably until it is used. Once, it is not advisable to invest the full emergency corpus in liquid funds due to the 24 hour redemption time but it’s been overcome with an innovative idea which we will see in detail below.

4. Efficient Salary Management:

Nobody is going to spend all of the salaries in a single day. Let’s take that you get paid on the 1st day of the month and your house rent goes on the 5th of every month. You can park the house rent that is of no use for 5 days in a liquid fund and then settles your return. This way, your rent will earn for the 5 days that will be of no use when kept in a savings account. When you repeat this every month for years, the returns will be really impressive.

5. Business purpose transactions:

If you own a business, then liquid funds will be much helpful for you. Let’s take a common business scenario of paying salary to your employees. Assume that you need to pay Rs 5 Lakh as salary for your employees on 5th of every month. Even if you park the amount for 10 days every month in liquid funds, with a 7% return. After a period of 10 years, you could get an additional amount of Rs X. If the same fund is kept in a current account, it would not have earned anything.

6. ATM/Debit card for liquid funds:

Liquid money and an emergency fund are traditionally parked in bank savings account for the 4% return. Because it gives the facility to withdraw money at any ATM centre using a debit card. Most of the facilities offered by the bank include a service charge, which is more than reasonable rate. The debit card facility in liquid funds will be a remedy for the service charges also.

Reliance AMC has recently introduced a feature for its liquid mutual fund unit holders, to provide a VISA Debit card as Reliance Any Time Money Card. The eligibility is to have invested in Reliance liquid funds/Reliance Ultra Short duration funds/Reliance Low duration funds/Reliance money manager funds as a primary scheme. You can invest in other schemes and keep it secondary and link it with the primary scheme. The card is backed by VISA and is accessible all over the world in the VISA network. It works similar to a normal debit card. There are some specific features to be mentioned.

- The daily withdrawal limit is 50% of the balance in the primary scheme account or upto the permissible limit determined by the bank or Rs 50,000 whichever is lower.

- Daily purchase limit (usage of the card in retail points) of 50% of the balance in the primary scheme account or Rs 1,00,000 whichever is lower.

- Fuel surcharge waiver.

- Free SMS and E-mail alerts on every transaction.

These are the benefits of using a liquid fund over a bank savings account. I bet the features would be convincing to you to go with liquid funds instead of a savings account.

Conclusion

Apart from the short-term investment facility, high returns, with the provision of Debit cards, liquid funds have now become the most efficient way of liquid cash handling. “What good is your money that doesn’t come for your need?” Whereas liquid fund makes you more money in little time and will be at your service at the time of need.

[the_ad id=’13360′]

this is a informative piece , but it would have been more useful having data to match up the the talk .

Any indicators on the growth of say a fixed sum of money over a period of few years in a liquid fund vis a vis a low interest earning bank deposit would make the point more stronger .

Thank you for your suggestion.