Is the Pramerica Life Guaranteed Return on Wealth Plan your path to assured wealth — or just another low-return trap?

Can this plan truly guarantee wealth, or is it simply guaranteeing average returns?

Is the Pramerica Life Guaranteed Return on Wealth Plan a reliable investment vehicle or just a marketing illusion?

Let’s explore this by examining the plan’s key features, benefits, and drawbacks—supported with detailed illustrations.

Table of Contents

What is the Pramerica Life Guaranteed Return on Wealth?

What are the features of the Pramerica Life Guaranteed Return on Wealth?

Who is eligible for the Pramerica Life Guaranteed Return on Wealth?

What are the plan options and the benefits of the Pramerica Life Guaranteed Return on Wealth?

Grace Period, Discontinuance and Revival of the Pramerica Life Guaranteed Return on Wealth

Free Look Period for the Pramerica Life Guaranteed Return on Wealth

Surrendering the Pramerica Life Guaranteed Return on Wealth

What are the advantages of the Pramerica Life Guaranteed Return on Wealth?

What are the disadvantages of the Pramerica Life Guaranteed Return on Wealth?

Research Methodology of Pramerica Life Guaranteed Return on Wealth

Benefit Illustration – IRR Analysis of Pramerica Life Guaranteed Return on Wealth

Pramerica Life Guaranteed Return on Wealth Vs. Other Investments

Pramerica Life Guaranteed Return on Wealth Vs. Pure-term + Equity Mutual Fund

Final Verdict on Pramerica Life Guaranteed Return on Wealth

What is the Pramerica Life Guaranteed Return on Wealth?

Pramerica Life Guaranteed Return on Wealth is a Non-Linked Non-Participating Individual Savings Life Insurance Plan. This life insurance plan offers guaranteed benefits. With this, you can pursue dreams for yourself and your loved ones with the reassurance of a life cover and a guaranteed future.

What are the features of the Pramerica Life Guaranteed Return on Wealth?

- Financial protection for your family: Enjoy life insurance coverage throughout the entire policy term, ensuring your loved ones remain financially secure.

- Flexible premium payment options: Choose a premium payment term that suits you — 5, 8, 10, or 12 years.

- Assured returns: Receive guaranteed benefits as long as the Pramerica Life Guaranteed Return on Wealth Plan policy remains active.

- Customizable payout options: Decide how you want to receive your benefits — either as a lump sum or as regular income through various income options, depending on your financial needs.

- Tax advantages: Premiums paid and benefits received may qualify for tax benefits under prevailing income tax laws.

