For many families in Madurai, an investment they believed would secure their future has instead put their savings — and their peace of mind — at risk.

Among those affected was a mother caring for her visually impaired son. In a television interview, she said, “My entire savings are locked there.” For her, this was not an investment loss. It was security, dignity, and survival.

The fraud came to light when cheques issued at maturity were dishonoured, leaving investors stranded with no clarity on fund recovery.

This incident underscores the urgent need for financial awareness and vigilance. This article examines the SRB FinServ scam, explains how such schemes operate, and highlights practical steps investors can take to avoid falling into similar traps.

Table of Contents:

The Investment Proposition: How the Scheme Was Marketed

The Scam Explained: Where the Numbers Don’t Add Up

Investment vs Scam: Understanding the Difference

Liquidity Failure and Collapse of the Scheme

Current Status of the Investors

How to Identify an Investment Scam

1. Unrealistically High and Consistent Returns

3. Social Proof and Herd Mentality

How Investors Can Avoid Falling into Such Traps

iv. Report Suspicious Activity

Conclusion: Investor Awareness Is the First Line of Defence

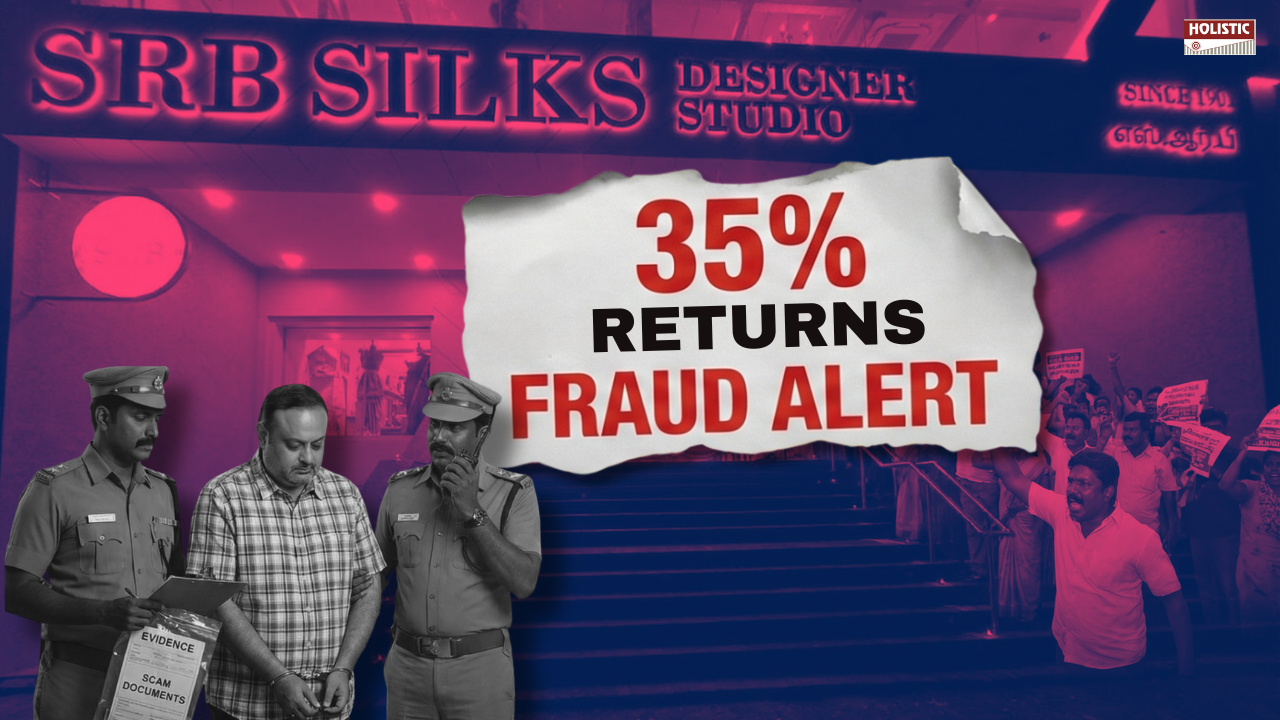

Overview of SRB FinServ

SRB FinServ is a private entity incorporated in Madurai. The company was promoted by Setty Kishorilal Arunlal and Mukunthu Iyappanbabu Anitha.

The promoters were also associated with other businesses such as Express Briyani Foods India Private Limited, Chennai Happy Bikes Private Limited, Madurai Food Street Private Limited, and a textile showroom operating under the name SRB Silks.

This apparent business presence created a perception of credibility, which played a key role in gaining investor trust.

