Is HDFC Click 2 Wealth, an attractive product for investment and insurance?

Are the features and benefits as attractive as they seem?

You might be considering purchasing this HDFC Life Click 2 Wealth and need a second opinion from a financial consultant.

Or you’re probably already an HDFC Life Click 2 Wealth Plan customer seeking a review.

If you are any of these people, your search has come to an end.

What are the advantages(pros) and disadvantages(cons) of this HDFC Life Click 2 Wealth ULIP?

How does it compare to the HDFC Life Click 2 Invest?

And also, lets us discover how both these plans compare with Term Insurance + PPF & ELSS.

Let’s see What is the Fund Performance, Fund Value and risk level of different fund options in this HDFC Life Click 2 Wealth ULIP.

This HDFC Life Click 2 Wealth ULIP Review will provide you with all the clarity you require.

Table of Content

1.)HDFC Life Click 2 Wealth Plan Review– Features, Benefits, and Returns

2.)HDFC Click 2 Wealth – Analysis of Sum Assured and Minimum Premium

3.)Other Key Features of HDFC Life Click 2 Wealth: Analysis

4.)HDFC Life Click 2 Wealth – Review of Fund Options with Illustration

5.)HDFC Click 2 Wealth Review of Benefits

6.)Analysis of HDFC Click 2 Wealth – Review of Maturity Benefits with Illustration

7.)Comparison of HDFC Click 2 Wealth Vs PPF + Term Insurance – Analysis

8.)Comparison of HDFC Click 2 Wealth Vs ELSS Mutual Fund + Term Insurance – Analysis

9.)Tax Computation for an ELSS Mutual Fund – Analysis

10.)HDFC Life Click 2 Wealth VS HDFC Life Click 2 Invest: Review

11.)HDFC Life Click 2 Wealth VS HDFC Life Super Income Plan – Review

12.)HDFC Life Click 2 Wealth VS Other Investment Plans – Review Conclusion

13.)Review of Charges Under HDFC Life Click 2 Wealth Plan

14.)What happens in case you do not pay the premiums before 5 years? An analysis

15.)How to Surrender HDFC Life Click 2 Wealth? An Analysis

16.)HDFC Click 2 Wealth Good or Bad?

HDFC Life Click 2 Wealth Plan from HDFC Life Insurance is a ULIP (Unit Linked Insurance Plan) product. It offers market-linked returns to the policyholder and acts as an insurance cover for the policyholder and their family.

It is a non-participating insurance plan, which means the policyholder does not get any bonuses, dividends, or such add-ons. This is because, in this plan, the insurer does not simply ‘participate’ in the business of the insurance company.

Let’s take a closer look at Features, Pros, Cons, Returns, and the alternative options for HDFC Click 2 Wealth to review this plan better.

1.)HDFC Life Click 2 Wealth Plan Review– Features, Benefits, and Returns

HDFC Life Click 2 Wealth comes with 3 plan options as under

Invest Plus Option: This is the most basic plan; you get a life cover and the accumulated fund that is realized on maturity, becomes your wealth creation. Upon the death of the life assured, he or she gets the highest of,

- Total Sum Assured – Any Partial Withdrawals

- Fund value

- 105% of the Total Premiums Paid

Premium Waiver Option Review: In this plan, there is a clear distinction between the policyholder and the Life Assured.

A proposer or the policyholder will be liable to pay the premiums under the premium waiver option. In case of the unfortunate death of the proposer/policyholder during the tenure of the plan, all future payments are waived.

In such a case, HDFC Click 2 Wealth makes all future payments toward the fund. Meanwhile, the risk cover for the life assured will continue, and the life assured will be made as the policyholder.

Since it is designed to protect your child’s future, it can be called an HDFC Click 2 Wealth Child Plan.

In the event of the death of the Life Assured, the death benefit is payable under the policy as a lump sum.

Golden Years Benefit Option Review: In addition to the basic Invest Plus Option, you are covered for the whole life (99 years) and on maturity, you receive the accumulated Fund Value and mortality charges are added to the fund value at the end of the policy year, which matches or follows the 70th birthday of the Life Assured.

Unlike the other two plans of ‘HDFC Click 2 Wealth, ‘Invest Plus’ and ‘Premium Waiver’, wherein the “age at maturity” was 75 years, is 99 years for Golden Years Benefit Option.

You can also call this HDFC Click 2 Wealth Retirement Plan because it is designed for your golden years when you need independent cash flow.

To cite an example, let us say Manoj is a 52-year-old journalist who wants to save for his retirement. He buys the HDFC Click 2 Wealth Plan with the Golden Years Benefit Option wherein the policy term is ‘Whole Life’ (99 years).

