What’s common between Google, Apple, Pepsi, Citi, Adobe, IBM, Vimeo, Starbucks, FedEx, Palo Alto, and YouTube?

Yes, you are right, they were headed by persons of Indian origin.

Many of these global leaders fall into categories such as NRI, OCI, or even former PIO cardholders, showing how deeply the Indian diaspora influences international institutions.

Non-Resident Indians (NRI) or Persons of Indian Origin (PIO) are amongst the most successful communities across all other emigrant communities in terms of positions of impact and income in the country of their residence.

And not just in the corporate world have the NRIs /PIOs made a mark, they have made outsized contribution in varied fields such as art & culture films, academics and even space.

Whether identified as NRI, PIO, or modern-day OCI cardholders, people of Indian origin continue to maintain a strong “Indian connection” that shapes global culture, economy, and innovation.

NRIs are citizens of India who are not living in the country, while the term PIO is used for people of Indian birth or ancestry who are citizens of other nations.

PIOs may additionally have Overseas Citizenship of India (OCI).

Today, many former PIO card holders have transitioned into the OCI system, and the terms PIO and OCI are often discussed together when exploring overseas Indian identity.

When the first time my friend asked me about NRI, PIO, and OCI, I was blank! I was clueless about what this acronym meant; and what is their importance.

I had several questions in my mind; the meaning, significance, and difference between these three terms, etc. After some in-depth study and research, I have understood these terms.

From my understanding, the only similarity factor in between these three terms NRI, PIO & OCI is that these are badges given to a person who has or had roots in India but lives overseas.

Despite this similarity, there exists a huge difference between an NRI, PIO & OCI across many categories.

I am presenting here, a detailed yet interesting summary of these terms! Take a look below to get clarity on these terms.

Understanding the difference between NRI vs PIO vs OCI is essential because each category carries a different set of rights, responsibilities, and benefits for people of Indian origin.

Table of Contents:

1.) NRI, PIO & OCI: What do these mean?

3) PIO – Person of Indian Origin

- Eligibility of PIO card

- The validity of PIO card

- Benefits of being a PIO cardholder

- Disadvantages of PIO card

4) OCI – Overseas Citizen of India

- Eligibility for OCI card

- Validity & Renewal of OCI card

- Benefits of being a OCI cardholder

- Disadvantages of OCI card

- Can OCI be revoked?

- How to apply for OCI card

5) The key difference between PIO, OCI & NRI

6) How an OCI/PIO can get Citizenship in India?

7) Do a PIO, NRI or OCI cardholder has to pay taxes in India?

8) Indian Connection – NRI, PIO & OCI:

9)Conclusion

1) NRI, PIO & OCI: What do these means?

Before understanding anything it is vital to know the full form of the acronyms NRI, PIO & OCI stands for: –

- NRI means Non-Resident Indian,

- PIO stands for Person of Indian Origin and

- OCI means Overseas Citizen of India.

Together, the classifications NRI, PIO, and OCI help define the legal and cultural identity of Indians living abroad, often referred to as the Indian diaspora.

NRI is a residential status given to a citizen of India with an Indian Passport who resides in a foreign country for the purpose of work/business, or education.

PIO is an identification status given to those whose ancestors were permanent Indian residents/citizen and who is currently holding valid citizenship and passport from another country.

Because PIO cards are now considered equivalent to OCI cards, many people use terms like “PIO/OCI” or “OCI PIO card” while referring to the same category.

OCI is an immigration status given to a foreign citizen of Indian origin as an alternative to dual citizenship which is not allowed by the Indian Constitution.

The OCI card serves as a long-term visa and gives several privileges to people of Indian origin who are citizens of countries like the USA, UK, Canada, Australia, and others.

Definition of the terms PIO and OCI may appear to be slightly similar, but there exists a discreet difference between the two.

You will understand the difference between NRI vs PIO vs OCI when taking a closer look below:

2) NRI – Non-Resident Indian

a) Eligibility for NRI

The eligibility criteria for NRI status is that the person should be an Indian citizen with a valid Indian Passport and should reside outside of India for at least 183 days or more in a financial year (April 1st – March 31st).

