Is the Edelweiss Life Guaranteed Flexi STAR Plan genuinely a “flexible star” in guaranteed income — or just a conservative savings product with limited upside?

At the end of your policy term, will Edelweiss Life Guaranteed Flexi STAR Plan feel like a safety net worth having — or a conservative compromise compared to market-linked alternatives?

Will the Edelweiss Life Guaranteed Flexi STAR Plan keep pace with inflation and evolving financial needs — or will fixed guaranteed benefits fall short over decades?

This review examines whether the plan truly delivers on these promises through a detailed analysis of its features, along with its merits and limitations.

Table of Contents:

What is the Edelweiss Life Guaranteed Flexi Star?

What are the features of the Edelweiss Life Guaranteed Flexi Star?

Who is eligible for the Edelweiss Life Guaranteed Flexi Star?

What are the benefits of the Edelweiss Life Guaranteed Flexi Star?

Grace Period, Discontinuance and Revival of the Edelweiss Life Guaranteed Flexi Star

Free Look Period for the Edelweiss Life Guaranteed Flexi Star

Surrendering the Edelweiss Life Guaranteed Flexi Star

What are the advantages of the Edelweiss Life Guaranteed Flexi Star?

What are the disadvantages of the Edelweiss Life Guaranteed Flexi Star?

Research Methodology of Edelweiss Life Guaranteed Flexi Star

Benefit Illustration – IRR Analysis of Edelweiss Life Guaranteed Flexi Star

Edelweiss Life Guaranteed Flexi Star Vs. Other Investments

Edelweiss Life Guaranteed Flexi Star Vs. Pure-term + PPF/Equity Mutual Fund

Final Verdict on the Edelweiss Life Guaranteed Flexi Star

What is the Edelweiss Life Guaranteed Flexi Star?

Edelweiss Life Guaranteed Flexi Star is an Individual, Non-Linked, Non-Participating, Savings, Life Insurance Product.

It is a life insurance plan designed to protect your family from any financial loss in case of an untimely death and offers a guaranteed income and/or a guaranteed lump sum on maturity to you and your family, provided all due premiums are paid.

What are the features of the Edelweiss Life Guaranteed Flexi Star?

- Provides life insurance cover to protect your family’s financial future.

- Offers stable, assured returns, payable either as a lump sum or as a lump sum combined with regular income.

- Allows extensive customisation through multiple plan options, policy terms, premium payment terms, income levels, income duration, and the chosen income start year.

- Enables you to enhance protection by adding optional riders at an additional cost.

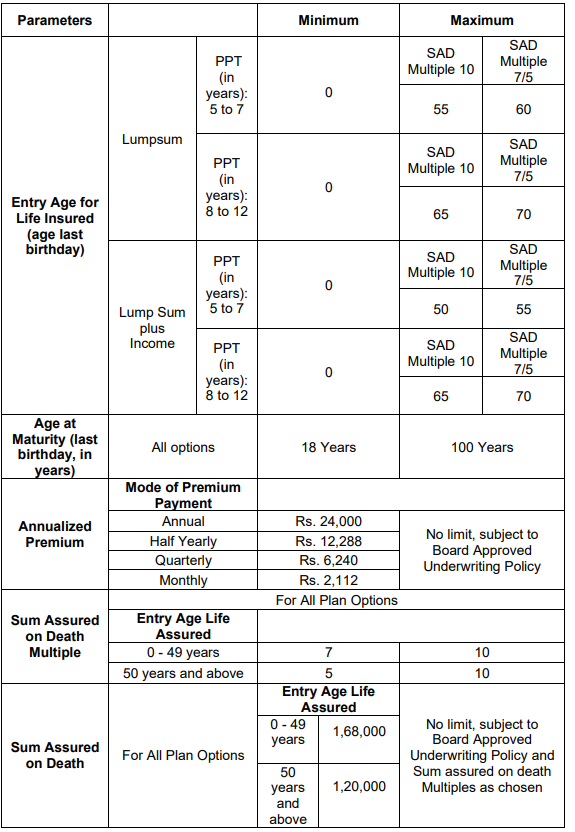

Who is eligible for the Edelweiss Life Guaranteed Flexi Star?

What are the benefits of the Edelweiss Life Guaranteed Flexi Star?

This product provides two Plan Options to choose from. These options help you customise the Edelweiss Life Guaranteed Flexi STAR Plan according to your individual needs. Your benefits will vary depending on the option chosen.

