Are you looking forward to investing in SBI Life Smart Privilege Plan?

Do you believe that this plan will offer you the perfect blend of both Insurance and Investment benefits?

But is it true that SBI Life Smart Privilege Plan is a smart solution for your financial goals and needs?

Are you in a dilemma about whether SBI Life Smart Privilege Plan gives you the returns that you calculate for your future?

The core desire or financial goal of every breadwinner is to make their family financially secure even in their absence.

Will SBI Life Smart Privilege Plan provide a smart solution for your family’s financial goals and needs?

In this article. Let’s do a comprehensive Analysis of the SBI Life Smart Privilege Plan and discuss its Advantages (Pros) and Disadvantages (Cons) in detail.

In this SBI Life Smart privilege review, we also calculate the Internal Rate of the plan and compare it with other investment products to help you make informed investment decisions

In this Article:

1.What is SBI Life Smart Privilege Plan?

2.What are the Eligibility Criteria of SBI Life Smart Privilege Plan?

3.What are the Key Features of SBI Life Smart Privilege Plan?

4.Various Fund Options In SBI Life Smart Privilege Plan

5.Benefits of the SBI Life Smart Privilege Plan

6.SBI Smart Privilege Plan Benefit Illustration

7.Various Charges in SBI Life Smart Privilege Plan

8.Advantages of the SBI Life Smart Privilege Plan

9.Disadvantages of the SBI Life Smart Privilege Plan

10.SBI Life Smart Privilege Plan VS Other Investments

11.SBI Life Smart Privilege Plan VS PPF / ELSS?

12.SBI Smart Privilege Plan – Good or Bad

13.How to Surrender / Cancel Your SBI Life Smart Privilege Plan?

14.Final Verdict on SBI Life Smart Privilege Plan?

What is SBI Life Smart Privilege Plan?

SBI Life Smart Privilege Plan is a Unit-Linked Investment Insurance Plan (ULIP) believed to be specifically designed for this purpose. At least that is how it is presented to the investors.

SBI Life Smart Privilege is a Long Term Investment Product with a minimum policy term being 5 years.

By the end of this review, you will have absolute clarity on whether SBI Life Smart Privilege Plan is good or bad —the actual benefits and returns from the policy. And whether or not you have alternatives that are better in every aspect.

Without any further ado, let’s start with the eligibility and other features of the SBI Life Smart Privilege plan.

What are the Eligibility Criteria of SBI Life Smart Privilege Plan?

The lowest policy term available for SBI Life Smart Privilege is 5 years, and it differs based on the different plan options and eligibility criteria.

The table below the different eligibility criteria for different plan options and other features of the SBI Life Smart privilege plan.

What are the Key Features of SBI Life Smart Privilege Plan?

- You have the flexibility to choose between Single Pay/ Limited Pay options.

- No premium allocation charge from the 6th policy year onwards.

- loyalty additions start from the end of the 6th policy year.

- The policyholder gets the option of unlimited free switches between the available 11 funds like midcap funds, balanced funds, equity funds, etc.

- There are a total of 11 Fund Options available under SBI Smart Privilege.

- SBHI Life Smart privilege offers unlimited Free Switches.

- Tax benefit under section 80C of the Income Tax Act, 1961. The maximum deduction that can be claimed under this section during a financial year is Rs.1,50,000.

Take a look at this short video that covers all of the essential features of the SBI Life Smart Privilege plan.

Continue reading this article for more information to help you decide whether this SBI life policy is a good or bad investment choice for you.

Various Fund Options In SBI Life Smart Privilege Plan

SBI Smart Privilege plan enables the investors to choose from 11 different fund options. The Risk profile and Asset Allocation varies according to the fund of your choice.

These funds range from low to medium-risk bond funds to high-risk pure equity funds. So choose a fund that you feel is suitable for your financial needs and requirements.

The different funds offered by the SBI Life Smart Privilege plan are shown in the table below.

The minimum and maximum percentage contributions of different funds are calculated in the above table.