For taxation purposes, an NRI is defined as an individual who satisfies the below-mentioned criteria:

- Resided out of India for 182 days or more during the financial year.

- Resided out of India for at least 365 days during the last four years and a minimum of 60 days in the current year.

This is why the difference between NRI and OCI is important: NRI is a tax-residency status, while OCI is a long-term immigration status.

There are about 32 million NRIs and OCIs residing outside India, forming the largest overseas diaspora of any nation.

This number includes both first-generation NRIs who have emigrated from India as well as their descendants.

This number goes up by about 2.5 million a year with many Indians migrating overseas for work or studies, which is the highest annual number of migrants in the world.

b) Benefits of being an NRI

Being an NRI is only a residential status classified by the Income-Tax of India. If you are an NRI, you can avail the following benefits from India,

i. Banks offer special overseas accounts like RFC/FCNR/NRE/NRO accounts.

ii. The education system in India allows special reservation quota for NRIs.

iii. You can vote for elections but you have to be physically present in the polling booth.

iv. Your income earned abroad will not be taxed by the Income-Tax Dept of India.

NRIs also enjoy relaxed investment rules compared to OCI cardholders when it comes to banking and property ownership in India.

c) Limitations of being an NRI

The limitations of being an NRI are as follows,

i. You cannot purchase agricultural land.

ii. You are taxed for the income you earn in India.

This distinction often leads people to compare NRI vs OCI and evaluate which status offers more flexibility depending on their long-term plans.

3) PIO – Person of Indian Origin

As noted already, the Gazette of India published on 09.01.2015, says that all existing PIO cardholders are deemed to be OCI cardholders.

The government of India has stopped issuing the handwritten PIO cards and asked the existing holders of PIO cards to replace them with the new OCI card.

Many families who held PIO cards earlier have now shifted to the OCI card, as the OCI system simplifies travel, residency, and cultural linkage to India.

a) Eligibility for PIO card

The eligibility criteria that HAD been set to apply for a PIO card is that you should be,

A person, who or whose parents, grandparents, great grandparents were born in India and were/are a citizen or eligible to become citizen of India at any time on or after commencement of the Constitution i.e. 26.01.1950; or belong to territories that became part of India after 15.08.1947, is eligible for holding a PIO card.

But, you cannot be eligible for something that is no more available. Since the Ministry of Home Affairs has stopped issuing new PIO cards from 2015 you do not have to worry about the eligibility criteria to apply for a PIO card. In that case, you only have to know about the eligibility criteria to apply for an OCI card.

The Ministry of Home Affairs has removed the eligibility criteria for PIO and added the validity/expiry of PIO cards.

So, if you already have an old PIO or want a new PIO card then your concerned problem should be the validity of your PIO card.

This shift from PIO to OCI has made the comparison of PIO vs OCI, and the understanding of PIO meaning or PIO stands for, more relevant for people of Indian origin living abroad.

Many families now focus on the OCI pathway because the PIO card is discontinued, creating a unified structure for NRI, PIO, OCI classifications under the broader overseas Indian identity.

b) The validity of PIO card

Your PIO card is valid only until 30th September 2019 as an alternate for a visa when provided along with a valid foreign passport.

After the deadline of 30.09.2019, handwritten PIO cards will not be accepted as a valid document to travel to India according to the ICAO guidelines.

This is why many people who still possess a PIO card often move to the OCI card, since the OCI card functions as a long-term alternative and aligns with current immigration rules.

c) Benefits of being a PIO cardholder

If you already hold PIO card, then you can avail the following benefits,

i. Your PIO card is an alternate for a visa to travel to and from India. It permits multiple entries for multiple purposes.

ii. You can work/study in India without any special visa.

iii. Special counters for fast immigration clearance at all international airports

iv. 180 days of continuous stay without any registration to FRRO (Foreigner Regional Registration Office) local police authorities.

v. Financial/economic/educational benefits at par with NRIs.