So, he can choose a premium payment term from 10 years to the time he attains the age of 70.

Once Mr. Manoj turns 70, the life cover continues, and he does not need to make any premium payments. At the end of the maturity of the plan, he receives the fund value as a lump sum benefit.

To produce a regular retirement income, Mr. Manoj can opt for a Systematic Withdrawal Plan under the Golden Years Benefit Option. Wherein he receives money at regular income from his accumulated fund.

Systematic Withdrawals: Analysis

A policyholder can request systematic or recurring withdrawals under the ‘Settlement’ option. The fund value is paid based on periodical investments over a period.

Besides, HDFC Life Click 2 Wealth also facilitates the Partial Withdrawal option under certain circumstances on all the options.

Partial Withdrawals: Analysis

The policyholder can make a partial withdrawal under the following conditions-

- He or she is an adult, at least 18 years of age.

- No partial withdrawals are allowed within the first five years of the policy period.

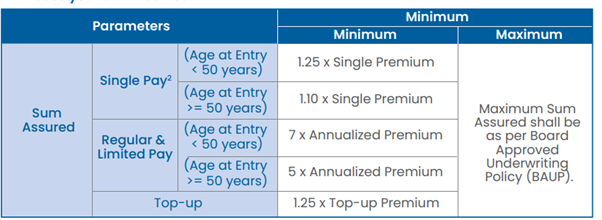

2.)HDFC Click 2 Wealth – Analysis of Sum Assured and Minimum Premium

Minimum Single Premium → ₹24,000.

- Monthly → ₹1000

- Quarterly → ₹3000

- Half Yearly → ₹6000

- Yearly → ₹12000

There is no limit to the maximum premium, subject to Board Approved Underwriting.

The Sum Assured is as follows:

Now, let us see the fund options available for an investor under HDFC Life Click 2 Wealth. And how they differ in their asset allocation and risk levels.

3.)Other Key Features of HDFC Life Click 2 Wealth: Analysis

- There are 17 different fund choices to suit your investment preferences.

- Switching is completely free and unlimited.

- Only the Fund Management charge for managing your funds and the Mortality charge for your life insurance are included.

- For the first 5 years, special addition of 1% of the Annualised premium is allocated to your fund.

- If the Proposer dies, all future premiums will be waived, and your fund will remain invested.

- Tax advantages may be offered depending on the prevailing tax laws.

The premium modes offered by HDFC Life Click 2 Wealth include single, monthly, quarterly, half-yearly, and annual installments.

This is entirely dependent on the risk appetite of the policyholder, allowing for a great deal of flexibility.

4.)HDFC Life Click 2 Wealth – Review of Fund Options with Illustration

HDFC Life Click 2 Wealth offers 17 different fund options to invest your money. The returns will depend on the choice of funds you take. So, if you take a low-risk debt fund, your returns may not be high.

But if you are going to stay invested for 5 years or more, you should go for a moderate to high-risk equity fund for better returns.

You can invest in a combination of funds by diversifying your fund among different fund options.

|

S.no |

FUND OPTION |

ASSET ALLOCATION |

RISK |

||

|

Money Market, cash & deposits |

Govt Sec, Fixed Income, Bonds |

Equity |

|||

|

1 |

Diversified Equity Fund |

0-40% |

0-40% |

60-100% |

Very High |

|

2 |

Blue Chip Fund |

0-20% |

– |

80-100% |

Very High |

|

3 |

Balanced Fund |

0-20% |

0-60% |

40-80% |

Moderate to High |

|

4 |

Bond Fund |

0-60% |

40-100% |

– |

Moderate |

|

5 |

Discovery Fund |

0-10% |

0-10% |

90-100% |

Very High |

|

6 |

Equity Advantage Fund |

0-20% |

0-20% |

80-100% |

Very High |

|

7 |

Opportunities Fund |

0-20% |

– |

80-100% |

Very High |

|

8 |

Liquid Fund |

0-100% |

– |

– |

Very Low |

|

9 |

Bond Plus Fund |

0-20% |

30-100% |

0-50% |

Moderate to High |

|

10 |

Secure Advantage Fund |

0-40% |

60-100% |

– |

Moderate |

|

11 |

Sustainable Equity Fund |

0-20% |

0-20% |

80-100% |

Very High |

|

12 |

Flexi cap Fund |

0-20% |

0-20% |

80-100% |

Very High |

|

13 |

Mid cap mometum Fund |

0-10% |

0-10% |

90-100% |

High |

|

14 |

Nifty Alpha 30 Fund |

0-10% |

0-10% |

90-100% |

High |

|

15 |

Top 500 Momentum 50 Fund |

0-10% |

0-10% |

90-100% |

High |

|

16 |

Dynamic Advantage Fund |

0-50% |

0-50% |

50-100% |

Moderate |

|

17 |

Top 300 Alpha 50 Fund |

0-10% |

0-10% |

90-100% |

High |

In the above illustration, the different risk level is calculated according to Fund Performance. (The risk level of HDFC Click 2 Wealth Discovery Fund seem to be very high).

