Do you have Capital Gains from the sale of properties?

If so, do you need to pay a tax of 20% or save Capital Gains tax instead?

Do you think you can avoid LTCG Tax by investing in Capital Gain Bonds/54EC?

Or do you think paying tax and investing further will earn you better returns?

What do you think which will be the better option for your financial life?

In this article, you will understand 13 things you should know about investing in Capital Gain/54EC Bonds.

Table Of Contents :

-

1.)Why should you buy Capital Gain bonds?

- NHAI– National Highway Authority of India and

- REC– Rural Electrification Corporation.

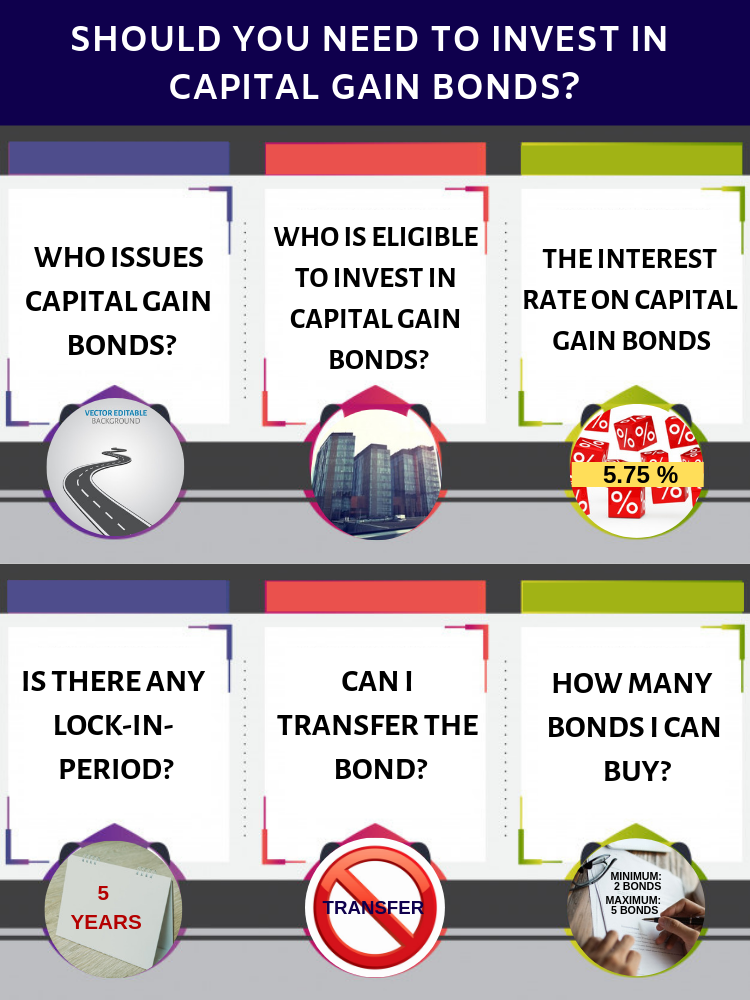

2.)Who issues Capital Gain bonds?

3.)Who is eligible to invest in Capital Gain bonds?

4.)The interest rate on Capital Gain bonds

5.)Is there any lock-in- period for Capital Gain Bonds?

7.)Is Interest on Capital Gain Bonds taxable?

8.)How many Capital Gain bonds I can buy?

9.)Which Bond is better NHAI or REC?

10.)Do these NHAI and REC bonds save tax?

11.)Fixed Deposits Vs Capital Gain Bonds

12.)Capital Gain Bonds Vs Mutual Funds

13.)Are NHAI and REC Bonds Good for Investment?

13 Things You Should Know About Investing in Capital Gains/54EC Bonds

1.Why should you buy Capital Gain/54EC bonds?

A Capital Gain refers to profit from the sale of capital assets such as properties, stocks or bonds and tax that levied on such gains is known as Capital Gains tax.

However, Long term Capital Gain tax from land and building can be saved by investing the sale proceeds in Capital Gains bonds under Section 54EC.

Interesting isn’t it? Do you know how much tax you will save if you invest in Capital Gain bonds?

You will be saving 20% of tax on long term Capital Gains.

Huge isn’t it?

