Is the Edelweiss Life Flexi Savings Plan truly a flexible gateway to savings and protection — or just another plan with fine print and hidden trade-offs?

Is the Edelweiss Life Flexi Savings Plan a good fit for risk-averse savers — or does it fall short of being truly risk-free?

Will the Edelweiss Life Flexi Savings Plan help you meet short-, medium-, and long-term goals — or is it too generic to suit any one of them properly?

This article examines the plan’s features, benefits, and limitations to help you determine whether it aligns with your investment strategy.

It also offers guidance on how to structure your overall investment portfolio effectively.

Table of Contents:

What is the Edelweiss Life Flexi Savings Plan?

What are the features of the Edelweiss Life Flexi Savings Plan?

Who is eligible for the Edelweiss Life Flexi Savings Plan?

What are the benefits of the Edelweiss Life Flexi Savings Plan?

Grace Period, Discontinuance and Revival of the Edelweiss Life Flexi Savings Plan

Free Look Period for the Edelweiss Life Flexi Savings Plan

Surrendering the Edelweiss Life Flexi Savings Plan

What are the advantages of the Edelweiss Life Flexi Savings Plan?

What are the disadvantages of the Edelweiss Life Flexi Savings Plan?

Research Methodology of Edelweiss Life Flexi Savings Plan

Benefit Illustration – IRR Analysis of Edelweiss Life Flexi Savings Plan

Edelweiss Life Flexi Savings Plan Vs. Other Investments

Edelweiss Life Flexi Savings Plan Vs. Pure-Term + PPF/Equity Mutual Fund

Final Verdict on the Edelweiss Life Flexi Savings Plan

What is the Edelweiss Life Flexi Savings Plan?

Edelweiss Life Flexi Savings Plan is An Individual, Non-Linked, Participating, Savings, Life Insurance Plan.

It is designed to provide protection to your family from any financial loss in case of an untimely death, and also provide a regular income and/or lump sum to you and your family. It has various options to help you customise the plan as per your requirements

What are the features of the Edelweiss Life Flexi Savings Plan?

- Secure your family’s financial future with a comprehensive life insurance cover.

- Choose from three benefit options—Flexi-Income Plan, Flexi-Income PRO Plan, and Large Sum Plan—based on your needs.

- Enjoy the added advantage of Life Cover Continuation Benefit to stay protected even beyond policy maturity.

- You can also opt to receive income as early as the 2nd policy year, the 5th policy year, or after completing the premium payment term.