The fund options range from the very low-risk liquid fund to the very high-risk Bluechip fund.

Based on the risk level, the returns from these funds also vary. An investor can choose to invest in any of these 17 different funds based on their risk appetite.

Let us analyse and review the return and benefits with an example in the HDFC Life Click 2 Wealth Review of Benefits below.

HDFC Life Click 2 Wealth gives benefits to the policyholder or the nominee under two different scenarios. It is either the Maturity benefit or the Death benefit.

We shall analyse each of these scenarios to check whether HDFC Life Click 2 Wealth is beneficial or not.

5.)HDFC Click 2 Wealth Review of Benefits

i.) Death Benefit of HDFC Life Click 2 Wealth-Review

In case of the death of the policyholder, the nominee gets the highest of the following –

- Total Sum Assured less the amount of Partial withdrawals made, if any, where Total Sum Assured is Basic Sum Assured plus any additional Sum Assured in respect of Top-up

- Fund Value

- 105 percent of the premiums paid.

To cite an example, under the basic “Invest Plus” Option, if Akash dies anytime in these 40 years, he gets the death benefit, as cited above. Once the death benefit is paid, the policy is said to be terminated.

For the ‘Premium Waiver’ Option, in the scenario, wherein the ‘proposer’ is different from ‘life assured; upon the death of the proposer, future premiums are waived. The policy goes on till maturity, and the maturity benefits are paid to the life assured.

To cite an example, let us say when his daughter was 10 years old, Mohit Saxena bought the HDFC Click 2 Wealth Plan with the Premium Waiver Option for 30 years. In this case, he is the policyholder or the Proposer, and the daughter is the Life Assured.

Every year he makes an annualized premium of ₹50,000 and the company adds 1 percent of the annualized premium to the fund value for the first five years.

In case Mohit dies after 20 years, the plan continues, the company or the insurer pays all future premiums on Mohit’s behalf, and at maturity, Mohit’s family gets the fund value as a lump sum benefit. The life cover of the daughter continues until maturity.

For the ‘Golden Years’ option also, the death cover continues for the entire policy term.

ii). Maturity Benefit of HDFC Life Click 2 Wealth-Review

On survival until the maturity of the plan, you will get the accumulated fund value. The Fund Value is calculated by multiplying balance units in your fund by the prevailing unit price, Net Asset Value (NAV).

The policy matures at the end of the policy tenure and the risk cover is deemed complete.

Let us say Mr. Akash is a 35-year-old software developer. He buys HDFC Click 2 Wealth Plan’s Invest-Plus Option with a policy term period of 15 years and a premium paying term of 15 years.

Every year, he pays an annual premium of ₹1.2 lakhs and the company adds 1 percent of the annualized premium to the fund value for the first five years.

The life cover continues for 15 years and when the policy matures at the end of the 15th year, he gets the accumulated fund value.

The maturity benefit is applicable for all three plans – Invest-Plus Option, Premium Waiver Option, and Golden Years.

Let us see what Mr. Akash could get from HDFC Life Click 2 Wealth at the end of his policy term.

6.)Analysis of HDFC Click 2 Wealth – Review of Maturity Benefits with Illustration

Here is a model illustration of HDFC Life Click 2 Wealth maturity benefits.

And for the illustration, I have chosen the Invest-Plus benefit option since it is more direct in calculating the maturity value.

|

Male |

35 years |

|

Sum Assured |

₹ 12,00,000 |

|

Policy Term |

15 years |

|

Premium Paying Term |

15 years |

|

Annualised Premium |

₹ 1,20,000 |

In the above illustration, the Maturity Value of the Invest-Plus benefit option is calculated.

Note: These assumed rates of returns are not guaranteed, but depend on the fund performance.

