Is the Edelweiss Life Guaranteed Savings Star Plan a reliable substitute for disciplined savings — or a trap that blurs the line between protection and investment?

Does the Edelweiss Life Guaranteed Savings Star Plan truly reward long-term commitment — or simply lock you into a low-yield structure disguised as security?

Does the Edelweiss Life Guaranteed Savings Star Plan actually help build “wealth” — or merely return your money with a small premium attached?

This article takes a closer look at its features, benefits, and drawbacks to assess whether it’s the right fit for your financial goals.

Table of Contents:

What is the Edelweiss Life Guaranteed Savings Star Plan?

What are the features of the Edelweiss Life Guaranteed Savings Star Plan?

Who is eligible for the Edelweiss Life Guaranteed Savings Star Plan?

What are the benefits of the Edelweiss Life Guaranteed Savings Star Plan?

Grace Period, Discontinuance and Revival of the Edelweiss Life Guaranteed Savings Star Plan

Free Look Period for the Edelweiss Life Guaranteed Savings Star Plan

Surrendering the Edelweiss Life Guaranteed Savings Star Plan

What are the advantages of the Edelweiss Life Guaranteed Savings Star Plan?

What are the disadvantages of the Edelweiss Life Guaranteed Savings Star Plan?

Research Methodology of Edelweiss Life Guaranteed Savings Star

Benefit Illustration – IRR Analysis of Edelweiss Life Guaranteed Savings Star

Edelweiss Life Guaranteed Savings Star Vs. Other Investments

Edelweiss Life Guaranteed Savings Star Vs. Pure-term + PPF/Equity Mutual Fund

Final Verdict on Edelweiss Life Guaranteed Savings Star Plan

What is the Edelweiss Life Guaranteed Savings Star Plan?

Edelweiss Life Guaranteed Savings Star Plan is an Individual, Non-Linked, Non-Participating, Savings, Life Insurance Plan. It offers life cover and stable assured returns that can take care of your future financial needs.

It also secures your family’s financial future by ensuring the benefits are paid on maturity, even if you are no longer around to care for them or diagnosed with any of the covered Critical illnesses.

What are the features of the Edelweiss Life Guaranteed Savings Star Plan?

- Protect your family’s financial future with a life insurance policy.

- Choose between two plan options — Base and Enhanced Cover.

- With the Enhanced Cover, you can boost your insurance protection and increase the death benefit.

- By paying an additional premium, you can ensure your family’s goals are safeguarded even in your absence or on diagnosis of a covered critical illness through Family Income Benefits.

- Secure your long-term goals with guaranteed returns that are clearly defined at the start of the policy.

- Enjoy tax benefits as per the prevailing tax laws.

