Is the Edelweiss Life Bharat Savings Star Plan really a smart savings choice—or just another well-packaged promise?

Is this plan a reliable path to long-term stability, or are smarter alternatives quietly doing better?

Does the Edelweiss Life Bharat Savings Star Plan truly build wealth, or does it only look safe on paper?

This review examines whether traditional plans truly succeed in delivering both protection and savings objectives. Specifically, it evaluates the features, benefits, and limitations of the Edelweiss Life Bharat Savings Star Plan.

Table of Contents

What is the Edelweiss Life Bharat Savings Star?

What are the features of the Edelweiss Life Bharat Savings Star?

Who is eligible for the Edelweiss Life Bharat Savings Star?

What are the benefits of the Edelweiss Life Bharat Savings Star?

Grace Period, Discontinuance and Revival of the Edelweiss Life Bharat Savings Star?

Free Look Period for the Edelweiss Life Bharat Savings Star

Surrendering the Edelweiss Life Bharat Savings Star

What are the advantages of the Edelweiss Life Bharat Savings Star?

What are the disadvantages of the Edelweiss Life Bharat Savings Star?

Research Methodology of Edelweiss Life Bharat Savings Star?

Benefit Illustration – IRR Analysis of Edelweiss Life Bharat Savings Star

Edelweiss Life Bharat Savings Star Vs. Other Investments

Edelweiss Life Bharat Savings Star Vs. Pure-term + Equity Mutual Fund

Final Verdict on the Edelweiss Life Bharat Savings Star

What is the Edelweiss Life Bharat Savings Star?

Edelweiss Life Bharat Savings Star is an Individual, Non-Linked, Non-Participating, Savings, Life Insurance Product. It offers you a guaranteed income to take care of your future financial needs and helps you achieve your goals.

It also offers you multiple flexibilities to customise when and how much of the income you’d like to withdraw according to your specific requirements.

What are the features of the Edelweiss Life Bharat Savings Star?

- Provides life insurance cover to safeguard your family’s financial future

- Supports long-term goals by offering guaranteed income for up to 40 years

- Begins paying regular income as early as the end of the first month

- Aids financial planning by allowing income to accrue and compound when not required, with the flexibility to withdraw partially or fully during the policy term

- Enhances liquidity by enabling you to advance a portion of future income and receive it as a lump sum earlier during the policy tenure

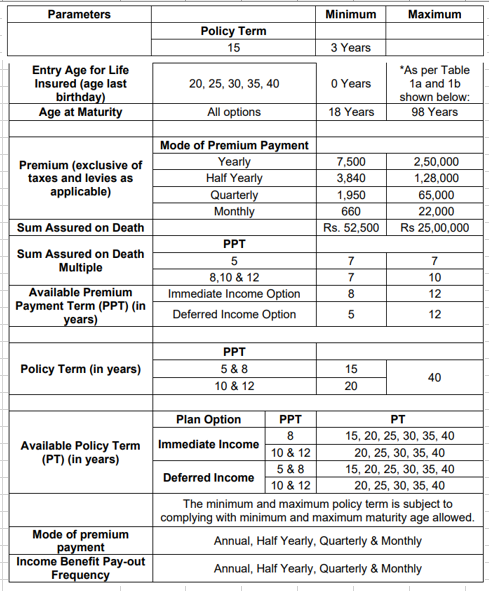

Who is eligible for the Edelweiss Life Bharat Savings Star?

What are the benefits of the Edelweiss Life Bharat Savings Star?

Here, you get two Plan Options to customise the Edelweiss Life Bharat Savings Star plan according to your individual needs. Your benefits will vary depending upon which of the following options is chosen:

- Immediate Income

- Deferred Income

Income Benefit

Plan Option 1: Immediate Income

In this plan option, you will receive a regular stream of income called ‘Income Benefit Pay-out’ starting from the 1st policy year at your chosen Income Benefit Pay-out Frequency.

The Income Benefit Pay-out will be 10% of the Annualised Premium, and it will continue from the end of 1st year to the end of the Premium paying term.

After completion of the PPT, the Income Benefit Pay-out will increase to a higher fixed % of the Annualised Premium.