Benefits of the SBI Life Smart Privilege Plan

Since SBI Life Smart Privilege is a ULIP policy, you can receive the the policy benefit is either a death benefit or a Maturity (read survival) benefit.

a) SBI Life Smart Privilege Plan Death Benefit: On the unprecedented demise of the policyholder while the policy is active, the beneficiary or nominee will receive the highest of the below:

- Fund Value as on the date of death intimation or

- The basic sum assured less APW (Applicable Partial Withdrawals), or

- 105% of total premiums received up to the date of death less APW

In the case of minor lives, the date of commencement of policy and date of commencement of risk can be the same and the policyholder/proposer can be parents or legal guardian, which shall be as per board-approved underwriting policy.

The nominee or the beneficiary (legal heir) has the option to receive death benefit by choosing from the 2 options available.

1. Receive death benefit as a lump sum or

2. In installments over 2 to 5 years under “settlement option”. It can be done as yearly, half-yearly, quarterly, or monthly payouts as required. (During the settlement period, the policyholder has to bear the investment risk in the investment portfolio).

b) SBI Life Smart Privilege Plan Maturity Benefit:

On surviving the policy term, the policyholder will receive the accumulated fund value as a lump sum.

However, under the settlement option, the policyholder can receive the maturity benefit in installments.

Let’s take a deeper look into the maturity benefits by calculating the IRR of SBI Life Smart Privilege to, analyse its effectiveness.

SBI Smart Privilege Plan Benefit Illustration

As we have seen in SBI Life Smart Privilege Plan the investors can choose from 11 different funds.

Since it is said that Equity Funds have the potential to deliver higher returns. Let’s find out the Internal Rate of Return (IRR) of SBI Life Smart Privilege Plan by opting for an Equity Fund as an example.

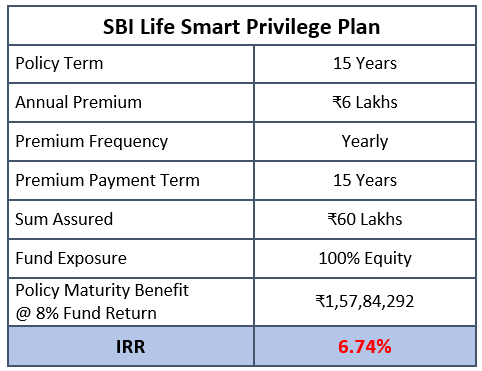

Suppose an investor buys the SBI Life Smart Privilege plan with a policy term of 15 years and invests ₹6 lakhs per annum. And here 100% of exposure is to only be given to equity funds under the SBI Life Smart Privilege Plan.

The returns illustration from the official SBI Life Smart Privilege Plan Calculator is shown in the table below.

From the official SBI Life Smart Privilege Plan Calculator, the maturity benefit illustration for the SBI Life Smart Privilege plan suggests that the policyholder will earn a maturity benefit of ₹1.57 Cr.

This return is calculated by assuming that the underlying fund earns @ 8% CAGR. However, it should not misunderstood as the IRR earned by the policyholder. When we consider the different charges levied by the policy, the actual return rate in the hands of the policyholder is only 6.74%.

For 15 years Long Term Investment product with a big capital of ₹6 lakhs per annum, a return rate of 6.74% is below par and mediocre.

This Benefit Illustration clearly indicates that this SBI Life Smart Privilege Plan will not be a suitable investment product for your Long Term Financial Goals.

Furthermore, there is a High Agent Commission in this plan which makes it even more unattractive for Long Term Investors.

To achieve Long Term Financial Goals you need an investment vehicle that surpasses inflation rate comfortably.

Various Charges in SBI Life Smart Privilege Plan

Like any other ULIP, the SBI Life Smart Privilege plan comes with a range of charges hidden under its benefits. We have reviewed each charge separately for your better understanding

Here is the list of different charges of the SBI Life Smart Privilege Plan that may affect your calculated returns.

Premium Allocation Charge:

- It is charged at 2.5% of the premium amount throughout the first 5 years of the policy term. No premium Allocation charge after the 6th Policy year.

Policy Administration Charge:

The Policy administration for SBI smart privilege as of now is subject to a cap of 500 rupees per month. However, the charges can be revised upon approval of IRDAI.

Fund Management Charges (FMC):

The SBI Smart privilege policy levies a predetermined percentage of the fund value as a fund management charge every year of the policy term.