Lump Sum Option

Lump Sum plus Income Option

1. Death Benefit

Under both options

If Sum Assured on Death multiple 10 is chosen, the Sum Assured on Death at any point of time, provided the Edelweiss Life Guaranteed Flexi STAR Plan policy is in force, is the highest of:

- 10 times the Annualised Premium

- Any Absolute amount assured to be paid on death

- 10 times the Annual Premium

If Sum Assured on Death multiple 7 or 5 (depending on the age) is chosen, the Sum Assured on Death at any point of time, provided the Edelweiss Life Guaranteed Flexi STAR Plan policy is in force, is the highest of:

- Sum Assured on Death Multiple times the Annualised Premium

- Any Absolute amount assured to be paid on death

2. Survival benefit

Lump Sum Option

There is no Survival benefit under the Lump Sum Option

Lump Sum Plus Income Option

Under this option, you will receive an Income Benefit Pay-out as a survival benefit for the Income Duration chosen by you.

This Income Benefit Pay-out will start from the end of the 2nd policy year falling after the completion of the Premium Payment Term (PPT), payable in arrears till maturity or death of the Life Assured, whichever is earlier, provided the Edelweiss Life Guaranteed Flexi STAR Plan policy is in force.

Preponement of Survival Benefits

At the inception of the policy, you have an option to receive income starting from Policy Year till Policy Year (PPT + 1), either at the start or end of the policy year by preponing your Income Benefit Pay-outs.

3. Maturity benefit

Lump Sum Option

On survival till the end of the Edelweiss Life Guaranteed Flexi STAR Plan policy term, you will receive a Maturity Benefit in a lump sum equal to Sum Assured on Maturity plus accrued Guaranteed Additions, provided the policy is in force.

The Guaranteed Additions will accrue, in arrears, every year starting from the 2nd policy year till the end of the Policy Term, provided the policy is in force.

The Guaranteed Additions are expressed as a % of the total Annualised Premium paid.

Lump Sum Plus Income Option

In addition to the last income payout, Maturity Benefit equal to Sum Assured on Maturity will be payable as a lump sum on the maturity if the Life Assured survives till the end of the Edelweiss Life Guaranteed Flexi STAR Plan Policy Term, provided the policy is in force.

The Sum Assured on Maturity is the maximum of (10 or PPT) times the Annualised Premium.

Grace Period, Discontinuance and Revival of the Edelweiss Life Guaranteed Flexi Star

Grace Period

The company will allow a Grace Period of 15 days, where the Edelweiss Life Guaranteed Flexi STAR Plan Policyholder pays the premium on a monthly basis, and 30 days in all other cases, during which you must pay the premium due in full.

Discontinuance

If all the Premiums for at least the first Policy Year have not been paid in full within the Grace Period, the Policy shall immediately and automatically lapse, and no benefits shall be payable.

After completion of the first policy year, provided one full year’s Premium has been paid, then on premium discontinuance, the Edelweiss Life Guaranteed Flexi STAR Plan policy will continue as a ‘Reduced Paid-up’ policy, and all the benefits shall be reduced proportionately.

Revival

If premiums are not paid within the grace period, the policy lapses or becomes reduced paid-up. The policy may be revived within the Revival Period of five consecutive complete years from the date of the first unpaid premium.

Free Look Period for the Edelweiss Life Guaranteed Flexi Star

You have a Free Look period of thirty (30) days beginning from the date of receipt of the Policy Document, whether received electronically or otherwise, to review the terms and conditions of this Policy.

If you disagree with any of the terms or conditions, or otherwise, and you have not made any claims, you may return this Policy for cancellation.

Surrendering the Edelweiss Life Guaranteed Flexi Star

After completion of the first policy year, provided one full year’s Premium has been paid, your policy will acquire a Surrender Value.

On receipt of a written request for Surrender from you, the Surrender Value, if any, will be immediately paid, the Policy will be terminated, and all the benefits under the Edelweiss Life Guaranteed Flexi STAR Plan Policy shall cease to apply.

The surrender value payable is the higher of Guaranteed Surrender Value (GSV) and Special Surrender Value (SSV).

What are the advantages of the Edelweiss Life Guaranteed Flexi Star?

- Loan facility available up to 60% of the policy’s surrender value.

- Enhanced protection through optional riders.

- Tax benefits are available on premiums paid and benefits received, as per prevailing tax laws.

What are the disadvantages of the Edelweiss Life Guaranteed Flexi Star?

- The sum assured may not be adequate to fully address your family’s future financial requirements.

- The returns offered are relatively modest.

- After selection, the survival benefit cannot be deferred.