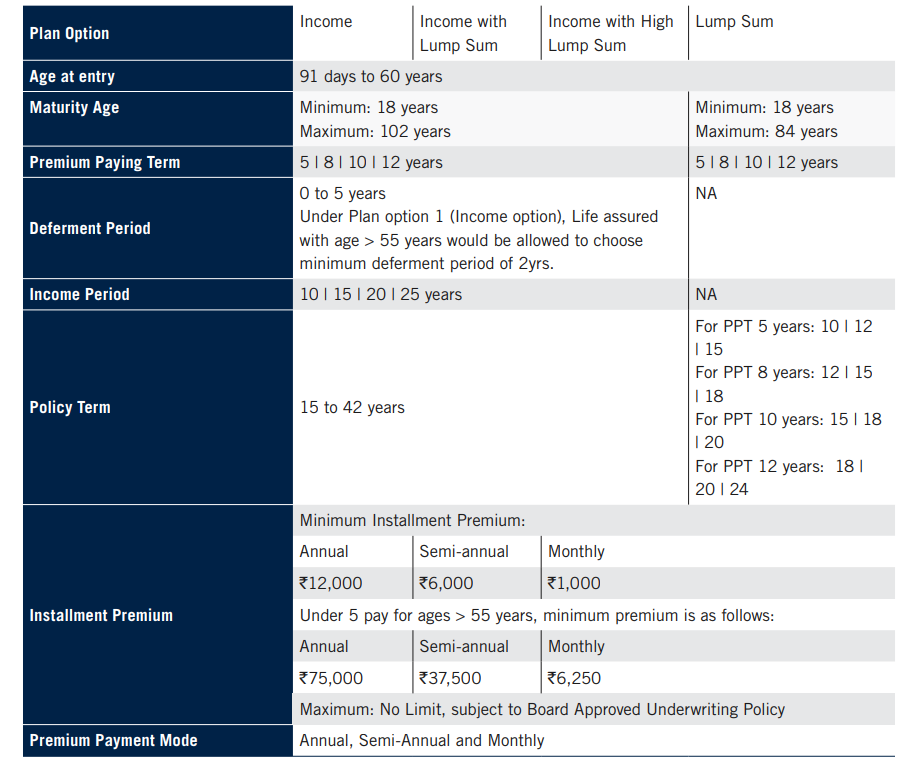

Who is eligible for the Pramerica Life Guaranteed Return on Wealth?

What are the plan options and the benefits of the Pramerica Life Guaranteed Return on Wealth?

Plan Option 1: Income – This option shall suit you if you wish to receive regular income payouts during the term instead of one lump sum at the end

Plan Option 2: Income with Lump Sum – This option shall suit you if you wish to receive regular income during the policy term, along with a lump sum amount at the end of the Pramerica Life Guaranteed Return on Wealth Plan policy term

Plan Option 3: Income with High Lump Sum – This option shall suit you if you wish to receive regular income during the Pramerica Life Guaranteed Return on Wealth Plan policy term to meet your liquidity requirement, along with a bigger lump sum amount at the end of the policy term

Plan Option 4: Lump Sum – This option shall suit you if you wish to take all the proceeds under the Pramerica Life Guaranteed Return on Wealth Plan policy in one lump sum

Survival Benefit

For Plan Option 1: Income, Plan Option 2: Income with Lump Sum and Plan Option 3: Income with High Lump Sum

Guaranteed Survival Benefit in the form of income payouts shall be payable in arrears, i.e. at the end of the month or at the end of the year as per the income payout frequency chosen for applicable Income Period, upon survival of the Life Insured at the time of income payment, provided the Pramerica Life Guaranteed Return on Wealth Plan policy is in force with all due premiums paid in full.

Guaranteed Survival Benefit, expressed as a percentage of Annualised Premium, varies based on chosen plan Option, Age at entry, Premium Paying Term, Deferment Period, Income Period and Premium Band.

For Plan Option 4: Lump Sum

Guaranteed Survival Benefit is not applicable to the Lump Sum option

Maturity Benefit

For Plan Option 1: Income

Maturity benefit is not applicable for this option.

For Plan Option 2: Income with Lump Sum and Plan Option 3: Income with High Lump Sum

On survival of the Life Insured till the end of the Pramerica Life Guaranteed Return on Wealth Plan policy term, i.e. the date of maturity, while the policy is in force, you shall receive a lump sum benefit equal to the Guaranteed Maturity Benefit plus accrued Loyalty Additions.

For Plan Option 2: the Guaranteed Maturity Benefit is equal to Sum Assured on Maturity, which shall be 50% of Total Annualised Premiums payable.

For Plan Option 3: the Guaranteed Maturity Benefit is equal to Sum Assured on Maturity, which shall be 75% of Total Annualised Premiums payable.

Loyalty Additions shall accrue to the Pramerica Life Guaranteed Return on Wealth Plan policy at the end of each completed policy year during the Income Period and shall be payable in a lump sum at the end of the policy term

For Plan Option 4: Lump Sum

On survival of the Life Insured till the end of the Pramerica Life Guaranteed Return on Wealth Plan policy term, i.e. the date of maturity, while the policy is in force, you shall receive a lump sum Maturity Benefit equal to Guaranteed Maturity Benefit plus accrued Loyalty Additions.

Where Guaranteed Maturity Benefit is equal to Sum Assured on Maturity, which shall be X% of Total Annualised Premiums payable. X varies as per the policy term.