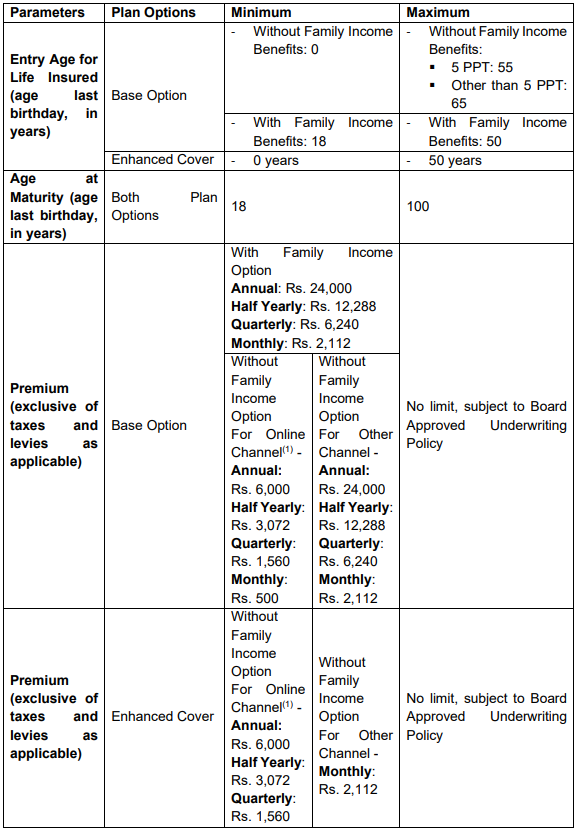

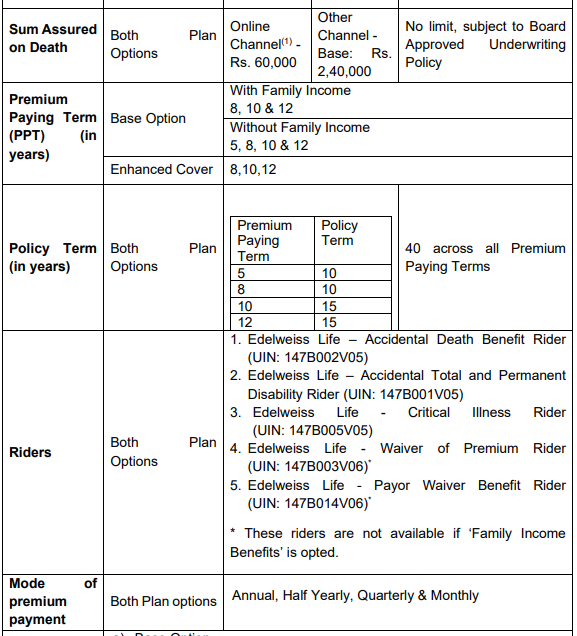

Who is eligible for the Edelweiss Life Guaranteed Savings Star Plan?

What are the benefits of the Edelweiss Life Guaranteed Savings Star Plan?

1. Death Benefit

On the death of the Life Insured during the Edelweiss Life Guaranteed Savings Star Plan policy term while the policy is in force, the Death Benefit equal to the Sum Assured on Death is payable, and the policy will terminate.

For Base Plan Option:

The Sum Assured on Death at any point of time, provided the policy is in force, is the highest of:

- 10 times the Annualised Premium

- Any absolute amount assured to be paid on death

- 10 times the Annual Premium

For Enhanced Cover Plan Option:

The Sum Assured on Death at any point in time, provided the Edelweiss Life Guaranteed Savings Star Plan policy is in force, is the highest of:

- 20 times the Annualised Premium

- Any absolute amount assured to be paid on death

- 20 times the Annual Premium

2. Maturity Benefit

At the end of the Policy Term, you will receive a guaranteed Maturity Benefit equal to the Sum Assured on Maturity upon payment of all due premiums.

You have an option to receive your Maturity Benefit as a lump sum or in equal annual instalments of 22.4% of the Maturity Benefit over a period of 5 years.

The option to receive your Maturity Benefit in a lump sum or instalments has to be chosen at the inception of the policy.

3. Family Income benefits

Family Income Benefit on Death (FIB on Death):

In case of the Life Insured’s death while the Edelweiss Life Guaranteed Savings Star Plan policy is in force, the Death Benefit is payable to the Nominee(s)/Legal heirs. In addition, no future Premiums are required to be paid, and the policy will continue as an in-force policy.

On Maturity, the Sum Assured on Maturity will be payable to the Nominee(s)/Legal heirs, and the policy will terminate without any further benefit.

Family Income Benefit on Critical Illness and Death (FIB on Critical Illness and Death):

In case of the Life Insured’s death while the Edelweiss Life Guaranteed Savings Star Plan policy is in force, the Death Benefit is payable to the Nominee(s)/Legal heirs. In addition, no future premiums are required to be paid, and the policy will continue as an in-force policy.

On Maturity, the Sum Assured on Maturity will be payable to the Nominee(s)/Legal heirs, and the policy will terminate without any further benefit.

Grace Period, Discontinuance and Revival of the Edelweiss Life Guaranteed Savings Star Plan

Grace Period

The company will allow a Grace Period of 15 days, where the Edelweiss Life Guaranteed Savings Star Plan Policyholder pays the premium on a monthly basis, and 30 days in all other cases, during which you must pay the premium due in full.

Discontinuance

If all the premiums for at least the first Policy Year have not been paid in full within the Grace Period, the Policy shall immediately and automatically lapse, and no benefits shall be payable by us under the Policy, unless the Policy is revived within the Revival Period

After completion of the first policy year, provided one full year’s Premium has been paid, then on premium discontinuance, the policy will continue as a ‘Reduced Paid-up’ policy, and all the benefits shall be reduced proportionately.

Revival

Any lapsed policy may be revived within five years from the due date of the first unpaid premium

Free Look Period for the Edelweiss Life Guaranteed Savings Star Plan

You have a Free Look period of thirty (30) days beginning from the date of receipt of the Policy Document, whether received electronically or otherwise, to review the terms and conditions of this Policy.

If you disagree with any of the terms or conditions, or otherwise, and you have not made any claims, you may return this Policy for cancellation.

Surrendering the Edelweiss Life Guaranteed Savings Star Plan

After completion of the first Policy Year, provided one full year’s Premium has been paid, your policy will acquire a Surrender Value.