The Investment Proposition: How the Scheme Was Marketed

Investors were offered a seemingly simple and familiar structure—

- Invest ₹10,000 per month for 12 months

- Receive a lump sum of ₹1,41,800 at maturity

The returns were scalable for investments made in multiples of ₹10,000. Since this resembled a recurring deposit (RD)—a product most investors are comfortable with—it appeared safe and convenient. The familiarity of the structure masked the true nature of the risk involved.

The Scam Explained: Where the Numbers Don’t Add Up

When the promised maturity amount is analysed, the implied annual return works out to around 35%. This is where the red flag emerges.

Many investors admitted they never calculated the return percentage. They trusted the maturity value. When returns are presented as a fixed number instead of a percentage, it reduces the instinct to question sustainability.

By the time they realised something was wrong, their life savings were already locked inside the scheme.

- Even equity markets, which carry high volatility, cannot consistently generate such returns.

- Investors focused on the final lump sum, without evaluating the return percentage or risk involved.

- SRB FinServ did not disclose where or how the pooled funds were invested—whether in equity, derivatives, startups, or any other business activity.

With no transparency on fund deployment or risk exposure, investors had no way to assess the safety of their capital.

Investment vs Scam: Understanding the Difference

In legitimate financial markets:

- Debt instruments typically deliver returns of 6–8%

- Equity investments may deliver 12–15% over the long term, with volatility

Scams, on the other hand:

- Promise high and assured returns

- Downplay or completely ignore risk

- Operate without regulatory oversight

- Lack transparency on the source of returns

In this case, although a 35% return was not explicitly advertised, it was implicitly guaranteed through the maturity value, making it a classic hallmark of a financial scam.

Liquidity Failure and Collapse of the Scheme

As maturity dates approached, investors began enquiring about repayments. The company managed to delay payouts by nearly a year, citing various reasons.

As months passed without repayment, anxiety turned into panic. For retirees, homemakers, and small business families, this money was not surplus capital. It was future security.

Some families had earmarked these funds for medical expenses, education, and essential living costs.

A genuine investment always allows liquidity or exit options. The absence of liquidity, combined with delayed payments and silence from the promoters, confirmed investor fears.

Current Status of the Investors

- Complaints have been lodged with the Central Crime Branch, Madurai

- Investigations are underway

- The promoters and their families have absconded

- Bank accounts linked to the promoters have been frozen

- As of February 2026, investors have not recovered even a single rupee

Since the scheme was unregulated, there is no formal grievance redressal mechanism, making recovery a long and uncertain process.

For many, the loss is not just financial. It is emotional trauma — the guilt of convincing relatives to invest, the embarrassment of explaining losses to family members, and the helplessness of waiting for justice.

How to Identify an Investment Scam

1. Unrealistically High and Consistent Returns

If returns appear too good to be true, they usually are. No legitimate investment can offer high returns without risk.

2. Lack of Transparency

Refusal to provide written details, unclear explanations of fund usage, or statements like “you don’t need to understand this” are serious warning signs.

3. Social Proof and Herd Mentality

Many investors rely on friends, relatives, or neighbours instead of doing independent due diligence—often leading to blind participation.

4. Pressure Tactics

Urgency, limited-time offers, or special discounts are used to rush decisions and suppress rational thinking.

How Investors Can Avoid Falling into Such Traps

i. Check Regulatory Approval

Verify whether the investment is regulated by SEBI, RBI, or other statutory authorities. Unauthorised schemes should be avoided outright.

ii. Read and Verify Documents

Always examine prospectuses, registrations, and legal disclosures. If documents are unavailable or vague, walk away.

iii. Understand the Product

Never invest in a product you don’t fully understand. Learn the basics, analyse returns, risks, and liquidity before committing money.

iv. Report Suspicious Activity

Suspected fraud should be reported immediately to:

- National Cyber Crime Reporting Portal (cybercrime.gov.in)

- RBI Ombudsman

- Your bank, if account details are compromised

Key Takeaways for Investors

- High returns often come with high risks—or hidden fraud

- Regulation and transparency are non-negotiable

- Greed can destroy years of disciplined savings

- Capital protection should always take priority over return chasing

Conclusion: Investor Awareness Is the First Line of Defence

Behind every investment scam statistic is a real family. A mother. A child. A retirement dream. Capital can be rebuilt. But lost trust and emotional trauma take far longer to recover.

Financial scams thrive on ignorance, urgency, and misplaced trust. They often disguise themselves as attractive investment opportunities backed by fake credibility. The saying holds true: “The only free cheese is in the mousetrap.”

Never invest based on phone calls, messages, or pressure tactics. Take time to research, verify, and consult qualified professionals. As financial products continue to evolve, continuous investor education is essential—not just for oneself, but also for family members, especially the elderly.

There are plenty of legitimate investment avenues available. The responsibility ultimately lies with the investor to understand the product before investing. When in doubt, seek guidance from a certified financial planner, who can align investments with your goals, risk profile, and long-term financial security.

Leave a Reply