Is the Edelweiss Life Wealth Plus Plan a true wealth-building ULIP — or just a long-term commitment wrapped in market-linked promises?

Can the Edelweiss Life Wealth Plus Plan realistically beat inflation over 15–20 years — or does the risk-return equation fall short?

Does the Edelweiss Life Wealth Plus Plan genuinely reward long-term discipline — or does it test your patience with unpredictable market cycles?

This review provides a clear and comprehensive analysis of the plan, covering its features, benefits, and limitations. It also includes detailed illustrations to help you make an informed decision.

Table of Contents:

What is the Edelweiss Life Wealth Plus?

What are the features of the Edelweiss Life Wealth Plus?

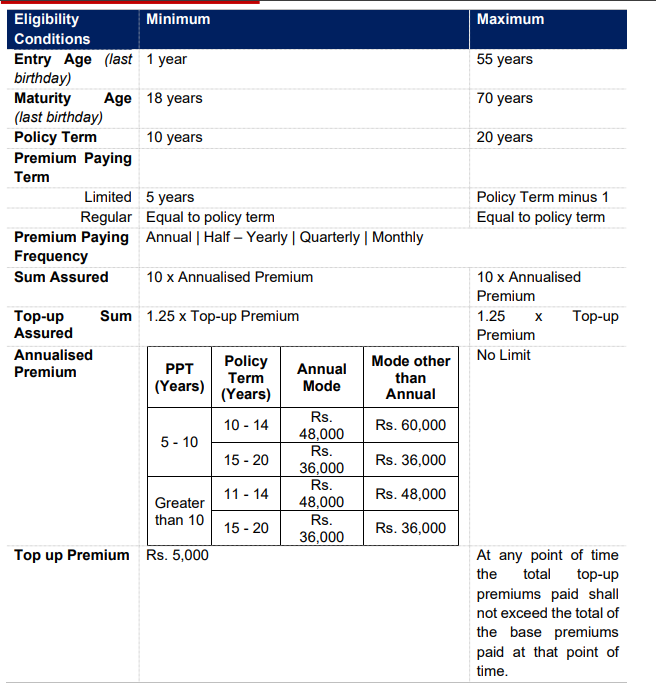

Who is eligible for the Edelweiss Life Wealth Plus?

What are the benefits of the Edelweiss Life Wealth Plus?

What are the investment strategies and fund options in the Edelweiss Life Wealth Plus?

What are the charges of the Edelweiss Life Wealth Plus?

Grace Period, Discontinuance and Revival of the Edelweiss Life Wealth Plus

Free Look Period for the Edelweiss Life Wealth Plus

Surrendering the Edelweiss Life Wealth Plus

What are the advantages of the Edelweiss Life Wealth Plus?

What are the disadvantages of the Edelweiss Life Wealth Plus?

Research Methodology of Edelweiss Life Wealth Plus

Benefit Illustration – IRR Analysis of Edelweiss Life Wealth Plus

Edelweiss Life Wealth Plus Vs. Other Investments

Edelweiss Life Wealth Plus Vs. Pure-term + PPF/Equity Mutual Fund

Final Verdict on the Edelweiss Life Wealth Plus

What is the Edelweiss Life Wealth Plus?

Edelweiss Life Wealth Plus is a Unit-Linked, Non-Participating, Individual, Savings Life Insurance Product.

The plan allocates 100% of your premiums paid during the premium paying term, and provides additional allocation every year. It also ensures financial protection for your family in case of your unfortunate demise

What are the features of the Edelweiss Life Wealth Plus?

- Life Cover provides financial protection for your family in the event of your unfortunate demise.

- Rising Star Benefit supports your children’s future financial needs, ensuring continuity even in your absence.

- Extra Allocation is added to your policy during the first five years, enhancing the value of your premiums.

- Premium Booster is added from the sixth policy year onward at the end of each policy year, further increasing your fund value.

- Two Investment Strategies are available to address different investment preferences and risk profiles.