These benefits earlier made the PIO card attractive, especially for individuals comparing NRI vs PIO or evaluating the privileges of PIO OCI cardholders before the merger with the OCI scheme.

d) Disadvantages of being a PIO cardholder

The limitations of PIO card extends beyond its upcoming expiration.

i. A PIO card is valid only for 15 years. In case your PIO card expired before 30.09.2015, then you must apply for an OCI card in lieu of PIO card.

ii. You may not hold a government job. (but can work for a private concern without conditions)

iii. You cannot vote or hold government jobs.

iv. If your purpose of the visit is not full filled in 180 days, then you need to register to FRRO or local police authorities within 30 days.

v. You need special permission to do research work in India from the Indian Mission/FRRO/Post.

vi. You cannot purchase agricultural land.

These limitations became key reasons why the Government replaced the PIO card with the OCI card, offering greater stability for people of Indian origin living overseas.

4) OCI – Overseas Citizen of India

a) Eligibility for OCI card

A person who is a citizen of India or eligible to become a citizen of India on or after the commencement of the Constitution i.e. 26.01.1950; or who belonged to a territory that became part of India after 15.08.1947; or who is a child (either minor or major) or grandchild or great-grandchild of such a citizen

A person, who or whose parents, grandparents, great grandparents were born in India and were/are citizen or eligible to become citizen of India at any time on or after commencement of the Constitution i.e. 26.01.1950; or belong to territories that became part of India after 15.08.1947 is eligible for holding an OCI card.

Spouse of OCI cardholder is eligible to apply for OCI card only after completion of two years of registered and subsisted marriage, provided that the person had not been a citizen of Pakistan, Bangladesh or such country listed by the Central Government.

However, a person isn’t entitled to apply for any of these cards, if the person or their ancestors at any time was a citizen of Pakistan, Bangladesh, and others as specified by the rules laid by the Government of India.

This broad eligibility framework explains why many former PIOs and long-settled Indian-origin families now opt for the OCI card, making OCI meaning and OCI holder meaning important concepts in diaspora identity.

b) Validity & Renewal of OCI card

The OCI card acts as a VISA to enter India for any purpose multiple times with life-long validity when carried along with a valid foreign passport.

Even though the OCI card is said to have lifelong validity, it needs to be renewed after expiry of the foreign passport of the OCI cardholder; and after reaching the age of 20 years of the OCI cardholder; after reaching the age of 50 years of the OCI cardholder.

The processing time for renewal of the OCI card will be around a maximum of 10 to 12 weeks.

These renewal rules often come up when people compare NRI OCI requirements or when applying for an OCI card for US citizens, UK citizens, or other foreign nationals of Indian origin.

c) Benefits of being an OCI cardholder

The benefits of holding an OCI card are as follows,

i. Multiple entries to visit India for lifelong for multi-purposes.

ii. You need NOT register with FRRO or local police authorities even after a continuous stay of 180 days.

iii. You can work/study in India without any special permission just like Indian nationals.

iv. Special counters for fast immigration clearance at all international airports

v. Financial/economic/educational benefits are on par with NRIs.

vi. Parity with Resident Indians in charges for Domestic Airfares/National Parks/Wild Life Sanctuaries/Museums/Historical sites etc.

These privileges are a major reason why many individuals compare OCI vs NRI, especially when evaluating long-term residency, taxation differences, and the benefits of holding an Overseas Citizenship of India document.

d) Disadvantages of being an OCI cardholder

Many OCI card applicants are often curious about the practical limitations of Overseas Citizenship of India, which is why understanding these restrictions is essential before applying.

The limitations of an OCI cardholder are bare when compared with the facilities offered to an Indian Resident. If you are an OCI cardholder, then your restrictions are,

i. You cannot purchase agricultural land.

ii. You may not hold a government job. (but can work for a private concern without conditions)

iii. You cannot vote or hold government jobs.

iv. You need special permission to do research work in India from the Indian Mission/FRRO/Post.

e) Can OCI be revoked?

Yes, an OCI card can be revoked under certain circumstances, because Overseas Citizenship of India is not full citizenship — it is a long-term residency privilege granted by the Government of India.