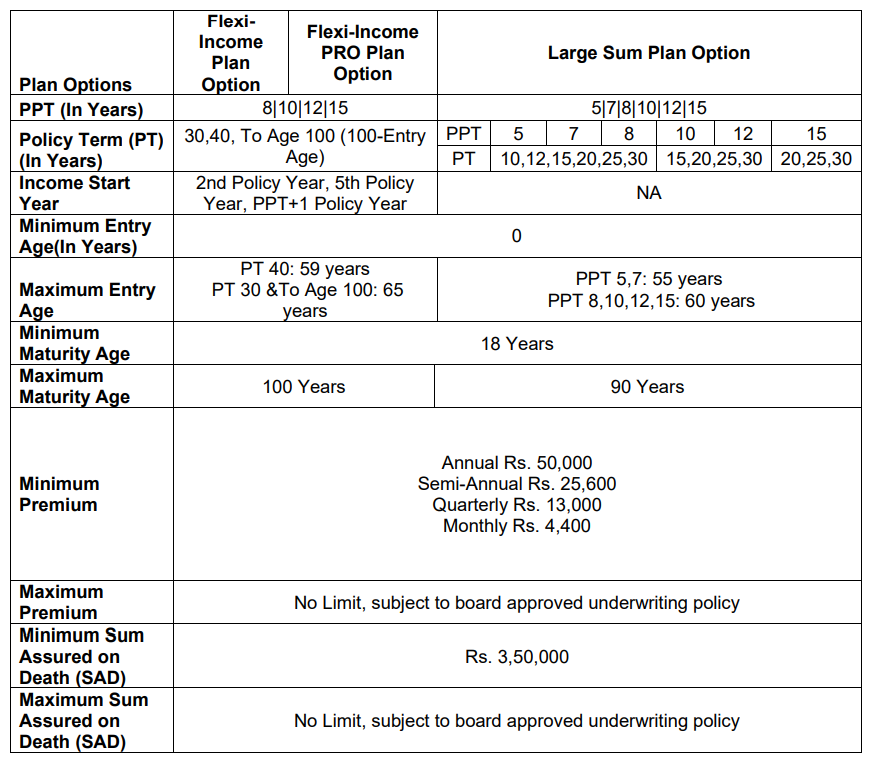

Who is eligible for the Edelweiss Life Flexi Savings Plan?

What are the benefits of the Edelweiss Life Flexi Savings Plan?

1. Death Benefit

The death benefit payable, under all Edelweiss Life Flexi Savings Plan options, is:

- Sum Assured on Death (SAD) plus

- Accrued Reversionary Bonus, if any, plus

- Terminal Bonus, if any

In addition, applicable Reversionary Bonus, Guaranteed Income, Guaranteed Lumpsum, Cash Bonus and Loyalty Sum Assured (only applicable in the last policy year for ‘Large Sum plan Option’), due in the Policy Year of death, will be payable on a pro rata basis considering the number of months elapsed in the policy year.

SAD is equal to 7 times the Annualised Premium.

The Sum Assured on Death (SAD) increases every policy year starting from the 2nd policy year by an absolute amount equal to Max {Sum Assured on Maturity less 7 times the Annualised Premium,0}/ (Policy Term – 1)

2. Survival Benefit

Flexi Income Option

Survival Benefit equal to the regular income will be payable annually in arrears every policy year, starting from the chosen Income Start Year (ISY) till maturity or death, whichever is earlier, while the Edelweiss Life Flexi Savings Plan policy is in force.

The regular income comprises

- Guaranteed Income, if applicable,

- Cash Bonus, if declared and

- Reversionary Bonus payout, if declared

Guaranteed Income: Guaranteed Income is a guaranteed benefit in the form of a cash payout

Cash Bonus: Cash Bonus is a non-guaranteed benefit in the form of a cash payout

Reversionary Bonus: Reversionary Bonus (RB) is applicable for Income Start Year 5 and ‘PPT+1’, and is not applicable for Income Start Year 2

Flexi-Income PRO Plan Option

Under this Edelweiss Life Flexi Savings Plan option, the Survival Benefit is equal to Regular Income plus Guaranteed Lump Sum.

The regular income comprises

- Guaranteed Income, if applicable,

- Cash Bonus, if declared and

- Reversionary Bonus payout, if declared.

Guaranteed Lumpsum: Guaranteed Lumpsum payments are payable in the interval of 5 years in the form of cash payouts till the 30th Policy Year or death, whichever is earlier

Guaranteed Income: Guaranteed Income is a guaranteed benefit in the form of a cash payout, payable annually in arrears every policy year, starting from the 31st policy year till maturity or death, whichever is earlier, while the Edelweiss Life Flexi Savings Plan policy is in force. Guaranteed Income is not applicable for Policy Term 30 years.

Cash Bonus: Cash Bonus is a non-guaranteed benefit in the form of cash payout, payable annually in arrears every policy year, starting from the Income Start Year till maturity or death, whichever is earlier

Reversionary Bonus Payout: Reversionary Bonus (RB) is applicable for Income Start Year 5 and ‘PPT+1’, and is not applicable for Income Start Year. Reversionary bonus would be declared and accrued every policy year starting from the 1st policy year till (Income Start Year – 1).