- Liquidity Option allows partial withdrawals from the sixth policy year, offering flexibility during emergencies.

Who is eligible for the Edelweiss Life Wealth Plus?

What are the benefits of the Edelweiss Life Wealth Plus?

1. Maturity Benefit

At the end of the Edelweiss Life Wealth Plus Plan Policy Term, on survival, you will receive the Fund Value as your Maturity Benefit.

You have an option to collect your Maturity Benefit in a lump sum or in instalments by choosing the Settlement Option.

Settlement Option: Under this option, you need to choose:

Settlement Term (option of 1, 2, 3, 4 or 5 years); and

Frequency of pay-out (yearly, half-yearly, quarterly or monthly instalments)

2. Death benefit

In case of the death of the Life Insured during the PT, while the Edelweiss Life Wealth Plus Plan policy is in force

The Death Benefit will be the Higher of:

- Sum Assured less Relevant Withdrawals

- Fund Value

- 105% of total Base Premiums paid till the time of death

Plus, the higher of:

- Top-up Sum Assured

- Top-up Fund Value

- 105% of total Top-up Premiums paid till the time of death

Additional death benefit under Rising Star Benefit:

In case of the unfortunate demise of the Policyholder before the demise of the Life Insured, the following benefit is applicable for the entire Edelweiss Life Wealth Plus Plan policy term, irrespective of the Life Insured turning major during the term.

- A Lump sum amount will be paid immediately, plus

- An amount equal to the sum of all the future Modal Premiums (if any) shall be credited to the Fund Value, plus

- The future Extra Allocation and Premium Booster, as and when due, would be added to the Fund Value

Once the Rising Star Benefit is triggered, the Policy will continue till the maturity date or the death of the Life Insured, whichever is earlier. No future premiums, if any, will be required to be paid.

Additional Allocations

Wealth Plus ensures that 100% of the premium paid by you is allocated to the fund(s) as per your choice and Investment Strategy

Extra Allocation

During the first 5 policy years, Extra Allocation will be added to the fund(s) along with each Modal Premium paid by you within the grace period.

Premium Booster

Starting from the 6th policy year, Premium Booster will be added to the fund(s) at the end of each policy year for the premiums paid by you within the grace period.

What are the investment strategies and fund options in the Edelweiss Life Wealth Plus?

You have an option to invest your premium in any one of the two Investment Strategies.

A. Life Stage & Duration-Based Strategy

One’s risk appetite depends on

Age: As age increases, one’s risk appetite decreases

Investment duration: Short investment duration leads to lower risk appetite

In order to manage your risk appetite, as your age increases and the remaining policy term reduces, this strategy ensures that your money is moved from the equity-oriented fund (Equity Large Cap Fund) to the debt-oriented fund (Bond Fund)

Proportion invested in the Equity Large Cap Fund

| Remaining Policy Term | |||

| Attained Age | 10 Years | 15 Years | 20 Years |

| 18 Years | 82% | 85% | 85% |

| 30 Years | 70% | 85% | 85% |

| 40 Years | 60% | 85% | 85% |

| 45 Years | 55% | 82.50% | 85% |

| 50 Years | 50% | 75% | 85% |

B. Self-Managed Strategy

Under this strategy, you can decide to invest your money in your choice of fund(s) in any proportion. You can switch money among these funds using the switch option.

The funds available are listed below:

| S.no | Fund Name | Asset Allocation | Risk | ||

| Equity | Debt | Money Market instruments | |||

| 1 | Equity Large Cap Fund | 60 – 100% | 0 – 40% | 0 – 40% | High |

| 2 | Equity Top 250 Fund | 60 – 100% | 0 – 40% | 0 – 40% | High |

| 5 | Equity Mid-Cap Fund | 80 – 100% | 0 – 20% | 0 – 20% | High |

| 4 | Managed Fund | 0 – 40% | 60 – 100% | 60 – 100% | Medium |

| 3 | Bond Fund | 0 | 0- 100% | 0 – 100% | Low to Medium |

| 6 | Equity Blue Chip Fund | 60 – 100% | 0 – 40% | 0 – 40% | High |

| 7 | Gilt Fund | 0 | 60 – 100% | 0 – 40% | Low to Medium |

| 8 | Equity SmallCap Fund | 80 – 100% | 0 – 20% | 0 – 20% | High |

What are the charges of the Edelweiss Life Wealth Plus?