Research Methodology of Edelweiss Life Guaranteed Flexi Star

The Edelweiss Life Guaranteed Flexi Star Plan provides guaranteed benefits that can be taken either as a lump sum or as regular payouts along with a final lump sum.

While the certainty of payouts may appear attractive, it is essential to evaluate the actual returns before committing to the plan. Accordingly, the Internal Rate of Return (IRR) has been calculated based on the figures illustrated in the policy brochure.

Benefit Illustration – IRR Analysis of Edelweiss Life Guaranteed Flexi Star

Consider a 35-year-old male opting for the Edelweiss Life Guaranteed Flexi Star Plan with a sum assured of ₹10 lakh.

The policy term is 25 years, with a premium payment term of 10 years and an annual premium of ₹1 lakh. The policyholder chooses the lump sum option.

| Male | 35 years |

| Sum Assured | ₹ 10,00,000 |

| Policy Term | 25 years |

| Premium Paying Term | 10 years |

| Annualised Premium | ₹ 1,00,000 |

Under this structure, after completing the premium payments, a lump sum maturity benefit is paid at the end of the policy term.

In this scenario, the maturity value works out to ₹30.85 lakh, translating into an IRR of approximately 5.59% as per the Edelweiss Life Guaranteed Flexi STAR Plan maturity calculator.

| Age | Year | Annualised premium / Maturity benefit | Death benefit |

| 35 | 1 | -1,00,000 | 10,00,000 |

| 36 | 2 | -1,00,000 | 10,00,000 |

| 37 | 3 | -1,00,000 | 10,00,000 |

| 38 | 4 | -1,00,000 | 10,00,000 |

| 39 | 5 | -1,00,000 | 10,00,000 |

| 40 | 6 | -1,00,000 | 10,00,000 |

| 41 | 7 | -1,00,000 | 10,00,000 |

| 42 | 8 | -1,00,000 | 10,00,000 |

| 43 | 9 | -1,00,000 | 10,00,000 |

| 44 | 10 | -1,00,000 | 10,00,000 |

| 45 | 11 | 0 | 10,00,000 |

| 46 | 12 | 0 | 10,00,000 |

| 47 | 13 | 0 | 10,00,000 |

| 48 | 14 | 0 | 10,00,000 |

| 49 | 15 | 0 | 10,00,000 |

| 50 | 16 | 0 | 10,00,000 |

| 51 | 17 | 0 | 10,00,000 |

| 52 | 18 | 0 | 10,00,000 |

| 53 | 19 | 0 | 10,00,000 |

| 54 | 20 | 0 | 10,00,000 |

| 55 | 21 | 0 | 10,00,000 |

| 56 | 22 | 0 | 10,00,000 |

| 57 | 23 | 0 | 10,00,000 |

| 58 | 24 | 0 | 10,00,000 |

| 59 | 25 | 0 | 10,00,000 |

| 60 | 30,85,047 | ||

| IRR | 5.59% |

At this level of return, the maturity corpus is unlikely to be sufficient to meet long-term financial goals, especially as the return fails to outpace inflation.

From a long-term investment perspective, the plan does not deliver inflation-beating growth. In addition, the sum assured remains inadequate to provide meaningful financial protection.

Overall, the combination of insufficient life cover and relatively low investment returns makes the Edelweiss Life Guaranteed Flexi Star Plan an unattractive proposition for investors.

Edelweiss Life Guaranteed Flexi Star Vs. Other Investments

Our return analysis clearly indicates that the Edelweiss Life Guaranteed Flexi Star Plan is a low-yield product. Combining insurance and investment within a single policy often results in compromised outcomes on both counts—insufficient protection and modest returns.

A more effective strategy is to separate these two objectives by opting for a pure-term life insurance policy with an adequate sum assured and investing independently to achieve long-term financial goals. Using the same assumptions as in the earlier example, let us evaluate this approach.

Edelweiss Life Guaranteed Flexi Star Vs. Pure-term + PPF/Equity Mutual Fund

A pure-term life insurance policy with a sum assured of ₹10 lakh would require an annual premium of approximately ₹9,750.

With a policy term of 25 years and a premium payment term of 10 years, this structure frees up ₹90,250 from the original ₹1 lakh annual outgo for investments.

| Pure Term Life Insurance Policy | |

| Sum Assured | ₹ 10,00,000 |

| Policy Term | 25 years |

| Premium Paying Term | 10 years |

| Annualised Premium | ₹ 9,750 |

| Investment | ₹ 90,250 |

Investment choices should align with an individual’s risk profile. Investors with a lower risk appetite may prefer debt-oriented instruments, while those willing to assume higher risk may allocate more towards equities.

