India’s equity markets have seen an extraordinary rise in IPO activity over the last five years.

IPO fundraising jumped from ₹12,985 crore in 2019 to ₹1.19 lakh crore in 2021.The momentum continues in 2025—94 mainboard IPOs have raised over ₹1.54 lakh crore, with:

- 64 positive listings

- 30 negative listings

- Average listing gain: 9.47%

This review focuses on the Neptune Logitek IPO—its business, strengths, and risks—and explains how retail investors can design their equity portfolio.

Table of Contents:

Neptune Logitek – Company Overview

Weaknesses / Risks of Neptune Logitek

IPO Investing – Is It the Right Long-term Strategy?

Mutual Fund Alternatives to Direct IPO Investing

1. Thematic Equity Funds – IPO Funds

2. Other Equity Mutual Funds (Diversified Funds)

Why Mutual Funds May Work Better Than IPO Chasing

Neptune Logitek IPO Review – Company Overview

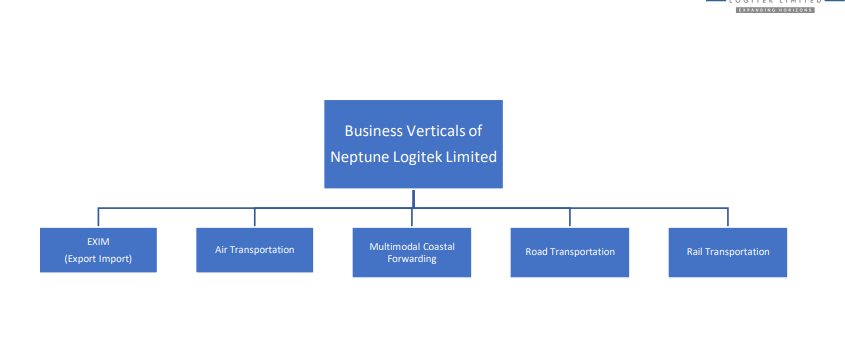

Neptune Logitek Private Limited (NLPL), founded in 2012 and headquartered in Gandhidham, Gujarat, provides integrated logistics and supply chain solutions.

It operates across road, rail, sea, and air freight, offering end-to-end services such as documentation, tracking, customs coordination, and handling of specialised cargos.

The company operates a fleet of 190+ trailers across key locations like Gujarat, Chennai, and Tuticorin, supporting major domestic trade routes.

Neptune Logitek IPO Issue Details

| IPO Size | ₹46.62 crore (entirely fresh issue) |

| Price | ₹126 per share |

| Open | Dec 15, 2025 |

| Close | Dec 17, 2025 |

| Listing | BSE SME (Dec 22, 2025) |

| Minimum Investment | 1 lot = 1,000 shares → ₹2,52,000 (retail) |

| Lead Manager | Galactico Corporate Services |

| Registrar | Bigshare Services |

| Market Maker | Asnani Stock Broker |

Objective of the Neptune Logitek IPO Issue

The Neptune Logitek Company proposes to utilise the Net Proceeds from the Issue towards funding the following objects

- Purchase of trucks and logistics equipment

- Loan repayment

- General corporate purposes

Strengths of Neptune Logitek IPO

- Customised logistics solutions tailored to diverse industry requirements

- End-to-end freight forwarding, simplifying global trade for clients

- Scalable service model supporting both small and large businesses

- Expertise in trade regulations, ensuring smooth cross-border movement

- Strong global partner network across major trade routes

Weaknesses / Risks of Neptune Logitek IPO

- Heavy dependence on a few key suppliers

- High customer concentration—loss of a major client can impact revenue

- Vulnerability to freight rate fluctuations and trade slowdowns

- Dependence on third-party service providers

- Exposure to rising fuel costs

- Cargo isn’t verified by NLPL—potential regulatory and legal risks

Neptune Logitek IPO Key Performance Indicators

| KPI | Value |

| ROE | 14.89% |

| ROCE | 21.25% |

| Debt/Equity | 2.91 |

| RoNW | 45.89% |

| PAT Margin | 3.56% |

| EBITDA Margin | 8.31% |

| P/B | 6.32 |

| Pre IPO | Post IPO | |

| EPS Rs | 9.16 | 7.04 |

| P/E (x) | 13.76 | 17.9 |

| Promoter Holding | 99.99% | 72.99% |

Neptune Logitek IPO Financials Snapshot (₹ Cr) Review

| Particulars | FY25 | FY24 | FY23 |

| Assets | 122.94 | 95.24 | 74.51 |

| Revenue | 260.74 | 175.76 | 187.71 |

| PAT | 9.16 | 0 | -0.18 |

| Total Borrowings | 58 | 62.48 | 38.2 |

IPO Investing – Is It the Right Long-term Strategy?

IPOs attract massive interest, but they are inherently volatile and lack historical price data. Listing-day movements can be unpredictable—with nearly 1 out of 3 listings turning negative in 2025.

Key reminders:

- IPOs should not be the only investment focus.

- Never invest money you cannot afford to lose.

- Avoid leveraging or using borrowed funds for IPOs.

Retail investors often face low allotment odds in quality issues, leading to blocked capital and frustration.

A smarter path is to gain IPO exposure through equity mutual funds.

Mutual Fund Alternatives to Direct IPO Investing

1. Thematic Equity Funds – IPO Funds

IPO-focused schemes invest in the top 100 recently listed or upcoming IPOs, aiming to capture:

- Listing gains

- Post-listing growth

- Exposure to new-age businesses

These funds:

- Invest selectively in high-quality IPOs

- Maintain diversification

- Access anchor and QIB quotas (higher allocation than retail)

- Use research-driven selection instead of hype

Suitable for:

Investors who want IPO exposure but lack time or expertise to analyse each issue.

Examples:

- Edelweiss Recently Listed IPO Fund

- Mirae Asset BSE Select IPO ETF / ETF FoF

- Motilal Oswal BSE Select IPO ETF

2. Other Equity Mutual Funds (Diversified Funds)

Diversified equity funds indirectly gain exposure to strong IPOs based on the fund manager’s assessment. They offer:

- Professional research

- Better risk management

- Tax-efficient long-term investing

- Broad diversification beyond newly listed companies

Compared to direct IPO investing—which is concentrated and high-risk—equity funds provide a smoother, more disciplined path to wealth creation.

Why Mutual Funds May Work Better Than IPO Chasing

- No need to apply for dozens of IPOs with uncertain allotment

- No capital blockage

- Professional research filters out weak or overpriced IPOs

- Investments align with long-term compounding principles

- Automatically gain exposure to India’s emerging companies

Direct IPO investing brings excitement, but mutual funds convert opportunity into a structured wealth-building approach.

Final Takeaway of Neptune Logitek IPO

IPOs offer attractive opportunities, but they also carry significant uncertainty and require careful evaluation. For most retail investors, a portfolio-based approach through mutual funds offers a better balance of risk, return, and peace of mind.

Mutual fund managers assess business models, valuations, and long-term potential before entering any newly listed company.

By delegating research and decision-making to professionals, investors can participate confidently in India’s IPO growth story—without chasing allotments or navigating volatility.

Real wealth lies not in catching every IPO, but in investing consistently through equity mutual funds that combine research, diversification, and long-term growth potential.

Leave a Reply