i. Premium Allocation Charges

NIL

ii. Policy Administration Charges

NIL

iii. Fund Management Charges

| S.no | Fund | FMC per annum |

| 1 | Equity Large Cap Fund | 1.35% |

| 2 | Equity Top 250 Fund | 1.35% |

| 5 | Bond Fund | 1.25% |

| 4 | Managed Fund | 1.35% |

| 3 | Equity Mid Cap Fund | 1.35% |

| 6 | Equity Blue Chip Fund | 1.35% |

| 7 | Gilt Fund | 1.25% |

| 8 | Equity Small-Cap Fund | 1.35% |

| Discontinued Policy Fund | 0.50% |

iv. Surrender/ Discontinuance Charges

These charges are recovered by way of cancellation of an appropriate number of units. The date of discontinuance shall be the date on which the grace period expires or the date of surrender, whichever is earlier.

v. Switching charges

Nil

vi. Premium Redirection charges

Nil

vii. Partial Withdrawal Charges

Nil

viii. Mortality Charges

Mortality charges are recovered on a monthly basis (on every policy month anniversary) from the date of commencement by way of cancellation of an appropriate number of units.

This charge, if any, shall be levied at the beginning of each policy month from the fund.

Impact of Charges: These charges act as additional costs for investors. Since some charges continue throughout the policy term, they gradually erode returns over time, reducing overall profitability.

Grace Period, Discontinuance and Revival of the Edelweiss Life Wealth Plus

Grace Period

A Grace Period of 30 days is available for Annual, Semi-Annual and Quarterly premium payment modes and 15 days for the Monthly premium payment mode.

Discontinuance

Discontinuance of the Policy during lock-in period (during the first five policy years): the fund value after deducting the applicable discontinuance charges shall be credited to the discontinued policy fund, and the risk cover and rider cover, if any, shall cease.

The proceeds of the discontinued policy fund shall be paid to the policyholder at the end of the revival period or lock-in period, whichever is later

Discontinuance of Policy after the lock-in period (after the first five policy years): the policy shall be converted into a reduced paid-up policy with the paid-up sum assured, i.e. original sum assured multiplied by the total number of premiums paid to the original number of premiums payable as per the terms and conditions of the policy.

Revival

The policyholder has an option to revive the Edelweiss Life Wealth Plus Plan policy within the revival period of three years.

Free Look Period for the Edelweiss Life Wealth Plus

You have a Free Look period of thirty (30) days beginning from the date of receipt of the Policy Document, whether received electronically or otherwise, to review the terms and conditions of this Policy.

If you disagree with any of the terms or conditions, or otherwise, and you have not made any claims, you may return this Policy for cancellation.

Surrendering the Edelweiss Life Wealth Plus

During the first five policy years, the policyholder has an option to surrender the policy anytime, and the proceeds of the discontinued policy shall be payable at the end of the lock-in period or date of surrender, whichever is later.

After the first five policy years, the policyholder has an option to surrender the policy anytime, and the proceeds of the policy fund shall be payable.

What are the advantages of the Edelweiss Life Wealth Plus?

- Settlement Option allows you to receive the maturity benefit in instalments rather than a lump sum.

- Flexible Premium Paying Term enables you to increase or decrease the premium payment duration as per your financial situation.

- Unlimited Premium Redirection and Free Fund Switches give you complete flexibility to manage your investments across available funds.

- Unlimited Opt-in and Opt-out Between Investment Strategies allows you to shift strategies based on your evolving goals and risk appetite.