Plan Option 2: Deferred Income

In this plan option, you will receive a regular stream of income called ‘Income Benefit Pay-out’ starting from the end of the 2nd policy year, after the end of the premium paying term (PPT).

This income will be paid till the maturity of the policy or death of the life insured, whichever is earlier, while the policy is in force.

Maturity Benefit

In case the Life Insured survives till the end of the policy term, provided the policy is in force, the last Income Benefit Pay-out instalment, along with the Sum Assured on Maturity, is payable as a lump sum to you.

If Premium Break Benefit is not chosen, Sum Assured on Maturity is equal to PPT times Annualised Premium.

If Premium Break Benefit is chosen, Sum Assured on Maturity is equal to {(PPT – Total no. of Premium Breaks available) times Annualised Premium}

Death Benefit

On the death of the Life Insured during the policy term while the policy is in force, the Death Benefit equal to the Sum Assured on Death is payable, and the policy will terminate.

Sum Assured Multiple – 7 times: If you’ve selected Sum Assured (SA) multiple of 7 times, the Sum Assured on Death at any point of time, provided the policy is in force, is the highest of:

- Sum Assured, i.e., 7 times Annualised Premium

- Any Absolute amount assured to be paid on death

Sum Assured Multiple – 10 times: If you’ve selected Sum Assured (SA) multiple of 7 times, the Sum Assured on Death at any point of time, provided the policy is in force, is the highest of:

- 10 times the Annualised Premium

- Any absolute amount assured to be paid on death

- 10 times the Annual Premium

Grace Period, Discontinuance and Revival of the Edelweiss Life Bharat Savings Star?

Grace Period

The company will allow a Grace Period of 15 days, where the Policyholder pays the premium on a monthly basis, and 30 days in all other cases, during which you must pay the premium due in full.

Discontinuance

If all the premiums for at least the first Policy Year have not been paid in full within the Grace Period, the Policy shall immediately and automatically lapse, and no benefits shall be payable by us under the Policy.

If all Premiums for at least the first Policy Year have not been paid in full, then the paid-up value is nil.

After completion of the first Policy Year, provided one full year’s Premium has been paid, then on premium discontinuance, the policy will continue as a ‘Reduced Paid-up’ policy, and all the benefits shall be reduced proportionately.

Revival

The policy may be revived within the Revival period of five consecutive years from the date of the first unpaid premium.

Free Look Period for the Edelweiss Life Bharat Savings Star

You have a Free Look period of thirty (30) days beginning from the date of receipt of the Policy Document, whether received electronically or otherwise, to review the terms and conditions of this Policy.

If you disagree with any of the terms or conditions, or otherwise, and you have not made any claims, you may return this Policy for cancellation.

Surrendering the Edelweiss Life Bharat Savings Star

After completion of the first Policy Year, provided one full year’s Premium has been paid, your policy will acquire a Surrender Value; the Surrender Value, if any, will be immediately paid, the Policy will be terminated, and all the benefits under the Policy shall cease to apply.

The surrender value payable is the higher of Guaranteed Surrender Value (GSV) and Special Surrender Value (SSV).

What are the advantages of the Edelweiss Life Bharat Savings Star?

- The maximum loan available is capped at 60% of the surrender value

- All benefits offered under the Edelweiss Life Bharat Savings Star plan are guaranteed

- The accrual of income benefits and the option for advance withdrawal provide added flexibility

What are the disadvantages of the Edelweiss Life Bharat Savings Star?

- Regular payouts may encourage spending on discretionary expenses rather than disciplined investing.

- Choosing annual income payouts limits the scope for compounding and long-term wealth creation.

- Despite being guaranteed, the benefits offer limited value due to low returns.

- The sum assured is insufficient to adequately cover long-term financial needs.

Research Methodology of Edelweiss Life Bharat Savings Star?

The Edelweiss Life Bharat Savings Star Plan offers the option of receiving regular income either immediately, starting from the end of the first policy year, or after the completion of the premium-paying term.

However, before opting for this plan, it is crucial to assess the return potential and overall suitability. Using illustrations from the policy brochure, the returns are analysed and compared with alternative investment avenues.

