Is the Pramerica Life Signature Wealth Plan truly a signature of wealth—or of risk?

Does the Signature Wealth Plan really align with your financial goals?

Is the Pramerica Life Signature Wealth Plan worth your investment—or better avoided?

This article explores its key features, benefits, and drawbacks.

Table of Contents

What is the Pramerica Life Signature Wealth?

What are the features of the Pramerica Life Signature Wealth?

Who is eligible for the Pramerica Life Signature Wealth?

What are the plan options and the benefits of the Pramerica Life Signature Wealth?

Free Look Period for the Pramerica Life Signature Wealth

Surrendering the Pramerica Life Signature Wealth

What are the advantages of the Pramerica Life Signature Wealth?

What are the disadvantages of the Pramerica Life Signature Wealth?

Research Methodology of Pramerica Life Signature Wealth

Benefit Illustration – IRR Analysis of Pramerica Life Signature Wealth

Pramerica Life Signature Wealth Vs. Other Investments

Pramerica Life Signature Wealth Vs. Pure-term + Equity Mutual Fund

Final Verdict on Pramerica Life Signature Wealth

What is the Pramerica Life Signature Wealth?

Pramerica Life Signature Wealth is a Non-Linked Non-Participating Individual Savings Life Insurance Plan. It is a single-premium plan that promises protection and guaranteed savings to lay the foundation for a lifetime of financial stability.

What are the features of the Pramerica Life Signature Wealth?

- Single Pay Convenience: Make a one-time premium payment and enjoy peace of mind throughout the Pramerica Life Signature Wealth Plan policy term.

- Family Protection: Ensure financial security for your loved ones with life insurance coverage during the policy term.

- Flexible Payout Options: Choose to receive the maturity benefit as a lump sum or as regular income—based on your financial needs.

- Guaranteed Returns: Enjoy assured benefits with complete transparency and no hidden surprises.

- Joint Life Option: Extend protection to your spouse or loved one under the same policy with the Joint Life Cover option.

- Customizable Income Period: Select an income payout period of 20, 25, or 30 years to align with your life goals.

- Tax Advantages: Avail tax benefits on premiums paid and policy proceeds as per prevailing income tax laws.

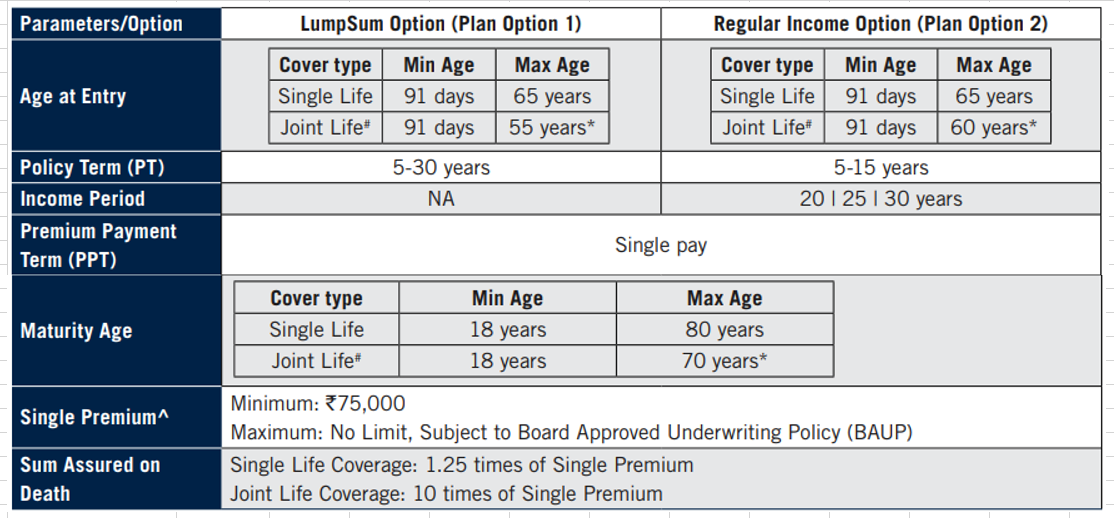

Who is eligible for the Pramerica Life Signature Wealth?