Large Sum Plan Option

There is no Survival Benefit in this Plan Option

3. Maturity Benefit

Flexi Income Option

Maturity Benefit is equal to Sum Assured on Maturity (SAM) plus accrued Reversionary Bonus, if any, plus Terminal Bonus, if any, provided the Edelweiss Life Flexi Savings Plan policy is in force

Flexi-Income PRO Plan Option

Maturity Benefit is payable equal to Sum Assured on Maturity (SAM) plus accrued Reversionary Bonus, if any, plus Terminal Bonus, if any

The Sum Assured on Maturity (SAM) is the minimum guaranteed maturity benefit and is equal to SAM Multiple X Annualised Premium

SAM Multiple varies by age, gender, PPT, PT, Plan Option and Income Start Year

Large Sum Plan Option

Maturity Benefit is equal to Sum Assured on Maturity (SAM) plus Loyalty Sum Assured on Maturity plus accrued Reversionary Bonus, if any, plus Terminal Bonus, if any.

The Sum Assured on Maturity (SAM) is the minimum guaranteed maturity benefit and is equal to SAM Multiple X Annualised Premium

SAM Multiple varies by age, gender, PPT, PT, and Plan Option.

Loyalty Sum Assured on Maturity is expressed as a % of Sum Assured on Maturity

Grace Period, Discontinuance and Revival of the Edelweiss Life Flexi Savings Plan

Grace Period

The company will allow a Grace Period of 15 days, where the Edelweiss Life Flexi Savings Plan Policyholder pays the Premium on a monthly basis, and 30 days in all other cases, during which you must pay the Premium due in full.

Discontinuance

If all the premiums have not been paid in full for at least the first policy year within the Grace Period, then on Premium Discontinuance, the Policy will be lapsed, and no Surrender Value or paid-up value will be payable.

If all Premiums for at least the first Policy Year have not been paid in full, then the paid-up value is nil.

After completion of the first Policy Year, provided one full year’s Premium has been paid, then on Premium Discontinuance, the Edelweiss Life Flexi Savings Plan Policy will continue as a ‘Reduced Paid-up’ policy, and all the benefits shall be reduced proportionately

Revival

The policy may be revived within the Revival Period. Revival Period means the period of five consecutive complete years from the date of the first unpaid premium.

Free Look Period for the Edelweiss Life Flexi Savings Plan

You have a Free Look period of thirty (30) days beginning from the date of receipt of the Policy Document, whether received electronically or otherwise, to review the terms and conditions of this Policy. If you disagree with any of the terms or conditions, or otherwise.

Surrendering the Edelweiss Life Flexi Savings Plan

After completion of the first Policy Year, provided one full year’s Premium has been paid, your policy will acquire a Surrender Value.

The Surrender Value, if any, will be payable after completion of the first Policy Year. The Edelweiss Life Flexi Savings Plan Policy will be terminated, and all the benefits under the Policy shall cease to apply.

The Surrender Value payable is the higher of Guaranteed Surrender Value (GSV) and Special Surrender Value (SSV).

What are the advantages of the Edelweiss Life Flexi Savings Plan?

- If the Life Cover Continuation Benefit is chosen, the Life Cover Continuation Sum Assured—equivalent to 10 times the annualised premium—will continue for a fixed period even after policy maturity.

- At any time during the policy term, the policyholder can choose to accumulate survival benefits instead of receiving them as cash payouts.

- Additional protection can be availed through optional riders.

- Tax benefits apply to both the premiums paid and the benefits received, as per prevailing tax laws.

- Policyholders can also avail a loan of up to 60% of the policy’s surrender value.

What are the disadvantages of the Edelweiss Life Flexi Savings Plan?

- The sum assured may not be sufficient to meet your family’s essential financial requirements.

- The plan delivers suboptimal returns, making it less suitable for long-term wealth creation.

- Early cash withdrawals weaken the power of compounding and reduce overall growth.

- You cannot earmark the survival benefit for specific goals, as it is non-guaranteed and depends on bonuses.

- Survival benefits often get diverted to discretionary spending, reducing their long-term impact.

Research Methodology of Edelweiss Life Flexi Savings Plan

Like most traditional life insurance plans, the Edelweiss Flexi Savings Plan offers life cover throughout the Edelweiss Life Flexi Savings Plan policy term along with either regular income or a lump sum maturity benefit.