On receipt of a written request for Surrender from you, the Surrender Value, if any, will be immediately paid, the Policy will be terminated, and all the benefits under the Edelweiss Life Guaranteed Savings Star Plan Policy shall cease to apply.

The surrender value payable is the higher of Guaranteed Surrender Value (GSV) and Special Surrender Value (SSV).

What are the advantages of the Edelweiss Life Guaranteed Savings Star Plan?

- Enhance your protection by choosing from additional riders.

- Avail policy loans whenever needed.

- Opting for the Family Income Benefit adds an extra layer of security.

- All benefits offered under this plan are guaranteed.

What are the disadvantages of the Edelweiss Life Guaranteed Savings Star Plan?

- Although the benefits are guaranteed, the overall returns are not attractive.

- The sum assured falls short of providing adequate life coverage.

Research Methodology of Edelweiss Life Guaranteed Savings Star

The Edelweiss Life Guaranteed Savings Star Plan offers a guaranteed maturity benefit, payable either as a lump sum or in five equal instalments.

However, depending solely on these guarantees can be misleading — it is essential to evaluate the plan based on actual percentage returns. Let’s compute the Internal Rate of Return (IRR) using the details provided in the policy brochure.

Benefit Illustration – IRR Analysis of Edelweiss Life Guaranteed Savings Star

A 30-year-old male buys the plan with a base sum assured of ₹5 lakhs (death benefit: ₹12 lakhs).

The policy term is 20 years, and the premium payment term is 10 years, with an annual premium of ₹50,000. He selects the Base Plan Option without the Family Income Benefit.

| Male | 30 years |

| Sum Assured | ₹ 5,00,000 |

| Policy Term | 20 years |

| Premium Paying Term | 10 years |

| Annualised Premium | ₹ 50,000 |

After paying premiums for 10 years, he receives the maturity benefit at the end of 20 years. The total maturity benefit is ₹11.07 lakhs.

This translates to an IRR of just 5.19% as per the Edelweiss Life Guaranteed Savings Star Plan maturity calculator, which is lower than inflation, making it an unattractive investment choice.

| Age | Year | Annualised premium / Maturity benefit | Death benefit |

| 30 | 1 | -50,000 | 5,00,000 |

| 31 | 2 | -50,000 | 5,00,000 |

| 32 | 3 | -50,000 | 5,00,000 |

| 33 | 4 | -50,000 | 5,00,000 |

| 34 | 5 | -50,000 | 5,00,000 |

| 35 | 6 | -50,000 | 5,00,000 |

| 36 | 7 | -50,000 | 5,00,000 |

| 37 | 8 | -50,000 | 5,05,646 |

| 38 | 9 | -50,000 | 5,39,747 |

| 39 | 10 | -50,000 | 5,76,173 |

| 40 | 11 | 0 | 6,15,035 |

| 41 | 12 | 0 | 6,56,554 |

| 42 | 13 | 0 | 7,00,841 |

| 43 | 14 | 0 | 7,48,228 |

| 44 | 15 | 0 | 7,98,715 |

| 45 | 16 | 0 | 8,52,635 |

| 46 | 17 | 0 | 9,10,097 |

| 47 | 18 | 0 | 9,71,545 |

| 48 | 19 | 0 | 10,37,201 |

| 49 | 20 | 0 | 11,07,174 |

| 50 | 11,07,174 | ||

| IRR | 5.19% |

Furthermore, the money remains locked until the policy term ends, meaning he must wait 10 more years after completing his premium payments. The sum assured also falls short of providing adequate financial protection.

Considering the poor liquidity, insufficient life cover, and low returns, the Edelweiss Life Guaranteed Savings Star Plan is not an appealing option for either insurance or investment purposes.

Edelweiss Life Guaranteed Savings Star Vs. Other Investments

Traditional insurance-cum-savings plans generally offer lower returns compared to investing separately. For life cover, a pure-term insurance policy is far more cost-effective and provides significantly higher coverage.

By separating insurance and investment, you gain better flexibility, higher returns, and improved protection. Let’s break this down with a comparative example.

Edelweiss Life Guaranteed Savings Star Vs. Pure-term + PPF/Equity Mutual Fund

Using the same assumptions as earlier, a pure-term policy with a ₹12 lakh sum assured (equivalent to the illustrated death benefit) costs just ₹6,800 per year for a 20-year term with a 10-year premium payment period.