Benefit Illustration – IRR Analysis of Edelweiss Life Bharat Savings Star

Consider a 40-year-old female opting for the Edelweiss Life Bharat Savings Star Plan with a 20-year policy term and a 12-year premium-paying period, paying an annual premium of ₹40,000. The sum assured under the policy is ₹4,00,000, and the Deferred Income option is selected.

| Female | 40 years |

| Sum Assured | ₹ 4,00,000 |

| Policy Term | 20 years |

| Premium Paying Term | 12 years |

| Annualised Premium | ₹ 40,000 |

Upon completion of the premium payments, the policyholder receives an annual survival benefit of ₹56,232 for the next seven years, followed by a maturity benefit of ₹4.8 lakh at the end of the policy term.

This cash-flow structure results in an Internal Rate of Return (IRR) of approximately 4.60% as per the Edelweiss Life Bharat Savings Star Plan maturity calculator.

| Age | Year | Annualised premium / Maturity benefit | Death benefit |

| 40 | 1 | -40,000 | 4,00,000 |

| 41 | 2 | -40,000 | 4,00,000 |

| 42 | 3 | -40,000 | 4,00,000 |

| 43 | 4 | -40,000 | 4,00,000 |

| 44 | 5 | -40,000 | 4,00,000 |

| 45 | 6 | -40,000 | 4,00,000 |

| 46 | 7 | -40,000 | 4,00,000 |

| 47 | 8 | -40,000 | 4,00,000 |

| 48 | 9 | -40,000 | 4,00,000 |

| 49 | 10 | -40,000 | 4,00,000 |

| 50 | 11 | -40,000 | 4,00,000 |

| 51 | 12 | -40,000 | 4,00,000 |

| 52 | 13 | 0 | 4,00,000 |

| 53 | 14 | 0 | 4,00,000 |

| 54 | 15 | 56,232 | 4,00,000 |

| 55 | 16 | 56,232 | 4,00,000 |

| 56 | 17 | 56,232 | 4,00,000 |

| 57 | 18 | 56,232 | 4,00,000 |

| 58 | 19 | 56,232 | 4,00,000 |

| 59 | 20 | 56,232 | 4,00,000 |

| 60 | 5,36,232 | ||

| IRR | 4.60% |

Since this return is lower than the prevailing inflation rate, the Edelweiss Life Bharat Savings Star plan fails to serve as an effective long-term investment.

The deferred income option itself delivers modest returns, which would be even lower under the immediate income option. Additionally, the sum assured remains inadequate to meet meaningful protection needs.

Furthermore, the regular income offered by the Edelweiss Life Bharat Savings Star plan is not inflation-adjusted, leading to a steady erosion of its real value over time.

Although the policy runs for 20 years, the combination of low returns and limited life cover reduces its attractiveness for investors seeking long-term wealth creation and adequate financial protection.

Edelweiss Life Bharat Savings Star Vs. Other Investments

The Edelweiss Life Bharat Savings Star Plan combines life insurance and investment into a single product. However, keeping these two objectives separate often leads to more efficient outcomes.

By deploying the same premium differently, investors can potentially generate superior cash flows through a more flexible and transparent strategy. Using the premium from the earlier illustration, let us examine this alternative approach.

Edelweiss Life Bharat Savings Star Vs. Pure-term + Equity Mutual Fund

In the previous example, the sum assured was ₹4 lakh, which is below the IRDAI-prescribed minimum of ₹5 lakh. Accordingly, for this comparison, the sum assured is considered at ₹5 lakh.

A pure-term life insurance policy with a sum assured of ₹5 lakh can be purchased at an annual premium of approximately ₹5,200 for a 20-year policy term with a 10-year premium-paying period. This leaves ₹34,800 per year available for investment.

Since the earlier example involved a 12-year premium-paying term, the full ₹40,000 is invested during the final two years to maintain parity in total outgo.

| Pure Term Life Insurance Policy | |

| Sum Assured | ₹ 5,00,000 |

| Policy Term | 20 years |

| Premium Paying Term | 10 years |

| Annualised Premium | ₹ 5,200 |

| Investment | ₹ 34,800 |

The investment component can be aligned with the investor’s risk profile. Conservative investors may choose debt-oriented instruments such as the Public Provident Fund (PPF), while aggressive investors can consider equity-oriented mutual fund schemes.