The Ministry of Home Affairs (MHA) has the legal authority to cancel an OCI card if the holder violates the conditions under which it was issued.

Some of the main grounds for cancellation include:

- Obtaining the OCI card through false information or fraudulent documents

- Criminal convictions, especially those involving moral turpitude, terrorism, or offences carrying a punishment of two years or more

- Acting against the interests of the sovereignty, security, or integrity of India

- Engaging in activities that damage India’s relations with a foreign country

- Violation of any specific OCI conditions, such as restricted-area permits, property laws, or overstaying beyond permitted durations

If the government decides to revoke an OCI card, the individual is usually given a notice and an opportunity to respond.

After cancellation, the person may be treated as a foreign national under Indian visa rules.

While revocation is rare, it is important for OCI holders to stay compliant with Indian laws, ensure transparency in documentation, and avoid any actions that may be interpreted as threatening national interest.

This helps maintain the long-term residency benefits and travel privileges associated with OCI status.

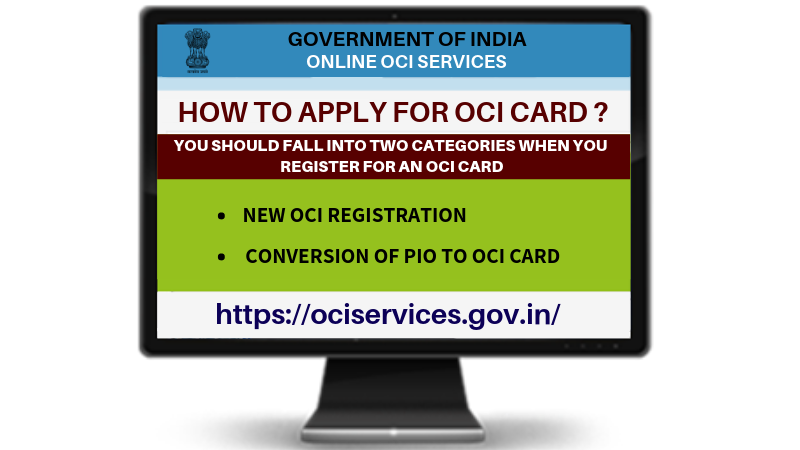

f) How to apply for OCI card

Many applicants exploring the NRI–PIO–OCI framework also seek clarity on the OCI application process, as it is now the primary route available after the PIO scheme was discontinued.

You should fall into two categories when you register for an OCI card – a new OCI registration and conversion of PIO to OCI card.

You can apply for an OCI card (both new & conversion) through online from the official website of Indian Government – https://ociservices.gov.in/

The website contains a brief guide of the application procedure.

The documents required to apply for the OCI certificate, OCI application status enquiry, OCI miscellaneous services, and F.A.Qs are also mentioned on the website. After successful online registration, you will be required to produce the original documents that you provided while submitting the online application.

On successful submission of the online application form, you have to visit the Indian Mission/post/office for original document verification if you currently reside in India. You have to visit the Indian embassy in the country where you hold citizenship if your current residence is in the country where you hold citizenship.

5) The key difference between PIO, OCI and NRI

These distinctions between NRI, PIO, and OCI often help individuals of Indian origin understand which category best fits their residency, citizenship, and long-term plans.

A). PIO vs. OCI

i) When talking about the differences between the two, let’s begin with the privileges. A PIO card allows visa-free travel from and to India to the person holding a valid card. A PIO card is considered valid only if you hold a valid passport. On the contrary, an OCI card allows lifetime visa-free traveling to and from India.

ii. Next important difference between OCI and PIO is the extension of stay. A PIO card allows only 180 days of continuous stay in India, the PIO cardholder has to inform the FRRO or local police if the stay needs to be extended beyond 180 days. An OCI cardholder can stay in India for any length of time without any concern of intimation to the local police or FRRO.

iii. The difference in the eligibility criteria is, the foreign spouse of the card holder is eligible to apply for PIO. However, for OCI card, it mandates the person to be eligible in their own capacity. In simple terms, a foreign national who isn’t eligible to apply for an OCI card, will not get an OCI card even if married to a person who is a holder of the valid OCI card. However, their children are eligible to hold an OCI card.