These assumed rates of returns are not guaranteed, but depend depends on the Fund’s Performance.

|

At 4% p.a. |

At 8% p.a. |

||||

|

Age |

Year |

Annualised premium / Maturity benefit |

Death benefit |

Annualised premium / Maturity benefit |

Death benefit |

|

35 |

1 |

-1,20,000 |

12,00,000 |

-1,20,000 |

12,00,000 |

|

36 |

2 |

-1,20,000 |

12,00,000 |

-1,20,000 |

12,00,000 |

|

37 |

3 |

-1,20,000 |

12,00,000 |

-1,20,000 |

12,00,000 |

|

38 |

4 |

-1,20,000 |

12,00,000 |

-1,20,000 |

12,00,000 |

|

39 |

5 |

-1,20,000 |

12,00,000 |

-1,20,000 |

12,00,000 |

|

40 |

6 |

-1,20,000 |

12,00,000 |

-1,20,000 |

12,00,000 |

|

41 |

7 |

-1,20,000 |

12,00,000 |

-1,20,000 |

12,00,000 |

|

42 |

8 |

-1,20,000 |

12,00,000 |

-1,20,000 |

12,00,000 |

|

43 |

9 |

-1,20,000 |

12,00,000 |

-1,20,000 |

12,00,000 |

|

44 |

10 |

-1,20,000 |

12,00,000 |

-1,20,000 |

12,00,000 |

|

45 |

11 |

-1,20,000 |

12,00,000 |

-1,20,000 |

12,00,000 |

|

46 |

12 |

-1,20,000 |

12,00,000 |

-1,20,000 |

12,00,000 |

|

47 |

13 |

-1,20,000 |

12,00,000 |

-1,20,000 |

12,00,000 |

|

48 |

14 |

-1,20,000 |

12,00,000 |

-1,20,000 |

12,00,000 |

|

49 |

15 |

-1,20,000 |

12,00,000 |

-1,20,000 |

12,00,000 |

|

21,83,407 |

30,39,029 |

||||

|

IRR |

2.38% |

6.30% |

|||

To check HDFC Click 2 Wealth Fund Performance Click here.

7.)Comparison of HDFC Click 2 Wealth Vs PPF + Term Insurance – Analysis

PPF (Public Provident Fund) is a government-backed scheme known for its stability, assured returns, and EEE tax exemption status.

The current interest rate (2025) at 7.1% is still strong enough to beat inflation during an investment period. The lock-in period is 15 years but partial withdrawals are allowed post the 7th policy year.

The maximum amount is 50 percent of the balance amount at the end of the fourth year.

PPF enables you to claim income tax benefits up to ₹ 1.5 Lakh under Section 80C. The returns as well as the corpus Post-Maturity are exempt from taxation.

To get the best value of compounding in a PPF, one must start early as possible. So let’s say at age 35, Akash chooses a PPF and invests ₹ 10000 per month for 15 years.

At the end of 15 years, he stands to accumulate a corpus of ₹32.54 lakhs with ₹14.54 lakhs as interest earnings. The following table shows the PPF balance and interest income earned at maturity.

|

Year |

Opening balance |

Annual Contribution |

Interest |

Closing balance |

|

1 |

0 |

1,20,000 |

8520 |

₹ 1,28,520.00 |

|

2 |

₹ 1,28,520.00 |

1,20,000 |

8520 |

₹ 2,66,164.92 |

|

3 |

₹ 2,66,164.92 |

1,20,000 |

8520 |

₹ 4,13,582.63 |

|

4 |

₹ 4,13,582.63 |

1,20,000 |

8520 |

₹ 5,71,467.00 |

|

5 |

₹ 5,71,467.00 |

1,20,000 |

8520 |

₹ 7,40,561.15 |

|

6 |

₹ 7,40,561.15 |

1,20,000 |

8520 |

₹ 9,21,660.99 |

|

7 |

₹ 9,21,660.99 |

1,20,000 |

8520 |

₹ 11,15,618.93 |

|

8 |

₹ 11,15,618.93 |

1,20,000 |

8520 |

₹ 13,23,347.87 |

|

9 |

₹ 13,23,347.87 |

1,20,000 |

8520 |

₹ 15,45,825.57 |

|

10 |

₹ 15,45,825.57 |

1,20,000 |

8520 |

₹ 17,84,099.18 |

|

11 |

₹ 17,84,099.18 |

1,20,000 |

8520 |

₹ 20,39,290.22 |

|

12 |

₹ 20,39,290.22 |

1,20,000 |

8520 |

₹ 23,12,599.83 |

|

13 |

₹ 23,12,599.83 |

1,20,000 |

8520 |

₹ 26,05,314.42 |

|

14 |

₹ 26,05,314.42 |

1,20,000 |

8520 |

₹ 29,18,811.74 |

|

15 |

₹ 29,18,811.74 |

1,20,000 |

8520 |

₹ 32,54,567.38 |

Besides, you can take a loan on your PPF money, which is not the case with a ULIP product like HDFC Click 2 Wealth.

Since PPF is backed by the government of India, the ‘risk factor’ is virtually zero. For a ULIP product like HDFC Click 2 Wealth, the returns are market-linked and unstable.