This percentage of Fund Management Charge varies for each category of funds. For example, equity funds incur a 1.35% charge per annum, Bond funds incur a 1.15% charge per annum, and so on.

Discontinuance Charge:

Discontinued policies incur a charge as a percentage of the fund value in a staggered manner. This percentage differs for each year for different policy options. However, for the 5th policy year, there is no discontinuance charge.

Partial Withdrawal Charge:

The policyholder gets 2 free partial withdrawals in the same year. For partial withdrawals above and beyond this limit, the policyholder will be charged ₹100 per withdrawal.

Switching Charge:

SBI Life Smart Privilege allows unlimited free switches between funds.

Premium Redirection Charge:

The Premium Redirection Charge of this SBI life smart privilege plan as of now is subject to a market cap of 50 rupees per transaction. However, charges can be revised on approval of IRDAI.

Mortality Charge:

It is deducted on the 1st business day of each policy month from the fund value by the cancellation of units. Mortality charge varies depending on the age of the policyholder and the sum assured.

SBI Life Smart Privilege Plan – Pros and Cons

Is the SBI Life Smart Privilege Plan really a privilege for you and your family?

To find out this, let us evaluate the pros and cons of this SBI Privilege Plan.

Advantages of the SBI Life Smart Privilege Plan

A. Tax Benefit – By purchasing this policy, the policyholder gets tax benefit u/s 80C of the Income Tax Act, 1945.

B. Grace Period – This 30 days grace period will be allowed for premiums paid yearly, half-yearly, and quarterly. Whereas, only 15 days will be allowed in the monthly premium phase.

C. Switching Option – Even during the policy term and settlement period, you can switch your investments among the 11 funds available to meet your changing investing needs.

D. Diverse Funds – SBI Life Smart Privilege Plan allows you to invest in diverse funds such as equity funds, midcap funds, balanced funds, etc.

Disadvantages of the SBI Life Smart Privilege Plan

- A premium top-up facility is not allowed in this policy under any circumstances.

- Under any circumstances, the policyholder cannot take a loan against this policy

- The funds under the SBI Life Smart Privilege plan lack the transparency that is offered by the standard mutual funds regulated by SEBI.

- The returns offered by the SBI Life Smart Privilege plan are below par.

You should look to gain insights of potential returns of the plan before choosing it as your investment vehicle. To evaluate the returns from SBI Life Smart Privilege, let’s compare how this plan will fare against different investment options.

SBI Life Smart Privilege Plan Vs Other Investments

When we calculated the potential return of the SBI Life Smart Privilege Plan we found out that it has offered only 6.74% IRR, even if the underlying funds earned 8% CAGR in the illustration above.

So now let’s do a comparison with other investments for investment choices.

SBI Life Smart Privilege Plan VS PPF / ELSS?

Can PPF Investment give better-assured returns than the SBI Life Smart Privilege plan?

Let’s assume that the policyholder is investing the same ₹ 6 Lac annually for 15 years in PPF. The prevailing PPF interest rate for Q1 2022-2024 is 7.1% p.a.

In such a case, by the end of the 15th year, the policyholder will receive ₹1.63 Cr. In comparison, it is approximately ₹5 lakhs better return.

Do you think it’s good? Wait, there is a caveat. In PPF, one can only invest ₹1.5 lakhs per annum while also enjoying the EEE tax benefits and assured returns.

See the compounding table below.

We have calculated the investment in PPF In comparison with the SBI Smart Privilege the calculated maturity amount of PPF the difference may look much less.

However, the return rate of PPF—7.1% pa— is comfortably higher than the IRR of the SBI Smart Privilege Plan @ 6.74%CAGR.

Moreover, the returns are completely tax-free and virtually risk-free. Whereas, SBI Life Smart Privilege Plan’s performance is not guaranteed and depends on the fund performance or the fund manager’s performance day in and day out.

PPF does not offer life cover like the SBI Life Smart Privilege Plan. Alternatively, you can buy a term insurance plan for the same sum assured but far less premium.

If you haven’t made good use of PPF yet, PPF + a term insurance policy is an alternative investment option every conservative investor should review before even considering SBI Life Smart Privilege Plan.