B). NRI vs. OCI

Many families with overseas backgrounds often confuse NRI status with the benefits of an OCI card, which is why understanding this difference is crucial for legal and financial clarity.

The key difference between NRI and OCI is that a Non-Resident Indian (NRI) is a residential status described by the Income Tax Department of India which comes into use only while filing IT returns.

An Overseas Citizen of India (OCI) is an immigration status or special visa given for foreign nationals of Indian Origin by the Government of India to visit or live in India indefinitely.

C). NRI vs. PIO

Before the PIO card system was discontinued, this comparison was extremely common among Indian-origin families living abroad who wanted to understand residency rules and identity documentation.

The key difference between NRI and PIO is that a Non-Resident India (NRI) is a residential status described by the Income Tax Department of India which comes into use only while filing IT returns.

Person of Indian Origin (PIO) Card was a form of identification issued to an Indian Origin individual who held a passport in a country other than Pakistan, Bangladesh, and others listed by the Indian Government.

D). Dual Citizenship Myth: Why OCI Is Not Dual Citizenship

Many people mistakenly believe that holding an OCI card is equal to having dual citizenship, but legally, that is not the case.

India does not allow dual citizenship in any form.

An OCI card is only a residency and travel privilege, not a citizenship document.

Although an OCI holder enjoys benefits like lifelong visa-free entry into India and permission to live or work in the country, these rights do not amount to citizenship.

OCI holders do not get political rights such as voting, contesting elections, or holding public office.

They also cannot obtain an Indian passport since they are not considered Indian citizens.

Citizenship includes full constitutional rights, the ability to participate in democratic processes, and the obligation of allegiance to the nation.

OCI status, meanwhile, is similar to a long-term visa granted to foreign nationals of Indian origin.

It eases travel, residency, property ownership (except agricultural land), and employment in private sectors, but without the legal and political privileges attached to Indian citizenship.

Understanding this distinction is important because it helps avoid unrealistic expectations.

OCI offers convenience, flexibility, and a strong connection to India—but it remains a permanent residency privilege, not dual citizenship.

6) Can an OCI/PIO get Citizenship in India?

Yes. The Government of India has provisions for grant of Indian Citizenship by registration to OCI card holders (including spouse, children).

For many Indian-origin individuals, the path from OCI status to full Indian citizenship is an important topic, especially for those planning long-term residence in India.

a) Eligibility for an OCI to apply for Indian Citizenship

As an OCI, in order to register as an Indian Citizenship under Section 5(1)(g) of the Citizenship Act 1955, you should be registered as an OCI for a minimum of 5 years and should be resident in India for 1 year before making the application to grant Indian Citizenship.

This eligibility requirement is often the first point OCI cardholders examine when considering the transition to full Indian citizenship.

b) Documents Required

Understanding the required documentation ensures smoother processing for OCI holders seeking Indian citizenship through registration.

The application form needs to be duly signed/self -attested by the applicant. The documents required which are mentioned below need to be duly signed/attested by the nearest Collector/District Magistrate/Deputy Commissioner personally.

- A copy of valid Foreign Passport

- A copy of valid Residential Permit/OCI card.

- Declaration and Oath of allegiance as specified in the form to be made before the offices specified in the Citisenshiozenship Rules, 1955 i.e. Collector/District Magistrate/Deputy Commissioner.

- Copy of Bank Challan in original amounting to 500 INR/- payable towards declaration and Oath of allegiance deposited in the State Bank of India under Head No. “0070-Other Administrative Services-Other Services-Receipts under the Citizenship Act”.

- A copy of marriage certificate issued by the Registrar of Marriage & evidence of his/her spouse’s Indian nationality viz. copy of Indian Passport or birth certificate. (if applicable to you)

c) Procedure to apply

This step-by-step process is particularly helpful for OCI applicants who want a clear understanding of how citizenship registration is carried out at the district and central levels.