Even when looking from an insurance perspective, ULIPsdo not stand as adequate insurance coverage. Term insurance policy is the cheapest and the most straightforward of all life insurance policies; there is no investment component involved.

For instance, you need to pay just ₹ 600 per month (or ₹7200 per year) for a life cover of ₹50 lakh, for a 20-year term period, assuming you are 36 years of age.

There is no investment involved in term insurance policies, it is a pure insurance product that gives income to the family in case of the breadwinner’s demise.

Even term insurance is eligible for tax deduction under Section 80 C, and the claim benefit for the nominee is tax-free under Section 10D (10 D).

Thus, we see as against HDFC Click 2 Wealth, you are getting much better coverage through a term insurance policy and building a good corpus through investing in a PPF.

8.)Comparison of HDFC Click 2 Wealth Vs ELSS Mutual Fund + Term Insurance – Analysis

If you are interested in wealth creation and have a high-risk appetite, it is much better to stay invested in an equity mutual fund for the long term and take a Pure-Term cover along with it, instead of a ULIP product.

Remember the rate of return from ULIP varies depending on the investment portfolio of equity, debt, or hybrid funds.

- HDFC Click 2 Wealth Return &Tax Benefits Vs ELSS Mutual Fund – Review

Let’s assume that Akash uses the same ₹ 10000 and puts in a well-performing ELSS mutual fund.

Since an equity mutual fund cannot give assured returns, let us assume an estimated rate of return at 12 percent per annum. At the end of 15 years, he will have earned a corpus or maturity value of ₹50.10 lakhs with interest earnings at ₹ 32.10 lakhs.

The following table shows the compounded growth of investing ₹ 10,000 per month through SIP in an ELSS mutual fund scheme for 15 years while assuming a very conservative 12% rate of return.

|

Year |

Opening balance |

Annual Contribution |

Closing balance |

|

1 |

0 |

1,20,000 |

₹ 1,34,400.00 |

|

2 |

₹ 1,34,400.00 |

1,20,000 |

₹ 2,84,928.00 |

|

3 |

₹ 2,84,928.00 |

1,20,000 |

₹ 4,53,519.36 |

|

4 |

₹ 4,53,519.36 |

1,20,000 |

₹ 6,42,341.68 |

|

5 |

₹ 6,42,341.68 |

1,20,000 |

₹ 8,53,822.69 |

|

6 |

₹ 8,53,822.69 |

1,20,000 |

₹ 10,90,681.41 |

|

7 |

₹ 10,90,681.41 |

1,20,000 |

₹ 13,55,963.18 |

|

8 |

₹ 13,55,963.18 |

1,20,000 |

₹ 16,53,078.76 |

|

9 |

₹ 16,53,078.76 |

1,20,000 |

₹ 19,85,848.21 |

|

10 |

₹ 19,85,848.21 |

1,20,000 |

₹ 23,58,549.99 |

|

11 |

₹ 23,58,549.99 |

1,20,000 |

₹ 27,75,975.99 |

|

12 |

₹ 27,75,975.99 |

1,20,000 |

₹ 32,43,493.11 |

|

13 |

₹ 32,43,493.11 |

1,20,000 |

₹ 37,67,112.29 |

|

14 |

₹ 37,67,112.29 |

1,20,000 |

₹ 43,53,565.76 |

|

15 |

₹ 43,53,565.76 |

1,20,000 |

₹ 50,10,393.65 |

In the case of ELSS, the returns are exempted from tax up to ₹1.25 lakh p.a. Gains above this limit are taxed at 12.5% LTCG (Long Term Capital Gain).

You should note that the 12% CAGR for an ELSS mutual fund is a conservative assumption. A good number of well-performing ELSS Mutual Funds can deliver returns at a rate of 15% or even higher in the long term.

But for now, let’s assume a conservative return and compute the Post-Tax Return in the hands of an investor.

9.)Tax Computation for an ELSS Mutual Fund – Analysis

Like any other ULIP, investments in HDFC Life Click 2 Wealth is eligible for tax deduction up to ₹1.5 lacks per annum under Section 80C of the Income Tax 1961.

ELSS Mutual Fund investments are also eligible for the same tax benefits under section 80C of the Income Tax Act, 1961.

But in HDFC Life Click 2 Wealth, the accumulated money that you get at the end of the maturity period or the sum assured at death, is also tax-free under Section 10 (10d).

An ELSS Mutual Fund on the other hand has no such tax exemption on withdrawals. However, mutual funds generate returns very high that even with taxation, an investor ends up with a higher return in his hand compared to the HDFC Life Click 2 Wealth plan.