Capital Gains that are held for a shorter period are known as Short term Capital Gains for which this exemption is not applicable.

While Capital Gains are held for a longer period (more than 2 years) are known as long term Capital Gains. This amount can be invested in Capital Gain bonds to save long term Capital Gain tax.

2. Who issues Capital Gain bonds?

Capital Gain bonds which help in saving tax are only issued by the government authorities through,

Here is a link to the appropriate bond form

And, it can be held either in Demat form or Physical form.

Since Capital Gain bonds are issued by the government, it is much safer than any other investments.

Yes, Government usually assures people and they repay the amount.

3. Who is eligible to invest in Capital Gain/54EC bonds?

According to Section 54EC of Income Tax any person individuals, HUFs, partnership firms, companies, etc are eligible to invest in Capital Gain bonds for a Maximum of Rs. 50 lakhs as an investment.

4.The interest rate on Capital Gain/54EC bonds.

Capital Gain bonds provide a 5.75% interest rate which is payable annually by NHAI as well as REC. Before April 1, 2018, the interest rate was 5.25%.

In 2020-21, both the REC bonds and the NHAI bonds provided the same 5.75% interest rate.

There is no cumulative interest option available.

5. Is there any lock-in- period on Capital Gain Bonds?

The lock-in period of Capital Gain bonds was implemented under Section 54EC for the purpose to save tax. Earlier it was for the period of 3 years and now it became to 5 years effective from 1st April 2018.

Lock-in period or tenure of investments plays a vital role in deciding whether to invest in it or not.

For example,

A and B are planning to invest their Capital Gains in Capital Gain bonds. A is a person who has sufficient funds for his needs other than Capital Gains but B is a person who lacks liquidity and has only Capital Gains.

Whom do you think will be suitable for this Capital Gain bonds? Yes, obviously ‘A’. Because they both have a lock-in period of 5 years. In case if there is an emergency, then person A can easily meet the emergency expenses with his adequate fund.

Person B doesn’t have an adequate liquid amount. If he invests in Capital Gain bonds for 5 years, the money will be locked. He will not be having the liquidity to meet his emergency.

6. Can I transfer the bond?

No, Capital Gain bonds are purely non- transferable. Transferability means… if an investor needs any liquidity he can transfer his bonds to another person to encash it. This is not possible with these Capital Gain bonds.

7. Is Interest on Capital Gain/54EC Bonds taxable?

The amount invested is exempted from Capital Gains tax but the interest that is earned on these bonds is liable to income tax.

If the amount invested in bonds is less than the Capital Gains realized, only proportionate Capital Gains would be exempt from tax.

8. How many Capital Gain/54EC bonds I can buy?

Minimum 2 bonds of Rs. 20000 and Maximum of 500 bonds can be purchased at Rs.10000 per bond i.e, Maximum investment limit of up to Rs.50 lakhs in a financial year per individual. The exemption will be the amount of Capital Gain or the amount of investment made, whichever is lesser.

9. Which Bond is Better NHAI or REC?

| NHAI bonds | REC bonds | |

|---|---|---|

| Type | National Highways Authority of India under Sec 54EC | Rural Electrification Corporation Ltd under Sec 54EC |

| Tenure | 5years | 5years |

| Interest Rate | 5.75% p.a. from April 2018 | 5.75% p.a. from April 2018 |

| Credit rating | CRISIL “AAA” Stable rating | CRISIL “AAA” Stable rating |

| Minimum Investment | Two bonds at Rs.10,000 per bond i.e., Rs.20,000 minimum investment | Two bonds at Rs.10,000 per bond i.e., Rs.20,000 minimum investment |

| Maximum Investment | 500 bonds of Rs.10,000/- each i.e.,Rs.50,00,000 in a financial year | 500 bonds of Rs.10,000/- each i.e.,Rs.50,00,000 in a financial year |

| Tax | Interest is taxable. | Interest is taxable. |

| Mode of subscription | 100% on application | 100% on application |

| Transferability | Non- transferable and cannot be offered as a security for any loan or advance. | Non- transferable and cannot be offered as a security for any loan or advance. |

| Maturity | An investor needs to apply for surrender of bond certificates on maturity. Then only, redemption is processed and paid. | Bonds will be automatically redeemed by REC on maturity without the surrender of Bond Certificates and the proceeds would be paid by cheque or ECS. |

REC bonds score a bit higher than NHAI bonds. Because on maturity i.e., after 5 years, NHAI bondholders have to apply for surrender of bonds only then the maturity amount is redeemed and paid by cheque or ECS. In the case of REC bonds, it will be automatically redeemed and paid by cheque or ECS.