In this illustration, PPF is considered for the debt portion and an equity mutual fund scheme for the equity allocation.

| Term Insurance + PPF | Term insurance + Equity Mutual Fund | ||||

| Age | Year | Term Insurance premium + PPF | Death benefit | Term Insurance premium + Equity Mutual Fund | Death benefit |

| 35 | 1 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 36 | 2 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 37 | 3 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 38 | 4 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 39 | 5 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 40 | 6 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 41 | 7 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 42 | 8 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 43 | 9 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 44 | 10 | -97,500 | 10,00,000 | -1,00,000 | 10,00,000 |

| 45 | 11 | -500 | 10,00,000 | 0 | 10,00,000 |

| 46 | 12 | -500 | 10,00,000 | 0 | 10,00,000 |

| 47 | 13 | -500 | 10,00,000 | 0 | 10,00,000 |

| 48 | 14 | -500 | 10,00,000 | 0 | 10,00,000 |

| 49 | 15 | -500 | 10,00,000 | 0 | 10,00,000 |

| 50 | 16 | 0 | 10,00,000 | 0 | 10,00,000 |

| 51 | 17 | 0 | 10,00,000 | 0 | 10,00,000 |

| 52 | 18 | 0 | 10,00,000 | 0 | 10,00,000 |

| 53 | 19 | 0 | 10,00,000 | 0 | 10,00,000 |

| 54 | 20 | 0 | 10,00,000 | 0 | 10,00,000 |

| 55 | 21 | 0 | 10,00,000 | 0 | 10,00,000 |

| 56 | 22 | 0 | 10,00,000 | 0 | 10,00,000 |

| 57 | 23 | 0 | 10,00,000 | 0 | 10,00,000 |

| 58 | 24 | 0 | 10,00,000 | 0 | 10,00,000 |

| 59 | 25 | 0 | 10,00,000 | 0 | 10,00,000 |

| 60 | 37,52,919 | 86,23,947 | |||

| IRR | 6.58% | 10.85% | |||

For the PPF investment, adjustments are made in the later years to meet the minimum investment requirement of ₹500 over a 15-year period. The investment accumulates to a maturity value of ₹37.52 lakh, delivering an IRR of 6.58%.

The equity mutual fund investment grows to a pre-tax value of ₹97.09 lakh at maturity. After accounting for capital gains tax, the post-tax corpus stands at ₹86.23 lakh.

The combined post-tax IRR of the equity investment, along with the pure-term life insurance policy, works out to 10.85%.

| Equity Mutual Fund Tax Calculation | |

| Maturity value after 25 years | 97,09,154 |

| Purchase price | 9,02,500 |

| Long-Term Capital Gains | 88,06,654 |

| Exemption limit | 1,25,000 |

| Taxable LTCG | 86,81,654 |

| Tax paid on LTCG | 10,85,207 |

| Maturity value after tax | 86,23,947 |

This return comfortably outpaces inflation, enabling the creation of a significantly larger corpus. Moreover, this strategy offers superior liquidity, allowing partial or full redemptions based on financial needs.

Considering the relatively poor returns, inadequate life cover, and the mismatch between investor needs and product structure, the Edelweiss Life Guaranteed Flexi Star Plan appears unattractive from an investor’s standpoint.

Final Verdict on the Edelweiss Life Guaranteed Flexi Star

The Edelweiss Life Guaranteed Flexi Star Plan combines life insurance with an investment component and offers flexibility in receiving benefits, either as a lump sum at maturity or as regular income payouts.

While the plan assures guaranteed benefits, the returns generated are not strong enough to make it a compelling investment choice.

Guaranteed payouts can create the perception that long-term financial goals will be met as planned. However, inflation remains a critical risk in long-term planning.

To build an adequate corpus, investment returns must consistently outpace inflation. This is where the Edelweiss Life Guaranteed Flexi Star Plan falls short and it also has a high agent commission.

The relatively low returns and inadequate life cover stem primarily from the bundling of insurance and investment within a single product.

A more efficient approach is to separate these objectives by choosing a pure-term life insurance policy for protection and investing independently to meet life goals.

Pure-term plans provide substantial coverage at low premiums, while a well-constructed, diversified investment portfolio can better support long-term financial objectives.

Do Quora, Facebook, and Twitter have the final say when it comes to financial advice?

For a holistic and goal-oriented financial plan, consulting a Certified Financial Planner is advisable. Professional guidance can help you structure your insurance and investments effectively, paving the way for a stable and progressive financial future.

Leave a Reply