The structure is simple: you pay premiums for a limited period and receive payouts later. However, to understand whether the plan truly adds value, it is essential to analyse its Internal Rate of Return (IRR).

Benefit Illustration – IRR Analysis of Edelweiss Life Flexi Savings Plan

Consider this illustration from the policy brochure:

A 30-year-old male buys the Edelweiss Flexi Savings Plan with a base sum assured of ₹7 lakhs (which may increase up to ₹15 lakhs).

The policy term is 20 years, and he pays an annual premium of ₹1,00,000 for 10 years under the Large Sum Plan Option.

| Male | 30 years |

| Sum Assured | ₹ 7,00,000 |

| Policy Term | 20 years |

| Premium Paying Term | 10 years |

| Annualised Premium | ₹ 1,00,000 |

In this option, he receives only the maturity benefit, including bonuses. The projected figures are based on assumed rates of 4% and 8%—these are not guaranteed and do not represent the maximum or minimum possible returns.

| At 4% p.a. | At 8% p.a. | ||||

| Age | Year | Annualised premium / Maturity benefit | Death benefit | Annualised premium / Maturity benefit | Death benefit |

| 30 | 1 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 31 | 2 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 32 | 3 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 33 | 4 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 34 | 5 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 35 | 6 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 36 | 7 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 37 | 8 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 38 | 9 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 39 | 10 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 40 | 11 | 0 | 10,00,000 | 0 | 10,00,000 |

| 41 | 12 | 0 | 10,00,000 | 0 | 10,00,000 |

| 42 | 13 | 0 | 10,00,000 | 0 | 10,00,000 |

| 43 | 14 | 0 | 10,00,000 | 0 | 10,00,000 |

| 44 | 15 | 0 | 10,00,000 | 0 | 10,00,000 |

| 45 | 16 | 0 | 10,00,000 | 0 | 10,00,000 |

| 46 | 17 | 0 | 10,00,000 | 0 | 10,00,000 |

| 47 | 18 | 0 | 10,00,000 | 0 | 10,00,000 |

| 48 | 19 | 0 | 10,00,000 | 0 | 10,00,000 |

| 49 | 20 | 0 | 10,00,000 | 0 | 10,00,000 |

| 50 | 15,86,317 | 25,78,883 | |||

| IRR | 3.00% | 6.20% | |||

At 4%, the estimated maturity benefit is ₹15.86 lakhs, resulting in an IRR of only 3% as per the Edelweiss Life Flexi Savings Plan maturity calculator, which is even lower than basic savings account rates.

At 8%, the projected maturity benefit is ₹25.78 lakhs, offering an IRR of 6.20% as per the Edelweiss Life Flexi Savings Plan maturity calculator, still below typical debt instrument returns.

Even over a 20-year horizon, the plan’s returns fail to beat inflation, making it ineffective for long-term wealth creation. The life cover offered is also insufficient to provide real financial protection.

Overall, the Edelweiss Flexi Savings Plan does not support meaningful goal-based investing and could potentially weaken your broader financial strategy.

Edelweiss Life Flexi Savings Plan Vs. Other Investments

When it comes to life protection, choosing a pure-term policy is always the smarter and more cost-effective option.

Term insurance provides only life cover—offering a death benefit in case of an unfortunate event—with no maturity or survival payouts. This keeps premiums low and coverage high, allowing you to invest the savings separately to build wealth and meet future goals.

Edelweiss Life Flexi Savings Plan Vs. Pure-Term + PPF/Equity Mutual Fund

Let’s break this down with an example:

A pure-term plan with a ₹15 lakh sum assured costs roughly ₹7,500 per year, whereas the Edelweiss Life Flexi Savings Plan charges ₹1,00,000 annually for similar coverage.

By investing the ₹92,500 difference based on your risk profile, you can achieve far superior returns.

| Pure Term Life Insurance Policy | |

| Sum Assured | ₹ 15,00,000 |

| Policy Term | 20 years |

| Premium Paying Term | 10 years |

| Annualised Premium | ₹ 7,500 |

| Investment | ₹ 92,500 |

Equity suits high-risk investors aiming for long-term growth.