See the tax computation and Post-Tax returns from the ELSS fund in the table below:

|

ELSS Tax Calculation |

|

|

Maturity value after 15 years |

50,10,394 |

|

Purchase price |

18,00,000 |

|

Long-Term Capital Gains |

32,10,394 |

|

Exemption limit |

1,25,000 |

|

Taxable LTCG |

30,85,394 |

|

Tax paid on LTCG |

3,85,674 |

|

Maturity value after tax |

46,24,719 |

- Analysis of Return From HDFC Life Clicks 2 Wealth Vs. ELSS Mutual Fund: Review

The post-tax return of ₹46.24 lakhs by ELSS Mutual Fund is still higher than the returns delivered by the HDFC Life Click 2 Wealth plan.

The return calculated in the HDFC Life Click 2 Wealth illustration table is the return before the deduction of Fund Management Charges. If we include the charges from HDFC Life Click 2 Wealth, it further reduces the return.

Even with a conservative comparison, an average ELSS Mutual Funds Can deliver ₹4 lakhs higher return than one of the best performing HDFC Life Click 2 Wealth Funds.

Hence, choosing to invest in HDFC Life Click 2 Wealth plan from the investment perspective is not a sound choice for an investor.

- Analysis of HDFC Life Clicks 2 Wealth Tax Benefit:

HDFC Life Click 2 Wealth also has another hook.

The annual premium should be less than 10 percent of the sum assured offered by HDFC Click 2 Wealth.

So, let’s say the sum assured is ₹15 lakh, and the annual premium is less than ₹1.5 lahks, then the entire amount qualifies for a tax deduction. But if the premium is more than ₹2.5 lakh for the same sum assured of ₹15 lahks, the available deduction is again ₹1.5 lakh.

Let’s say you invested in HDFC Click 2 Wealth ULIP plan and saved some tax. But what happens at maturity when you want to liquidate the investment? Do you pay tax on the entire maturity proceeds or just the profits you made?

The answer is that if all premiums were duly paid, you do not pay any tax at the time of maturity for ULIP policies that were issued before 1st February 2021, because you get tax -free maturity amount as per Section 10 (10D) of the Income Tax 1961, as per conditions stated therein.

For new ULIPs and for policies issued after 1st February 2021, if the total premium in a financial year is more than ₹2.5 lahks, the maturity proceeds from such a policy are treated as a capital asset, and the returns will no longer be tax-exempt.

Thus, with the new tax amendments for ULIP for a premium above ₹2.5 lakhs, HDFC Life Click 2 Wealth and all other ULIPs are at a severe disadvantage.

So, sticking to HDFC Click 2 Wealth Plan from a tax perspective is not a sound choice either for an investor.

- Evaluation of Additional Reasons to Choose Equity Mutual Funds over HDFC Click 2 Wealth:

Here are some of the key points why you must choose an equity mutual fund as an investment vehicle over HDFC Click 2 Wealth.

- Equity Mutual Funds have superior liquidity over HDFC Life Click 2 Wealth & other ULIPs.

- The long tenure, lock-in period, and compulsory contributions of 5 years make ULIPs unattractive.

- The lock-in period of 3 years for ELSS Funds is the lowest among all investment instruments considered under section 80C of the Income Tax Act, 1961.

- HDFC Click 2 Wealth has a narrow fund choice of only 17 funds.

- ELSS mutual fund category alone will have 10+ funds outperforming the best funds in HDFC Life Click 2 Wealth.

- Also, if you check the returns, a good number of mutual fund schemes have consistently beaten ULIP Funds on a medium to long-term horizon.

- One may argue that, in case of the death of the policyholder or the insured, the nominee will get life insurance coverage or the fund value, with the death benefit being

- But, in the case of term insurance + ELSS combination, the nominee will get the sum assured (a very high sum assured) from the term insurance which is also tax-exempt under section 10(10D). It doesn’t stop there, the nominee will also get the fund value from the ELSS mutual fund.

- So, in case of the death of the insured person, there is a double financial protection with the term insurance + ELSS option. Meanwhile, with the HDFC Life Click 2 Wealth or any other ULIP, the beneficiary or the nominee will get only one benefit.

- Finally, any ULIP investment, including HDFC Life Click 2 Wealth is a long-term commitment. You have a 5-year lock-in period and a policy term of a minimum of 10 years. There is no systematic compulsion on the ULIP fund manager to be at their best consistently.

- In the case of ELSS mutual funds, you can stop investing in a scheme and invest in a different scheme to get the 80C tax benefit at any time you want. This flexibility makes the fund managers perform at their best day in and day out. And inevitably they deliver the best return to their investors.