Death Benefit

For Plan Option 1: Income

In the unfortunate event of the death of the Life Insured during the Pramerica Life Guaranteed Return on Wealth Plan Policy Term while the policy is in force on the date of death, the beneficiary shall receive the Sum Assured on Death. The Sum Assured on death shall be the highest of:

- Base Sum Assured, which is equal to 11 times of Annualised Premium (or)

- 105% of the total premiums paid till the date of death (or)

- Surrender Value as on the date of death, excluding surrender value pertaining to loyalty additions

For Plan Option 2: Income with Lump Sum, Plan Option 3: Income with High Lump Sum, and Plan Option 4: Lump Sum

In the unfortunate event of the death of the Life Insured during the Pramerica Life Guaranteed Return on Wealth Plan Policy Term while the policy is in force on the date of death, the beneficiary shall receive

- Sum Assured on Death; Plus

- Accrued Loyalty Additions till the date of death

The Sum Assured on death shall be the highest of:

- Base Sum Assured, which is equal to 11 times of Annualised Premium (or)

- 105% of the total premiums paid* till the date of death (or)

- Surrender Value as on the date of death, excluding surrender value pertaining to loyalty additions

Grace Period, Discontinuance and Revival of the Pramerica Life Guaranteed Return on Wealth

Grace Period

You will be given a grace period of 15 days for the monthly mode and 30 days for all other premium payment modes to pay the premium.

Discontinuance

The Pramerica Life Guaranteed Return on Wealth Plan Policy will acquire Surrender Value after paying the premium for the first complete policy year & will become payable after completion of the first policy year.

If you discontinue the payment of premiums before your Policy has acquired a Surrender Value, your Policy will lapse at the end of the grace period, the Death Benefit will cease immediately, and no benefits will be paid when the Policy is in lapsed status.

If the Pramerica Life Guaranteed Return on Wealth Plan Policy has acquired a Surrender Value and no future premiums are paid, you may choose to continue your Policy on a Reduced Paid-up basis.

Revival

You can revive your lapsed/Paid-up policy for its full coverage within five years from the due date of the first unpaid premium, but before policy maturity.

Free Look Period for the Pramerica Life Guaranteed Return on Wealth

You will have a period of 30 days from the date of receipt of the Pramerica Life Guaranteed Return on Wealth Plan Policy Document to review the terms and conditions of the Policy, and if you disagree with any of these terms and conditions, you have the option to return the Policy.

Surrendering the Pramerica Life Guaranteed Return on Wealth

The Pramerica Life Guaranteed Return on Wealth Plan Policy will acquire Surrender Value after paying the premium for the first complete policy year and will become payable after completion of the first policy year.

If you choose to discontinue your policy, you will be entitled to receive Surrender Value, which will be the higher of the Guaranteed Surrender Value (GSV), if applicable or the Special Surrender Value (SSV) of the Policy

What are the advantages of the Pramerica Life Guaranteed Return on Wealth?

- Loan facility: You can avail a loan of up to 75% of the Pramerica Life Guaranteed Return on Wealth Plan policy’s surrender value to meet your financial needs.

- Customisable benefits: Tailor the plan’s benefits to align with your cash flow requirements.

- Guaranteed benefits: All the benefits offered under this plan are fully guaranteed.

What are the disadvantages of the Pramerica Life Guaranteed Return on Wealth?

- Fixed payout option: Once selected at the time of policy inception, the payout option cannot be changed during the Pramerica Life Guaranteed Return on Wealth Plan policy term.

- Limited life cover: The sum assured may not be sufficient to fully protect your family’s future financial needs.

- Lower return potential: The plan yields comparatively lower returns compared to other investment alternatives.

Research Methodology of Pramerica Life Guaranteed Return on Wealth

From a liquidity standpoint, the Pramerica Life Guaranteed Return on Wealth (GROW) Plan offers guaranteed survival and/or maturity benefits over a defined period. However, to understand its true effectiveness, it’s essential to evaluate its returns using the Internal Rate of Return (IRR) method.

Benefit Illustration – IRR Analysis of Pramerica Life Guaranteed Return on Wealth

For example, consider a 30-year-old male investing ₹50,000 per year in the plan for 10 years, with a policy term of 20 years under Plan Option 4: Lump Sum.