10. Does these NHAI and REC bonds save tax?

You may think that these bonds provide only 5.75% taxable return which is lesser compared to other investments.

But the positive side of these bonds are,

But the positive side of these bonds are,

– As compared to other investments, NHAI and REC bonds not only provide you returns with taxable interest. But also saves 20% LTCG tax which is one of the advantages to invest in these bonds.

– The credit rating for these Capital Gain bonds is CRISIL AAA rating i.e., highest credit rating. This helps you to know about the bonds creditworthiness and the ability to repay the principal and interest on time.

– Long term Capital Gains arising from the sale of Commercial property, Non- agricultural land, and under construction property.

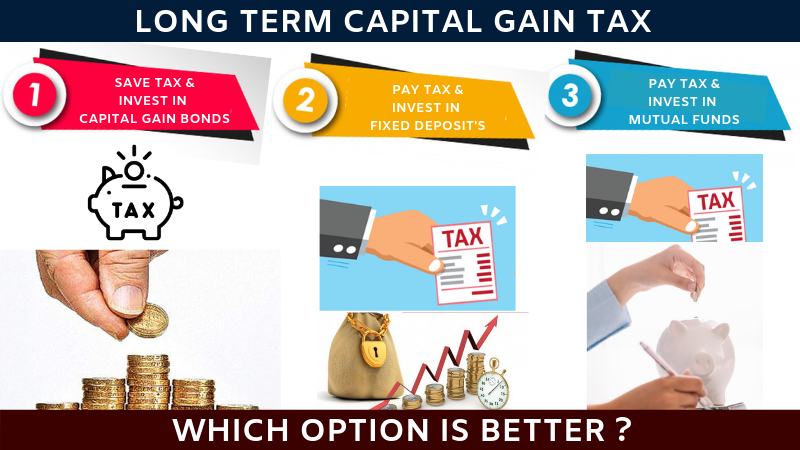

11. Fixed Deposits Vs Capital Gain Bonds

The interest earned on these Capital Gain bonds of 5.75% is lower as compared to the interest on a fixed deposit which is around 7%.

So, at the surface level, it looks like 7% FD is better. Let us dive deep and understand reality.

If you invest in Fixed Deposits, you need to pay the long term Capital Gain tax from the sale of property and you can invest only the balance in Fixed Deposit.

Let me illustrate on this with Capital Gains of Rs.50,00,000 for 5 years on different income slabs.

Investing in Capital Bonds Vs Fixed Deposits (5% Tax Bracket)

| Investing Amount (Rs.) | Investment after LTCG tax(Rs.) | Interest Rate (%) | Interest Amount (Rs.) | Tax Amount (5%) | Earnings | Earnings after 5 years | Closing Balance | |

|---|---|---|---|---|---|---|---|---|

| Capital Bonds – No LTCGT | 5000000 | 5000000 | 5.75 | 287500 | 14375 | 273125 | 1365625 | 6365625 |

| Fixed Deposit – 20% on LTCGT | 5000000 | 4000000 | 7 | 280000 | 14000 | 266000 | 1330000 | 5330000 |

Investing in Capital Bonds Vs Fixed Deposit (20% Tax Bracket)

| Investing Amount (Rs.) | Investment after LTCG taxv(Rs.) | Interest Rate (%) | Interest Amount (Rs.) | Tax Amount (20%) | Earnings | Earnings after 5 years | Closing Balance | |

|---|---|---|---|---|---|---|---|---|

| Capital Bonds – No LTCGT | 5000000 | 5000000 | 5.75 | 287500 | 57500 | 230000 | 1150000 | 6150000 |

| Fixed Deposit – 20% on LTCGT | 5000000 | 4000000 | 7 | 280000 | 56000 | 224000 | 1120000 | 5120000 |