Though a product like HDFC Click 2 Wealth may seem like a good product, it is better to keep your investments & insurance separate. The disadvantages of investing in HDFC Life Click 2 wealth is more compared to Term insurance + ELSS combo.

You can put the same money in equity mutual funds through the SIP route and earn much higher returns; get better and adequate protection through a term insurance plan.

10.)HDFC Life Click 2 Wealth VS HDFC Life Click 2 Invest: Review

HDFC Life Click 2 Wealth has been designed to cater exclusively to HNI customers. It offers a wide range of investment options with a simple mechanism to invest and grow your money.

On the other hand, HDFC Life Click2Invest has a more diversified investment portfolio and long-term growth objectives.

HDFC Life Click 2 Wealth and HDFC Life Click 2 Invest seem almost identical in terms of services offered, products covered, and annual cost.

In this article, we have discussed the HDFC Life Click 2 Wealth Plan in depth.

To know more about HDFC Life Click 2 Invest Plan, you must read HDFC Life Click 2 Invest Review.

11.)HDFC Life Click 2 Wealth VS HDFC Life Super Income Plan – Review

‘Click 2 Wealth’ is a ULIP that comes with three different plan options and 17 different fund options whereas there are 6 different plan options in the ‘Life Super Income Plan’ that differs in Premium Payment Term, Payout Period & Policy Term.

Super Income Plan is also a non-linked participating and limited pay money-back insurance plan.

Read the complete review below with an analysis of Maturity Benefits, Survival Benefits & Death Benefits.

HDFC Life Super Income Plan Review: Should you buy or not?

12.)HDFC Life Click 2 Wealth VS Other Investment Plans – Review Conclusion

As we discussed before,

“Even after taxes, the ELSS Mutual Fund’s post-tax return of ₹ 46.24 lakhs is still better than the returns provided by the HDFC Life Click 2 Wealth plan”.

Other important points we discussed earlier are that,

“PPF is a government-sponsored program that is well-known for its consistency, guaranteed returns, and EEE tax exemption status”.

“Equity Mutual Funds offer more liquidity than ULIPs like HDFC Life Click 2 Wealth”.

All these have been proven true after a thorough analysis of all other investment options.

So, it is better to choose a Term Insurance Plan + ELSS or PPF for better overall returns and lifelong protection.

13.)Review of Charges Under HDFC Life Click 2 Wealth Plan

HDFC Click 2 Wealth has no premium allocation charges, fund switching charges (unlimited switching allowed within their 17 funds), no partial withdrawal charges, no premium redirection charges, no discontinuation charges, or other miscellaneous charges.

There is a ‘mortality charge’ to provide the life cover to the life insured. This mortality charge depends on the age of the proper and life assured and the extent of the cover.

However, the policy has a fund management charge that will be deducted from the Fund Value annually.

The fund management charges are given as follows –

0.80% p.a. of the fund value for Liquid Fund, Bond Plus Fund & Secure Advantage Fund and

1.35% p.a. of the fund value for Diversified Equity, Blue Chip, Balanced, Bond, Discovery, Equity Advantage, Opportunities, Sustainable Equity, Flexi Cap, Midcap Momentum, Nifty Alpha 30 and Top 500 Momentum 50 Funds charged daily

In the above illustration, the Fund Management Charges of different funds are calculated.

These charges, by themselves, may not be a concern for an investor. But in context with the risk-return involved and the availability of a better alternative, it makes a noticeable difference.

Should you keep investing in this policy?

HDFC Life Click 2 Wealth may look like a better investment option in comparison with other ULIPs in the market. But, it is still a below-par investment in comparison with the alternative Term insurance with PPF or ELSS mutual fund.

14.)What happens in case you do not pay the premiums before 5 years? An analysis

In this case, the plan is deemed withdrawn and will be discontinued. The risk cover will stop, the fund will only earn a minimum guaranteed interest rate, which is presently 4 percent, and a fund management charge of 0.5% will be levied.

There will not be any other deductions. The fund value is paid at the end of 5 years and the policy is said to be terminated.

You can however revive the policy by making the remaining premium payments; there are no interest charges on the delayed payments.

The 4% minimum return may tempt the investors to keep investing and get the returns generated by the fund. Who would want the minimum 4% return anyway?

It is a deliberate risk. Yes. But it is a calculated risk, and also the optimal way out.

The wise option would be to stop any further investment in this policy and invest in better alternatives. By the time the policy completes the 5-year lock-in, you will have already recovered and generated more returns in the alternate options.

Unless your policy is maturing very soon, it is always better to surrender your HDFC Life Click 2 Wealth.