At maturity, the Pramerica Life Guaranteed Return on Wealth Plan policy provides a guaranteed lump sum of ₹12.53 lakhs, including accrued loyalty additions.

This translates to an IRR of 6.01% as per the Pramerica Life Guaranteed Return on Wealth Plan maturity calculator, which is lower than the returns typically offered by debt instruments.

| Male | 30 years |

| Sum Assured | ₹ 5,50,000 |

| Policy Term | 20 years |

| Premium Paying Term | 10 years |

| Annualised Premium | ₹ 50,000 |

| Age | Year | Annualised premium / Maturity benefit | Death benefit |

| 30 | 1 | -50,000 | 5,50,000 |

| 31 | 2 | -50,000 | 5,50,000 |

| 32 | 3 | -50,000 | 5,50,000 |

| 33 | 4 | -50,000 | 5,50,000 |

| 34 | 5 | -50,000 | 5,50,000 |

| 35 | 6 | -50,000 | 5,50,000 |

| 36 | 7 | -50,000 | 5,50,000 |

| 37 | 8 | -50,000 | 5,50,000 |

| 38 | 9 | -50,000 | 5,50,000 |

| 39 | 10 | -50,000 | 5,50,000 |

| 40 | 11 | 0 | 5,50,000 |

| 41 | 12 | 0 | 5,50,000 |

| 42 | 13 | 0 | 5,50,000 |

| 43 | 14 | 0 | 5,50,000 |

| 44 | 15 | 0 | 5,50,000 |

| 45 | 16 | 0 | 5,50,000 |

| 46 | 17 | 0 | 5,50,000 |

| 47 | 18 | 0 | 5,50,000 |

| 48 | 19 | 0 | 5,50,000 |

| 49 | 20 | 0 | 5,50,000 |

| 50 | 12,53,100 | ||

| IRR | 6.01% |

Moreover, this illustration excludes survival benefits — opting for an income payout option would reduce returns even further.

Considering the long investment horizon of 20 years, such returns are inadequate, especially when inflation is factored in, as it erodes purchasing power and raises the cost of future goals.

Therefore, the Pramerica Life Guaranteed Return on Wealth Plan may not help you build the required corpus to achieve your long-term objectives. Additionally, the low sum assured makes the plan less appealing from both protection and investment perspectives.

In conclusion, IRR analysis indicates that this plan is not a favourable choice for investors aiming to meet their financial goals efficiently.

Pramerica Life Guaranteed Return on Wealth Vs. Other Investments

The returns from the Pramerica Life Guaranteed Return on Wealth Plan fail to keep pace with inflation over the long term. For better returns and enhanced liquidity, it’s advisable to separate your insurance and investment needs. Here’s an alternative strategy worth considering:

Pramerica Life Guaranteed Return on Wealth Vs. Pure-term + Equity Mutual Fund

By investing the same annual amount of ₹50,000, you can secure adequate life cover while simultaneously building a stronger investment corpus.

For insurance, choose a pure-term life policy with a sum assured of ₹7.5 lakhs, costing approximately ₹5,500 per year for a 20-year term and a 10-year premium payment period.

| Pure Term Life Insurance Policy | |

| Sum Assured | ₹ 7,50,000 |

| Policy Term | 20 years |

| Premium Paying Term | 10 years |

| Annualised Premium | ₹ 5,500 |

| Investment | ₹ 44,500 |

The remaining ₹44,500 can then be channelled into wealth-building investments. Your investment avenue can vary based on your risk appetite — from low-risk instruments like the Public Provident Fund (PPF) to high-risk options such as equity mutual funds.