Debt options like PPF appeal to conservative investors seeking stable and guaranteed returns.

| Term Insurance + PPF | Term insurance + Equity Mutual Fund | ||||

| Age | Year | Term Insurance premium + PPF | Death benefit | Term Insurance premium + Equity Mutual Fund | Death benefit |

| 30 | 1 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 31 | 2 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 32 | 3 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 33 | 4 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 34 | 5 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 35 | 6 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 36 | 7 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 37 | 8 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 38 | 9 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 39 | 10 | -1,00,000 | 10,00,000 | -1,00,000 | 10,00,000 |

| 40 | 11 | 0 | 10,00,000 | 0 | 10,00,000 |

| 41 | 12 | 0 | 10,00,000 | 0 | 10,00,000 |

| 42 | 13 | 0 | 10,00,000 | 0 | 10,00,000 |

| 43 | 14 | 0 | 10,00,000 | 0 | 10,00,000 |

| 44 | 15 | 0 | 10,00,000 | 0 | 10,00,000 |

| 45 | 16 | 0 | 10,00,000 | 0 | 10,00,000 |

| 46 | 17 | 0 | 10,00,000 | 0 | 10,00,000 |

| 47 | 18 | 0 | 10,00,000 | 0 | 10,00,000 |

| 48 | 19 | 0 | 10,00,000 | 0 | 10,00,000 |

| 49 | 20 | 0 | 10,00,000 | 0 | 10,00,000 |

| 50 | 27,29,733 | 50,72,011 | |||

| IRR | 6.58% | 10.74% | |||

In this case, the surplus amount is invested either in a PPF account or an equity mutual fund:

PPF Investment:

With necessary adjustments in the final year (due to the 10-year premium payment term and PPF’s 15-year lock-in), the maturity value reaches ₹27.29 lakhs, generating an IRR of 6.58%.

Equity Mutual Fund:

Over 20 years, the investment grows to ₹56.46 lakhs. After accounting for tax, the post-tax value is ₹50.72 lakhs, resulting in an impressive IRR of 10.74%.

| Equity Mutual Fund Tax Calculation | |

| Maturity value after 20 years | 56,46,584 |

| Purchase price | 9,25,000 |

| Long-Term Capital Gains | 47,21,584 |

| Exemption limit | 1,25,000 |

| Taxable LTCG | 45,96,584 |

| Tax paid on LTCG | 5,74,573 |

| Maturity value after tax | 50,72,011 |

This alternative strategy not only ensures adequate life cover but also delivers significantly stronger returns than the Edelweiss Life Flexi Savings Plan.

For investors looking for real financial protection along with meaningful wealth creation, the Edelweiss Life Flexi Savings Plan falls short on both fronts.

Final Verdict on the Edelweiss Life Flexi Savings Plan

The Edelweiss Life Flexi Savings Plan is a savings-cum-insurance product that offers flexibility through three benefit options. You may choose to receive survival income at regular intervals or accumulate it for a lump sum at maturity.

However, despite this flexibility, the plan functions like a traditional endowment policy, where benefits are not guaranteed and depend entirely on future bonus declarations.

A closer analysis shows that the plan delivers low returns, making it ineffective for long-term wealth creation.

The sum assured is also modest and may not provide adequate financial protection for your family.

As a result, the Edelweiss Life Flexi Savings Plan underperforms on both fronts—life coverage and investment returns and it also has a high agent commission.

To build long-term financial security, it is crucial to invest in a well-diversified portfolio aligned with your goals, risk appetite, and investment horizon.

For life protection, opting for a pure-term insurance policy is a far better choice, offering high coverage at an affordable cost based on your future goals, income, and liabilities.

Traditional policies that mix insurance and investment often weaken your financial strategy. A focused, goal-based investment approach leads to far stronger outcomes.

Do Quora, Facebook, and Twitter have the final say when it comes to financial advice?

For personalised guidance and a plan tailored to your financial needs, consulting a Certified Financial Planner is highly beneficial.

Leave a Reply