- Partial Withdrawals are permitted anytime after the completion of the fifth policy year, helping you access funds to meet liquidity needs.

- Top-up Premium Facility enables you to invest surplus money over and above your regular premium to enhance your fund value.

What are the disadvantages of the Edelweiss Life Wealth Plus?

- No Policy Loan Facility is available under this plan.

- No Liquidity in the Initial Years, as access to funds is restricted during the early policy period.

- Sum Assured may be inadequate to provide meaningful financial protection for most families.

- Returns may be lower compared to alternative investment options that offer better risk-adjusted performance.

Research Methodology of Edelweiss Life Wealth Plus

Evaluating the potential returns of the Edelweiss Life Wealth Plus Plan is essential to determine whether it truly meets an investor’s financial needs.

Although the plan may appear appealing due to its market-linked investment component, calculating the Internal Rate of Return (IRR) provides a more accurate understanding of its actual benefits—even for investors without technical expertise.

To illustrate this, let us analyse a sample quote from the insurer’s portal.

Benefit Illustration – IRR Analysis of Edelweiss Life Wealth Plus

A 35-year-old male purchases the Edelweiss Life Wealth Plus Plan with a sum assured of ₹10 lakhs, a policy term of 20 years, and a premium payment term of 20 years. He pays an annual premium of ₹1 lakh.

| Male | 35 years |

| Sum Assured | ₹ 10,00,000 |

| Policy Term | 20 years |

| Premium Paying Term | 20 years |

| Annualised Premium | ₹ 1,00,000 |

By paying the premiums consistently, he becomes eligible to receive the fund value at the end of the policy term.

However, the projected return scenarios of 4% p.a. and 8% p.a. in the illustrations are not guaranteed and do not represent the upper or lower bounds of returns. Actual performance will vary based on market movements and underlying fund management.

| At 4% p.a. | At 8% p.a. | ||||

| Age | Year | Annualised premium / Maturity benefit | Death benefit | Annualised premium / Maturity benefit | Death benefit |

| 35 | 1 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 36 | 2 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 37 | 3 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 38 | 4 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 39 | 5 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 40 | 6 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 41 | 7 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 42 | 8 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 43 | 9 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 44 | 10 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 45 | 11 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 46 | 12 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 47 | 13 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 48 | 14 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 49 | 15 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 50 | 16 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 51 | 17 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 52 | 18 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 53 | 19 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 54 | 20 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 55 | 27,31,492 | 42,65,503 | |||

| IRR | 2.88% | 6.76% | |||

At a 4% return scenario: The fund value is ₹27.31 lakhs, with an IRR of 2.88% as pert the Edelweiss Life Wealth Plus Plan maturity calculator.

At an 8% return scenario: The fund value is ₹42.65 lakhs, with an IRR of 6.76% as per the Edelweiss Life Wealth Plus Plan maturity calculator.

Even in the higher return scenario of 8%, the IRR is comparable to—or in some cases lower than—the returns offered by several traditional debt instruments.

Since this is a market-linked product, one would expect it to deliver inflation-beating returns. However, the plan’s performance falls short when compared with other market-linked investment avenues.

Additionally, the sum assured provided is inadequate. The plan also suffers from limited transparency regarding investments, high charge structures, and low life coverage.

Taken together, these factors make the Edelweiss Life Wealth Plus Plan a less compelling choice for long-term financial planning.

Edelweiss Life Wealth Plus Vs. Other Investments

A major limitation of ULIP products, such as the Edelweiss Life Wealth Plus Plan, is the imbalance between the level of risk taken and the returns delivered.

Moreover, the life cover offered under this plan is insufficient. To achieve adequate protection and meaningful wealth creation, it is more prudent to separate insurance from investment and evaluate the outcomes independently.

Edelweiss Life Wealth Plus Vs. Pure-term + PPF/Equity Mutual Fund

Using the same parameters as the earlier illustration, let us assess an alternative approach. A pure-term insurance policy offering a sum assured of ₹10 lakhs costs an annual premium of ₹4,100 for a 20-year policy term.