| Term Insurance + PPF | Term insurance + Equity Mutual Fund | ||||

| Age | Year | Term Insurance premium + PPF | Death benefit | Term Insurance premium + Equity Mutual Fund | Death benefit |

| 30 | 1 | -50,000 | 7,50,000 | -50,000 | 7,50,000 |

| 31 | 2 | -50,000 | 7,50,000 | -50,000 | 7,50,000 |

| 32 | 3 | -50,000 | 7,50,000 | -50,000 | 7,50,000 |

| 33 | 4 | -50,000 | 7,50,000 | -50,000 | 7,50,000 |

| 34 | 5 | -50,000 | 7,50,000 | -50,000 | 7,50,000 |

| 35 | 6 | -50,000 | 7,50,000 | -50,000 | 7,50,000 |

| 36 | 7 | -50,000 | 7,50,000 | -50,000 | 7,50,000 |

| 37 | 8 | -50,000 | 7,50,000 | -50,000 | 7,50,000 |

| 38 | 9 | -50,000 | 7,50,000 | -50,000 | 7,50,000 |

| 39 | 10 | -47,500 | 7,50,000 | -50,000 | 7,50,000 |

| 40 | 11 | -500 | 7,50,000 | 0 | 7,50,000 |

| 41 | 12 | -500 | 7,50,000 | 0 | 7,50,000 |

| 42 | 13 | -500 | 7,50,000 | 0 | 7,50,000 |

| 43 | 14 | -500 | 7,50,000 | 0 | 7,50,000 |

| 44 | 15 | -500 | 7,50,000 | 0 | 7,50,000 |

| 45 | 16 | 0 | 7,50,000 | 0 | 7,50,000 |

| 46 | 17 | 0 | 7,50,000 | 0 | 7,50,000 |

| 47 | 18 | 0 | 7,50,000 | 0 | 7,50,000 |

| 48 | 19 | 0 | 7,50,000 | 0 | 7,50,000 |

| 49 | 20 | 0 | 7,50,000 | 0 | 7,50,000 |

| 50 | 13,12,720 | 24,48,157 | |||

| IRR | 6.32% | 10.50% | |||

In the case of PPF (Public Provident Fund), calculations are based on the minimum investment requirement of ₹500 for 15 years. Investing in PPF results in a final maturity value of ₹13.12 lakhs, delivering an IRR of 6.32%.

For instance, investing in equity mutual funds could generate a pre-tax maturity value of ₹27.16 lakhs. After accounting for capital gains tax, the post-tax value stands at ₹24.48 lakhs, resulting in an IRR of 10.50%.

| Equity Mutual Fund Tax Calculation | |

| Maturity value after 20 years | 27,16,465 |

| Purchase price | 4,45,000 |

| Long-Term Capital Gains | 22,71,465 |

| Exemption limit | 1,25,000 |

| Taxable LTCG | 21,46,465 |

| Tax paid on LTCG | 2,68,308 |

| Maturity value after tax | 24,48,157 |

Clearly, separating insurance and investment proves far more efficient and goal-oriented.

While traditional insurance plans offer limited coverage and modest returns, combining a pure-term policy with tailored investments based on your risk profile enables you to achieve better financial outcomes and meet your long-term goals more effectively.

Final Verdict on Pramerica Life Guaranteed Return on Wealth

The Pramerica Life Guaranteed Return on Wealth (GROW) Plan combines savings and life insurance into a single product, offering flexibility through four plan options designed around different cash flow needs.

The final maturity value varies depending on the periodic (survival) benefits chosen — the higher the periodic payouts, the lower the lump sum benefit at maturity.

However, the return analysis indicates below-average performance on the savings component. Additionally, the sum assured is inadequate to cover a family’s essential financial needs and it also has a high agent commission.

Although the plan promotes disciplined saving, it fails to deliver competitive returns or sufficient insurance coverage. The guaranteed benefit alone should not be the deciding factor for investing in this plan.

A more effective strategy is to separate insurance and investment. Secure your family’s financial future with a pure-term life insurance policy and invest independently to grow your wealth and meet your long-term goals. This approach enhances both financial protection and investment potential.

For sustainable success, it’s essential to diversify your investments across asset classes.

Do Quora, Facebook, and Twitter have the final say when it comes to financial advice?

If you find it challenging to build a balanced portfolio, consider consulting a Certified Financial Planner (CFP). A professional advisor can help you bridge the gap between your current financial position and your future aspirations, ensuring your money works efficiently toward your goals.

Leave a Reply