This leaves ₹43,200 per year from the original ₹50,000 premium—money that can be invested according to your risk preference.

| Pure Term Life Insurance Policy | |

| Sum Assured | ₹ 12,00,000 |

| Policy Term | 20 years |

| Premium Paying Term | 10 years |

| Annualised Premium | ₹ 6,800 |

| Investment | ₹ 43,200 |

High-risk investors may choose equity instruments, while low-risk investors can opt for debt options. In this comparison, we evaluate PPF (debt) and Equity Mutual Funds (equity).

| Term Insurance + PPF | Term insurance + Equity Mutual Fund | ||||

| Age | Year | Term Insurance premium + PPF | Death benefit | Term Insurance premium + Equity Mutual Fund | Death benefit |

| 30 | 1 | -50,000 | 12,00,000 | -50,000 | 12,00,000 |

| 31 | 2 | -50,000 | 12,00,000 | -50,000 | 12,00,000 |

| 32 | 3 | -50,000 | 12,00,000 | -50,000 | 12,00,000 |

| 33 | 4 | -50,000 | 12,00,000 | -50,000 | 12,00,000 |

| 34 | 5 | -50,000 | 12,00,000 | -50,000 | 12,00,000 |

| 35 | 6 | -50,000 | 12,00,000 | -50,000 | 12,00,000 |

| 36 | 7 | -50,000 | 12,00,000 | -50,000 | 12,00,000 |

| 37 | 8 | -50,000 | 12,00,000 | -50,000 | 12,00,000 |

| 38 | 9 | -50,000 | 12,00,000 | -50,000 | 12,00,000 |

| 39 | 10 | -47,500 | 12,00,000 | -50,000 | 12,00,000 |

| 40 | 11 | -500 | 12,00,000 | 0 | 12,00,000 |

| 41 | 12 | -500 | 12,00,000 | 0 | 12,00,000 |

| 42 | 13 | -500 | 12,00,000 | 0 | 12,00,000 |

| 43 | 14 | -500 | 12,00,000 | 0 | 12,00,000 |

| 44 | 15 | -500 | 12,00,000 | 0 | 12,00,000 |

| 45 | 16 | 0 | 12,00,000 | 0 | 12,00,000 |

| 46 | 17 | 0 | 12,00,000 | 0 | 12,00,000 |

| 47 | 18 | 0 | 12,00,000 | 0 | 12,00,000 |

| 48 | 19 | 0 | 12,00,000 | 0 | 12,00,000 |

| 49 | 20 | 0 | 12,00,000 | 0 | 12,00,000 |

| 50 | 12,74,343 | 23,77,094 | |||

| IRR | 6.13% | 10.30% | |||

PPF requires a minimum contribution of ₹500 per year for 15 years. Since the premium payment period is 10 years, adjustments are made to comply with PPF rules.

The final maturity value from PPF is ₹12.74 lakhs, delivering an IRR of 6.13%.

Equity Mutual Fund investments, after deducting capital gains tax, yield a post-tax maturity value of ₹23.77 lakhs (pre-tax value: ₹26.37 lakhs). The combined IRR for the term insurance + equity mutual fund strategy stands at 10.30% post-tax.

| Equity Mutual Fund Tax Calculation | |

| Maturity value after 20 years | 26,37,107 |

| Purchase price | 4,32,000 |

| Long-Term Capital Gains | 22,05,107 |

| Exemption limit | 1,25,000 |

| Taxable LTCG | 20,80,107 |

| Tax paid on LTCG | 2,60,013 |

| Maturity value after tax | 23,77,094 |

This comparison clearly shows that keeping insurance and investments separate is a smarter strategy.

You get returns that beat inflation, far better liquidity, and greater flexibility—benefits that the Edelweiss Life Guaranteed Savings Star Plan does not offer.

Final Verdict on Edelweiss Life Guaranteed Savings Star Plan

The Edelweiss Life Guaranteed Savings Star Plan is an insurance-cum-savings policy that offers both life cover and investment benefits. However, the life cover provided is insufficient for a family’s financial security, and the guaranteed returns are modest.

As a result, the plan falls short on both insurance and investment fronts. Even the Family Income Benefit is not included by default—you must opt for it separately, which increases the premium.

Key drawbacks of the plan include low returns, poor liquidity due to long lock-in, and an inadequate sum assured for meaningful financial protection and it also has a high agent commission.

These limitations make the plan less suitable as a comprehensive insurance or investment solution.

Most traditional policies bundle insurance and investment, reducing their effectiveness. A better approach is to choose a pure-term life insurance policy for robust financial protection, while making separate investments based on your risk tolerance, time horizon, and life goals.

Do Quora, Facebook, and Twitter have the final say when it comes to financial advice?

A well-structured financial plan is crucial for long-term success. For personalised guidance, consider consulting a certified financial planner who can help align your financial strategy with your goals.

Leave a Reply