What are the plan options and the benefits of the Pramerica Life Signature Wealth?

Plan Option 1 (Lump Sum Option): This option shall suit you if you wish to receive a lump sum at the end of the Pramerica Life Signature Wealth Plan Policy Term.

Plan Option 2 (Regular Income Option): This option will be better suited if you wish to receive a regular income for 20, 25, or 30 years to fulfil life-stage-specific financial needs.

Death benefit

For Both Plan Options

Single Life Coverage:

In the unfortunate event of the death of the Life Insured during the Policy Term, the Death Benefit shall be the higher of:

- Sum Assured on Death (or)

- Death Benefit Multiple Times Single Premium (or)

- 105% of Total Premiums paid, which is Single Premium (Including discount, if any) till the date of death (or)

- Surrender Value as on the date of death

Upon the payment of the death benefit, the Pramerica Life Signature Wealth Plan policy shall terminate, and no further benefits shall be payable.

Joint Life Coverage:

On First Death during the Policy Term: Death Benefit payable on the first death of any of the lives Insured shall be the higher of:

- 1.25 times of Single Premium (or)

- 105% of Total Premiums paid, which is the Single Premium (Including discount, if any) till the date of death.

Upon payment of the above benefit on First Death, the Pramerica Life Signature Wealth Plan policy will continue for the surviving life Insured

On Second Death during the Policy Term: Death Benefit payable on second death shall be the highest of:

- Sum Assured on Death (or)

- Death Benefit Multiple Times Single Premium (or)

- 105% of Total Premiums paid, which is Single Premium (Including discount, if any) till the date of death (or)

- Surrender Value applicable as on the date of death

Death during Income Period:

In case of Death of the Life Insured or surviving Life Insured (In case of joint life coverage) during the Income Period, Nominee/ Beneficiary shall continue receiving all future payouts as and when due or shall have the option to receive a Lumpsum value instead of the future payouts which shall be the present value of the future payouts, discounted at 30yr G sec + 2%.

Maturity Benefit

For Plan Option 1 (Lump Sum Option):

At maturity, the Beneficiary shall receive the Sum Assured on Maturity, which is a lump sum amount equal to the Guaranteed Maturity Benefit. The Pramerica Life Signature Wealth Plan policy shall terminate on the payment of the maturity benefit, and no further benefits shall be payable.

Guaranteed Maturity Benefit is defined as a percentage of the Single Premium that varies on the basis of Chosen Policy Term, Premium Band and Age at entry of both the lives (in case of Joint life).

For Plan Option 2 (Regular Income Option):

Maturity Benefit shall be paid in arrears as Guaranteed Income Benefit as per the chosen income pay-out frequency from the end of the Pramerica Life Signature Wealth Plan policy term for the chosen Income Period.

The Single Premium shall also be paid back along with the last Income Instalment. No further benefits shall be payable after the last Income Instalment.

Guaranteed Income Benefit is defined as a percentage of the Single Premium that varies on the basis of the Chosen Policy Term, the Premium Band and Age at entry of both the lives (in case of Joint life).

Free Look Period for the Pramerica Life Signature Wealth

You will have a period of 30 days from the date of receipt of the Pramerica Life Signature Wealth Plan Policy Document to review the terms and conditions of the Policy, and where you disagree with any of these terms and conditions, you have the option to return the Policy.

Surrendering the Pramerica Life Signature Wealth

The Pramerica Life Signature Wealth Plan policy shall acquire surrender value immediately on payment of a Single Premium, and the Surrender Value shall become payable immediately after payment of a Single Premium.