Over time, the accumulated corpus is shifted to an instrument delivering an assumed annual return of 7% to generate periodic withdrawals comparable to the payouts offered under the Edelweiss Life Bharat Savings Star Plan.

| Age | Year | Term Insurance premium + Equity Mutual Fund | Death benefit |

| 40 | 1 | -40,000 | 4,00,000 |

| 41 | 2 | -40,000 | 4,00,000 |

| 42 | 3 | -40,000 | 4,00,000 |

| 43 | 4 | -40,000 | 4,00,000 |

| 44 | 5 | -40,000 | 4,00,000 |

| 45 | 6 | -40,000 | 4,00,000 |

| 46 | 7 | -40,000 | 4,00,000 |

| 47 | 8 | -40,000 | 4,00,000 |

| 48 | 9 | -40,000 | 4,00,000 |

| 49 | 10 | -40,000 | 4,00,000 |

| 50 | 11 | -40,000 | 4,00,000 |

| 51 | 12 | -40,000 | 4,00,000 |

| 52 | 13 | 0 | 4,00,000 |

| 53 | 14 | 0 | 4,00,000 |

| 54 | 15 | 56,232 | 4,00,000 |

| 55 | 16 | 56,232 | 4,00,000 |

| 56 | 17 | 56,232 | 4,00,000 |

| 57 | 18 | 56,232 | 4,00,000 |

| 58 | 19 | 56,232 | 4,00,000 |

| 59 | 20 | 56,232 | 4,00,000 |

| 60 | 11,21,061 | ||

| IRR | 8.24% |

Under the equity mutual fund scenario, the pre-tax accumulated value works out to ₹9.52 lakh. After accounting for capital gains tax, the post-tax corpus stands at ₹9.02 lakh.

This amount, when reinvested at 7%, supports annual withdrawals and results in an Internal Rate of Return (IRR) of approximately 8.24%.

| Equity Mutual Fund Tax Calculation | |

| Maturity value after 12 years | 9,52,960 |

| Purchase price | 4,28,000 |

| Long-Term Capital Gains | 5,24,960 |

| Exemption limit | 1,25,000 |

| Taxable LTCG | 3,99,960 |

| Tax paid on LTCG | 49,995 |

| Maturity value after tax | 9,02,965 |

If annual withdrawals are deferred, the overall returns could be even higher, offering significantly greater flexibility to align cash flows with actual financial needs.

In comparison, the Edelweiss Life Bharat Savings Star Plan delivers relatively low returns, making it a less efficient option. Separating life insurance and investment not only improves return potential but also provides better transparency, flexibility, and control over long-term financial goals.

Final Verdict on the Edelweiss Life Bharat Savings Star

The Edelweiss Life Bharat Savings Star Plan provides regular income payouts, either on an immediate or deferred basis, depending on individual preferences.

While these payouts are guaranteed, the return potential remains unappealing, and the sum assured is insufficient to adequately support a family’s long-term financial needs and it also has a high agent commission.

Return analysis indicates that the Edelweiss Life Bharat Savings Star plan is a low-yield product. The income payouts are not inflation-adjusted and, moreover, regular withdrawals dilute the power of compounding.

The earlier the withdrawals begin, the lower the overall returns. Consequently, for individuals aiming for meaningful wealth creation or robust life insurance coverage, the Edelweiss Life Bharat Savings Star Plan may not be a suitable option.

Rather than depending on insurance products for regular income, a more effective approach is to build a diversified investment portfolio aligned with one’s risk appetite, financial goals, and investment horizon.

This strategy offers greater flexibility and better potential to meet changing financial requirements over time.

Do Quora, Facebook, and Twitter have the final say when it comes to financial advice?

For adequate family protection, opting for a pure-term life insurance policy is crucial. Additionally, seeking guidance from a Certified Financial Planner can help in designing a personalised financial strategy and selecting appropriate products based on individual needs and circumstances.

Leave a Reply