15.)How to Surrender HDFC Life Click 2 Wealth? An Analysis

i.) Surrender HDFC Click 2 Wealth before Free-Look Period – Analysis

The ‘Free-Look’ period for HDFC Click 2 Wealth Plan is 30 days from the receipt of the policy since this is an online policy.

For policy cancellation within this period, you have to send them a letter along with the original policy documents and include the reason for cancellation in your request.

ii.) Surrender HDFC Click 2 Wealth after Free-Look Period – Review

You can surrender HDFC Click 2 Wealth any time after the free-look period.

In case, you surrender before the 5th year, the fund is treated as a ‘discontinued fund’ and you can withdraw your money after 5 years.

You can also surrender the policy any time after the lock-in period and get back the fund value. The risk cover ceases, and the policy will be terminated on submission of the surrender request.

Although, when should one surrender their HDFC Life Click 2 Wealth depends on the individual. Your goal is to get the optimal return from your investment, whether you surrender your policy or not.

Ideally, surrendering your HDFC Life Click 2 Wealth in the early years and investing in alternate options will be beneficial. On the other hand, if you are near the policy maturity, it would be better to wait till the maturity. Of course, it is very subjective.

If it is already been a few years, however, to take a calculated decision, you can always consult a Certified Financial Planner.

A Certified Financial Planner or an Investment Advisor can give you a detailed analysis of what will a financially sound decision for you.

Procedure to Surrender HDFC Life Click 2 Wealth: Analysis

To surrender(withdrawal before maturity), simply drop an email from your registered email address to service@hdfclife.com with the subject line ‘Request to deactivate or Surrender HDFC Click 2 Wealth, Policy number (Policy No.).

If you are making regular auto-debit payments, then include the request for Auto-Debit Deactivation too. You can also go to the closest HDFC Life Branch and fill up the Mandate Deactivation Form, 15 days before the premium due date.

For more information on HDFC Click 2 Wealth Plan

You can also download the HDFC Click 2 Wealth Brochure from their official website – https://www.hdfclife.com/ulip-plans/click-2-wealth-ulip-plan The official website also has an HDFC Click 2 Wealth Calculator to calculate your actual premium as per your age, you can also make your HDFC Click 2 Wealth Online Premium Payment without any hassle.

For more information, you can also reach out to the HDFC Click 2 Wealth Customer Care for chat and email support, at their official website. To buy their policy, contact 1800-266-9777 (9 AM to 9 PM IST), with a provision for instant call back.

You can also watch this HDFC Click 2 Wealth review in Hindi.

HDFC Life Click2 Wealth (एचडीएफसी लाइफ क्लिक2 वेल्थ) – Should you Buy? – (Hindi – हिन्दी)

[/desktoponly]

16.)HDFC Click 2 Wealth Good or Bad?

To sum up, in this HDFC Click 2 Wealth review, it is essential to know that an investment product should be used for investment and a Pure Term insurance product is the best for life cover. Smart investors distinguish between their insurance and investment objectives.

Combining the two of them in the form of a ULIP cannot give you optimal returns or adequate life cover.

Avoid HDFC Click 2 Wealth at all costs. Instead, go for a term plan, and choose PPF or an ELSS fund, depending on your risk appetite.

Insurance agents will push you into this plan for their agent commission, please beware!

In a nutshell, if you are a conservative investor, you are better off going with a Term Insurance Plan + PPF.

For risk-tolerant investors with an eye for wealth creation, you can go for a top-performing ELSS Mutual Fund + Term Insurance.

Do you think Social media sites like Quora, Facebook, Twitter, etc, Will give you 100% authentic information on investment plans in the market?

Please consult a professional financial planner for an authentic source of information.

If you have any comments or questions, write them in the comment box below.

Or are you interested in creating a Comprehensive Financial Plan for your financial goals?

Skip the queue by registering for your 30-minute FREE Financial Plan Consultation. Click the ‘‘BOOK YOUR SLOT NOW!’’ button below.

Hi,

I am holding this HDFC Click to Wealth plan for almost two years now. As said, after surrendering the policy before 5 years will hold my fund value for remaining years (in my case 3 more years). So, my fund will be unused by me and even the returns would be at 4% p.a.

Should I discontinue my policy or I should wait till 5 years.

Any suggestions is appreciated.

Thanks,

Shivam Gupta

Hi I need financial consultation

Please check with your financial planner.

You can also book a slot with our financial planner for an initial complimentary consultation.

https://www.holisticinvestment.in/complimentary-financial-plan-consultation/

need 30 min consulation please

Hi!

Please click the link to register for the 30-minute Complimentary Financial Plan Consultation.

https://www.holisticinvestment.in/complimentary-financial-plan-consultation/

is there any 10 10(D) benefits in this product and LTCG applied on this product

Yes.