Investing in Capital Bonds Vs Fixed Deposit (30% Tax Bracket)

| Investing Amount (Rs.) | Investment after LTCG tax(Rs.) | Interest Rate (%) | Interest Amount (Rs.) | Tax Amount (30%) | Earnings | Earnings after 5 years | Closing Balance | |

|---|---|---|---|---|---|---|---|---|

| Capital Bonds – No LTCGT | 5000000 | 5000000 | 5.75 | 287500 | 86250 | 201250 | 1006250 | 6006250 |

| Fixed Deposit – 20% on LTCGT | 5000000 | 4000000 | 7 | 280000 | 84000 | 196000 | 980000 | 4980000 |

From the above table, NHAI and REC bonds yield better than Fixed Deposits. More than returns, the prime benefit of investing in these Capital Gain bonds is not just the interest earned but also the Capital Gains tax which is being saved.

12. Capital Gain Bonds Vs Mutual Funds

Now let us compare Capital Gain/54EC Bonds and Mutual Funds with the help of an illustration.

Mr. Ganesh invested in Real estate and earned Rs.1,00,00,000 Capital Gains. Further, he decided to reinvest his Capital Gains equally on Equity funds and Capital Gains bonds. Let us check what will be his returns finally?

Investing in Capital Gain/54EC bonds

| Tax slab | Investing Amount (Rs.) | Investment after LTCG tax(Rs.) | Interest Rate (%) | Interest Amount(Rs.) | Tax Amount(30%) | Earnings | Earnings after 5 years | Closing Balance |

|---|---|---|---|---|---|---|---|---|

| 5% | 5000000 | 5000000 | 5.75 | 287500 | 14375 | 273125 | 1365625 | 6365625 |

| 20% | 5000000 | 5000000 | 5.75 | 287500 | 57500 | 230000 | 1150000 | 6150000 |

| 30% | 5000000 | 5000000 | 5.75 | 287500 | 86250 | 201250 | 1006250 | 6006250 |

Investing in Equity Mutual Funds

Capital Gain : Rs. 50 lacs

LTCG tax paid: 20% = 10 lacs

Net Amount invested after LTCG Tax = 40 lacs

| Opening Balance | Investing Amount after LTCGT | Expected Rate of Returns* | Appreciation amount (Rs.) | Tax Amount (10%) | Closing Balance (Rs.) |

|---|---|---|---|---|---|

| 0 | 4000000 | 12% | 480000 | 0 | 4480000 |

| 4480000 | 12% | 537600 | 0 | 5017600 | |

| 5017600 | 12% | 602112 | 0 | 5619712 | |

| 5619712 | 12% | 674365.4 | 0 | 6294077 | |

| 6294077 | 12% | 755289.3 | 0 | 7049367 | |

| 7049367 | 3049367 | 304936.7 | 6744430 |

* 12% is the rate of return assumed for equity mutual funds.

Equity Funds are taxed on a flat 10% for its long term Capital Gains. So regardless of your income tax slab, you will be taxed at 10% for long term Capital Gains.

Comparatively, Equity Mutual Fund earns a much better return than Capital Gain bonds. But the only problem with the equity investment is that they are high risk-oriented investments. Capital Gain bonds earn a much lesser return as compared to equity. The main USP of Capital Gain bonds is they save long term Capital Gain tax.

If you are comfortable with the risk associated with equity funds, then you can avoid investing in Capital Gain bonds and just pay the LTCG tax and reinvest the balance in equity funds. The returns from equity funds will be more than the returns from the Capital Gain bonds and also the tax amount saved by way of investing in Capital Gain bonds.

To calculate your Long Term Capital Gain Tax(LTCG), check out this LTCG Calculator from Economic Times.

13. Verdict NHAI and REC Bonds Good for Investment?

If you have enough liquidity, then you can lock up your money and invest in Capital Gain bonds. If you don’t have liquidity, then instead of locking up your money, you may avoid investing in Capital Gain bonds and pay the long term Capital Gain tax. You can invest the balance money in liquid investments like Fixed Deposits or debt funds.

If you have an appetite for risk, then you have one more alternative. That is you can pay the long term Capital Gain tax and invest the balance money in equity funds which can deliver much higher returns in the long run.

If you are ever in need of financial guidance, you can Register for our 30 minutes FREE Financial Planning Consultation by clicking on the link below.