The policy shall terminate after payment of the surrender value, and no further benefit shall be payable. Surrender value payable shall be the higher of Guaranteed Surrender Value (GSV) and Special Surrender Value (SSV).

What are the advantages of the Pramerica Life Signature Wealth?

- Loan Facility: The Pramerica Life Signature Wealth Plan policyholder can avail a loan of up to 75% of the surrender value, offering liquidity when needed.

- Convenient Investment: Enjoy a hassle-free, single premium investment option for long-term financial security.

What are the disadvantages of the Pramerica Life Signature Wealth?

- Limited Liquidity: Funds remain locked-in until the completion of the Pramerica Life Signature Wealth Plan policy term.

- Modest Returns: The plan offers relatively low returns compared to other investment avenues.

- Insufficient Coverage: The sum assured may not be adequate to meet your family’s financial protection needs.

Research Methodology of Pramerica Life Signature Wealth

Long-term investments should ideally help you build a substantial corpus to achieve your life goals. While the Pramerica Life Signature Wealth Plan offers guaranteed maturity benefits, it’s important to evaluate its actual returns through proper calculation.

Benefit Illustration – IRR Analysis of Pramerica Life Signature Wealth

Let’s analyse the Internal Rate of Return (IRR) based on the figures provided in the Pramerica Life Signature Wealth Plan policy brochure.

A 55-year-old male invests a single premium of ₹10 lakhs in the Pramerica Life Signature Wealth Plan for a 15-year policy term, with a sum assured of ₹12.88 lakhs. At the end of the term, he receives a maturity benefit of ₹23.74 lakhs.

The calculated IRR for this cash flow is 5.93% as per the Pramerica Life Signature Wealth Plan maturity calculator.

| Male | 55 years |

| Sum Assured | ₹ 12,88,000 |

| Policy Term | 15 years |

| Premium Paying Term | Single pay |

| Annualised Premium | ₹ 10,00,000 |

| Age | Year | Single premium / Maturity benefit | Death benefit |

| 55 | 1 | -10,00,000 | 12,88,000 |

| 56 | 2 | 0 | 12,88,000 |

| 57 | 3 | 0 | 12,88,000 |

| 58 | 4 | 0 | 12,88,000 |

| 59 | 5 | 0 | 12,88,000 |

| 60 | 6 | 0 | 12,88,000 |

| 61 | 7 | 0 | 12,88,000 |

| 62 | 8 | 0 | 12,88,000 |

| 63 | 9 | 0 | 12,88,000 |

| 64 | 10 | 0 | 12,88,000 |

| 65 | 11 | 0 | 12,88,000 |

| 66 | 12 | 0 | 12,88,000 |

| 67 | 13 | 0 | 12,88,000 |

| 68 | 14 | 0 | 12,88,000 |

| 69 | 15 | 0 | 12,88,000 |

| 70 | 23,74,400 | ||

| IRR | 5.93% |

The Pramerica Life Signature Wealth Plan functions much like a fixed-income instrument, where the maturity value is predetermined. However, when compared to other fixed-return options such as bank fixed deposits or debt instruments, the plan’s returns are relatively low.

Even a bank fixed deposit could offer better returns while providing higher liquidity and easier access to your funds. Hence, the low returns and lack of liquidity are major drawbacks of investing in the Pramerica Life Signature Wealth Plan.

Pramerica Life Signature Wealth Vs. Other Investments

Given that the returns from the Pramerica Life Signature Wealth Plan are not favourable for investors, it’s worth exploring better alternatives for your lump sum investment.

Since this plan combines insurance and savings, the ideal strategy is to separate the two components — ensuring adequate protection and better returns.

Pramerica Life Signature Wealth Vs. Pure-term + Equity Mutual Fund

For life coverage, a pure-term life insurance policy with a sum assured of ₹13 lakhs costs around ₹2.27 lakhs as a single premium for a 15-year term.