By choosing term insurance instead of investing ₹1 lakh annually in the ULIP, an individual saves ₹95,900 each year. This amount can be invested based on risk appetite.

| Pure Term Life Insurance Policy | |

| Sum Assured | ₹ 10,00,000 |

| Policy Term | 20 years |

| Premium Paying Term | 20 years |

| Annualised Premium | ₹ 4,100 |

| Investment | ₹ 95,900 |

High-risk investors may allocate the surplus to equity-oriented products, whereas risk-averse individuals may consider debt instruments. Both scenarios are presented below:

| Term Insurance + PPF | Term insurance + Equity Mutual Fund | ||||

| Age | Year | Term Insurance premium + PPF | Death benefit | Term Insurance premium + Equity Mutual Fund | Death benefit |

| 35 | 1 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 36 | 2 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 37 | 3 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 38 | 4 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 39 | 5 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 40 | 6 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 41 | 7 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 42 | 8 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 43 | 9 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 44 | 10 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 45 | 11 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 46 | 12 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 47 | 13 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 48 | 14 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 49 | 15 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 50 | 16 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 51 | 17 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 52 | 18 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 53 | 19 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 54 | 20 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 55 | 42,56,866 | 70,27,008 | |||

| IRR | 6.75% | 10.89% | |||

Pure-Term + PPF (Public Provident Fund):

The maturity value is ₹42.56 lakhs, delivering an IRR of 6.75%. The outcome is almost identical to the 8% return scenario of the Wealth Plus Plan. Despite being a debt instrument, PPF matches the performance of a market-linked ULIP.

Pure-Term + Equity Mutual Fund:

The pre-tax maturity value is ₹77.39 lakhs. After capital gains tax, the post-tax value stands at ₹70.27 lakhs, resulting in an IRR of 10.89%.

This clearly demonstrates that investing separately in equity markets generates significantly higher returns and consistently outpaces inflation.

| Equity Mutual Fund Tax Calculation | |

| Maturity value after 20 years | 77,39,009 |

| Purchase price | 19,18,000 |

| Long-Term Capital Gains | 58,21,009 |

| Exemption limit | 1,25,000 |

| Taxable LTCG | 56,96,009 |

| Tax paid on LTCG | 7,12,001 |

| Maturity value after tax | 70,27,008 |

By decoupling insurance and investment, this strategy offers stronger risk-adjusted returns, greater transparency, and enhanced flexibility—advantages that the Edelweiss Life Wealth Plus Plan does not provide.

Final Verdict on the Edelweiss Life Wealth Plus

Edelweiss Life Wealth Plus combines market-linked investments with life coverage, offering maturity benefits through fund value and additional allocations. The Rising Star Benefit, if chosen, ensures policy continuity in the event of an unfortunate incident.

However, the returns analysis highlights a disproportionate relationship between risk and reward. In addition, the plan’s sum assured is inadequate, reducing its effectiveness as a financial protection tool.

Long-term investment products are expected to generate substantial, inflation-beating returns to support wealth creation.

Despite its long-term structure, the Edelweiss Life Wealth Plus Plan struggles to deliver competitive returns due to high charges, which erode growth over time. This may leave investors financially underprepared when their goals approach and it also has a high agent commission.

For sustainable long-term wealth creation, ULIPs are generally not advisable. More efficient equity-based investment options are available that offer higher, inflation-adjusted returns at significantly lower costs.

For life protection, it is best to keep insurance and investment separate, with a pure-term insurance policy serving as the most effective and cost-efficient way to safeguard your family’s financial security.

Do Quora, Facebook, and Twitter have the final say when it comes to financial advice?

For a customised investment roadmap, it is prudent to consult a Certified Financial Planner. Their guidance can help you develop a structured, goal-aligned, and risk-appropriate financial strategy tailored to your long-term objectives.

Leave a Reply