[the_ad id=’13360′]

If a property sale happens in 2023 January and Bonds are Purchased in 2023 April that is sold in FY 2022-2023 AND CAPITAL GAINS INVESTED IN TAX EXEMPTION BONDS IN FY 2023-2024. IN THIS CASE WHAT LAW SAYS ABOUT INCOME TAX Exemption (54EC)? THAT IS ITR SUBMISSION FOR FY 2022-2023?

Most useful and knowledge gaining about 54 EC AND PROPERTY SALE BY COMMON PEOPLE. One clarification: No where there is mention of financial year for investing. Capital gained in bonds. Only condition is with in six months from the date of sale of property capital gained must be invested. EXAMPLE: If PERSON “A” 1. Sold flat in YEAR 2022 January month 2. Purchased Bonds (REC OR SUCH ELIGIBLE BONDS FOR INCOME TAX EXEMPTION) IN APRIL 2023 (WELL WITH IN SIX MONTHS TIME GIVEN UNDER LAW. JANUARY TO APRIL IS ONLY FOUR MONTHS) 3. How to show this in ITR 2 (SOLD IN FINANCIAL YEAR 2022- 2023 AND PURCHASED BONDS IN FY 2023-2024 Adhering TO SIX MONTHS RULE) 4. Can you please explain?

Most useful and knowledge gaining about 54 EC AND PROPERTY SALE BY COMMON PEOPLE. One clarification: No where there is mention of financial year for investing. Capital gained in bonds. Only condition is with in six months from the date of sale of property capital gained must be invested. EXAMPLE: If PERSON “A” 1. Sold flat in YEAR 2022 January month 2. Purchased Bonds (REC OR SUCH ELIGIBLE BONDS FOR INCOME TAX EXEMPTION) IN APRIL 2023 (WELL WITH IN SIX MONTHS TIME GIVEN UNDER LAW. JANUARY TO APRIL IS ONLY SIX MONTHS) 3. How to show this in ITR 2 (SOLD IN FINANCIAL YEAR 2022- 2023 AND PURCHASED BONDS IN FY 2023-2024 Adhering TO SIX MONTHS RULE) 4. Can you please explain?

Thanks for your detailed writeup. It is easy to understand with your example oriented lucid details.

Are the NRIs also entitled to invest in these bonds?

Yes they can.

As per your advice I invested Rs 40 lakhs on REC CG bonds to save cg tax. The current rate of interest is 5 percent. I am glad I followed your advice.Thanks.d

I am glad that you found our article useful!

Thanks for good insight! Also want to point out that the CG investment vs FD comparison doesn’t include the CUMMULATIVE factor in FD. It is normally available in FD and hence with that FD can be attractive than CG.

Could you also post a write up for TAX FREE bonds comparison? Esp between CG REC bond vs TAX FREE REC bond. It will be very interesting

EXCELLENT DETAILS.THANKS.

It is understood that Government of India have not mandated NHAI to raise funds from market for FY 2022-23. NHAI, therefore, is not issuing Capital Gain Bonds w.e.f. 1st April 2022.

Accordingly, presently, the following are eligible 54EC Capital Gain Bonds :

1) Power Finance Corporation Ltd., a MAHARATNA Company (PFC)

2) REC Ltd, a Navratna Company (REC)

3) Indian Railway Finance Company (IRFC)

Thank you for sharing the info.

nicely explained.

Thanks

Lot of Thanks for sharing your diligence to invest our hardcore money.

Very detailed and excellent write up with lucid explanation with scenarios.

Thank you

Very nice How to buy Nhai bonds in Jaipur Rajasthan

You can contact your financial planner

Also, you can contact our certified financial planner. Please click the link and fill out the 30-minute complimentary consultation form to book your appointment.

https://www.holisticinvestment.in/complimentary-financial-plan-consultation/

Excellent explanation with illustration.

Thank you

Nice write up

Thank You!

What is the ROI for REC bonds now 1-10-21

5%

Excellent write up. Very thanks. Appreciate

Thanks

Are these bonds ever available for investment or only when those are floated?

Dear Shrikant,

Mostly, these bonds are ever available.

Excellent write-up. Ready to understand and on point.