After completing the application form and preparation of the documents required, they need to be submitted to Collector/District Magistrate/Deputy Commissioner of the area of residence of the applicant.

The application process generally takes up to 90 days for processing by the State Government and The Ministry of Home Affairs. Once your application is approved by the Government, you will be intimated.

After getting the intimation from the Government, you need to submit the Proof of Renunciation attested by a Gazette Officer and proof of payment of the applicable fee.

Once all the documentation is over, you will be provided with the certificate of Indian Citizenship by the Government of India.

[Note: To know about the detailed procedure to apply for Indian Citizenship, visit the official website here.]

7) Do a PIO, NRI or OCI card holder has to pay taxes in India?

Yes, PIO, OCI, or NRI have to pay tax in India but only for the income earned in India.

Taxation is one of the most common topics of confusion among NRI, PIO, and OCI individuals, especially for those maintaining financial ties with India.

The PIO/OCI card holder is not liable to pay or declare any tax for the income earned abroad. Only income earned in India is subject to taxes.

8. Indian Connection – NRI, PIO & OCI:

Despite varying legal statuses, the emotional and cultural bond shared by NRI, PIO, and OCI communities continues to strengthen India’s global presence.

NRIs and PIOs, even if living and working away from India, have a strong emotional connection with their motherland.

They retain their culture and traditions, creating almost a mini-India wherever they stay and remain closely bonded with their fellow NRIs.

In their country of residence, NRIs are generally perceived as an affluent group due to their higher levels of education, professional success, and financial stability.

NRIs have been contributing to the Indian economy in many ways, such as investing in Indian start-ups, setting up business here, supporting various social causes, and promoting Indian culture globally.

Additionally, many NRIs are involved in philanthropic activities in India, supporting causes such as education, healthcare, and women empowerment.

9. Conclusion

With the evolving structure of NRI, PIO, and OCI classifications, understanding these terms helps individuals make informed decisions about long-term engagement with India.

If you are looking forward to applying for a PIO or OCI card, enlighten your mind with this information and apply for the card.

As an NRI you may have few queries, which you may want to clarify. To clarify your queries, we are now offering

We were denied boarding on a major airline as the passport number on the handwritten PIO card did not match current passport number. Despite having both old expired passport (the one on which PIO was given) and new current passport, boarding was denied.

As you know, PIO cards can be used till end of Dec 2022.

Was the airline right in denying us boarding?

We were forced to cancel ticket before plane took and lost a considerable amount of money due to it.

The government of India has stopped issuing handwritten PIO cards and asked the existing holders of PIO cards to replace them with the new OCI card.

i was an Indian citizen till October 2021 but now I’m italian citizen, planning to go back to India with tourist visa.. can i apply for an OCI card from india as well? bcoz i have read somewhere that it’s not possible with tourist visa.

You can apply for an OCI card (both new & conversion) through online from the official website of Indian Government – https://ociservices.gov.in/

The website contains a brief guide of the application procedure. The documents required to apply for the OCI certificate, OCI application status enquiry, OCI miscellaneous services, and F.A.Qs are also mentioned on the website. After successful online registration, you will be required to produce the original documents that you provided while submitting the online application.

NRI are indian citizens but PIO and OCI are the citizen of another country excluding pakistan and bangladesh.They required OCI and pio for travelling in india is it correct?

Yes! You are right.

I am a resident in India. Can I buy domestic airline tickets for my friend and family who are PIOs by paying from my Indian credit card

Yes you can.

Is 365 days stay in last four years apply to OCI card holder or they can stay for 181 days in every year from Income tax point of view.

An OCI cardholder can stay in India for any length of time.

If you are an OCI card holder, then you can stay in India as long as you can.

As an OCI. what investment can an OCI holder make , who has property in India and earns from the rentals, to get deductions in taxable income in India.

Hi!

For personalized investment suggestions, please click the below link and register for our 30-minute complimentary financial plan consultation to talk with our certified financial planners.

Book your appointment here:

https://www.holisticinvestment.in/complimentary-financial-plan-consultation/