In the earlier example, the premium for the Signature Wealth Plan was ₹10 lakhs, which means you can save ₹7.72 lakhs by choosing the term policy.

| Pure Term Life Insurance Policy | |

| Sum Assured | ₹ 13,00,000 |

| Policy Term | 15 years |

| Premium Paying Term | Single pay |

| Annualised Premium | ₹ 2,27,500 |

| Investment | ₹ 7,72,500 |

This saved amount can then be invested according to your risk appetite — debt instruments for conservative investors or equity funds for those willing to take higher risk.

| Age | Year | Term Insurance premium + Equity Mutual Fund | Death benefit |

| 55 | 1 | -10,00,000 | 13,00,000 |

| 56 | 2 | 0 | 13,00,000 |

| 57 | 3 | 0 | 13,00,000 |

| 58 | 4 | 0 | 13,00,000 |

| 59 | 5 | 0 | 13,00,000 |

| 60 | 6 | 0 | 13,00,000 |

| 61 | 7 | 0 | 13,00,000 |

| 62 | 8 | 0 | 13,00,000 |

| 63 | 9 | 0 | 13,00,000 |

| 64 | 10 | 0 | 13,00,000 |

| 65 | 11 | 0 | 13,00,000 |

| 66 | 12 | 0 | 13,00,000 |

| 67 | 13 | 0 | 13,00,000 |

| 68 | 14 | 0 | 13,00,000 |

| 69 | 15 | 0 | 13,00,000 |

| 70 | 38,11,976 | ||

| IRR | 9.33% |

To evaluate potential returns, let’s assume the lump sum is invested in an equity mutual fund. The pre-tax maturity value of the investment is ₹42.28 lakhs. After adjusting for capital gains tax, the post-tax maturity value stands at ₹38.11 lakhs.

The post-tax IRR for this combined strategy (term insurance + equity mutual fund) works out to 9.33%.

| Equity Mutual Fund Tax Calculation | |

| Maturity value after 15 years | 42,28,330 |

| Purchase price | 7,72,500 |

| Long-Term Capital Gains | 34,55,830 |

| Exemption limit | 1,25,000 |

| Taxable LTCG | 33,30,830 |

| Tax paid on LTCG | 4,16,354 |

| Maturity value after tax | 38,11,976 |

By separating insurance and investment, you not only earn inflation-beating returns but also enjoy liquidity, a key advantage missing in the Pramerica Life Signature Wealth Plan.

Hence, this combined approach proves far more efficient, making the Pramerica Life Signature Wealth Plan an unsuitable choice for both insurance and investment purposes.

Final Verdict on Pramerica Life Signature Wealth

The Pramerica Life Signature Wealth Plan is a traditional endowment policy where you make a one-time premium payment and receive a guaranteed maturity benefit, either as a lump sum or through regular payouts.

However, the plan’s returns are lower than debt instruments, making it an unattractive choice for lump-sum investments and it also has a high agent commission.

In addition, the funds remain locked until the end of the Pramerica Life Signature Wealth Plan policy term, and the life cover provided is modest compared to other insurance options.

At first glance, the idea of investing a lump sum while enjoying life cover may appear appealing—offering what seems like the best of both worlds. Yet, by combining insurance and investment, the plan ends up underperforming on both fronts.

This makes the Pramerica Life Signature Wealth Plan a less compelling choice for long-term financial planning.

In contrast, a pure-term life insurance policy is a far more efficient option. It offers substantial coverage at a lower cost, freeing up funds that can be invested in higher-yielding instruments aligned with your risk appetite.

This strategy ensures comprehensive financial protection for your loved ones while enabling better wealth creation through focused investments.

Do Quora, Facebook, and Twitter have the final say when it comes to financial advice?

For expert guidance on structuring your financial plan, it’s advisable to consult a Certified Financial Planner (CFP). They can design a personalised strategy tailored to your risk tolerance, life goals, and investment horizon, helping you achieve financial clarity and long-term growth.

Leave a Reply