SBI Life Smart Privilege Plan Vs ELSS Mutual Fund

Since the SBI Life Smart Privilege plan is a ULIP policy, it will be only fair to compare its return against another equity investment. In this case, let’s see what if the investor has opted for an ELLS fund with the same investment premium.

Let’s consider the same investment of ₹6 lakhs annually for the same term of 15 years as we did with the SBI Life Smart Privilege plan. We are assuming a very conservative 12% CAGR for the ELSS Mutual Fund.

And more importantly, the investment risk level is the same as SBI Life Smart Privilege Plan, since both are market-linked investments.

In the above table, we have calculated the return and balance amount for investment in ELSS Mutual Funds.

In the SBI Life Smart Privilege plan review of benefits illustration,it is identified that , the policy could generate a maximum return of only ₹1.57 Cr.

But for the same investment, an investor will receive almost ₹2.5 Cr at the end of the 15th year . Let me remind you, this is a conservative assumption for an ELSS mutual fund.

In comparison with ELSS (12% CAGR), there is a huge difference in the maturity amount. The difference is approximately ₹93 lakhs.

And again, ELSS Mutual Fund is good as purely an investment instrument. It does not offer life cover like SBI Life Smart Privilege Plan.

Yes, it is absolutely necessary to have a life cover to protect yourself and your loved ones from uncertainties.

However, you can always buy a term insurance plan for the same life cover. Term insurance policies offer a higher sum assured amount for far less premium.

An online calculator can give numbers but the final decision lies with you as an individual.

This combination of ELSS Mutual Fund + Term Insurance is a better option than SBI Life Smart Privilege Plan for a risk-tolerant investor

Mutual Fund invites Non-Resident Indians ( NRI ) to take the opportunity to invest and benefit from the growth potential in India. The intent of writing this post is to inform you about the investment aspects of this plan and to evaluate if SBI Smart Privilege Plan is a good or bad investment for you.

Let us share our final thoughts about the same in the next section.

SBI Smart Privilege Plan – Good or Bad?

Considering and comparing the alternative options in all aspects, it’d be wise for an investor to Not Invest in the SBI Life Smart Privilege plan.

The following are 5 good reasons to avoid Investing in SBI Smart Privilege Plan.

- PPF investment with a Term Insurance plan is a better alternative for investors with no or lesser risk tolerance.

- On the other hand, the ELSS Mutual Fund with Term Insurance plan is a better alternative for investors with a certain level of risk tolerance and investment discipline.

- One may argue that the SBI Life Smart Privilege Plan is more likely to generate higher returns. However in reality the returns of SBI Smart Privilege is not even able to match with the Debt Instrument Return.

- Consider this, the SBI Life Smart Privilege Plan is a long-term commitment of at least 5 years. Even if you choose to discontinue your policy, your investments will be moved to the Discontinued Policy Fund, earning a bare minimum of 4% per annum.

- There is no systematic compulsion on the policy’s fund manager to perform at his best all the time. However with ELSS Mutual Funds, the investor invest in a different funds at any time. This compels the fund managers to deliver better returns consistently.

If you have already bought the SBI Life Smart Privilege plan, you may want to consider surrendering it. However, it is always wise to consult your financial or investment advisor to plot the optimal strategy that fits your requirements.

Click Here for SBI Smart Privilege Plan (एसबीआई लाइफ स्मार्ट प्लेटिना प्लस कैलकुलेटर) Review in Hindi

How to Surrender Your SBI Life Smart Privilege Plan?

i. Surrendering During The Free-look Period:

This SBI Life Smart Privilege policy has a free look period of 15 days if the policy is bought physically and 30 days if the policy is bought via digital marketing.

ii. Surrendering After The Free-look Period:

You can surrender the SBI Life Smart Privilege policy at any time during the policy term, once surrendered the policy cannot be revived

Procedure to surrender/Cancel your SBI Life Smart Privilege Plan:

If the policyholder wants to surrender his/her SBI Life Smart Privilege policy, the policyholder needs to submit reason(s) for Policy surrender and the surrender form needs to be submitted at the nearest SBI Life Insurance Branch, along with the following documents. They are as follows –

- Original policy documents

- Cancelled cheque with the policyholder’s name on it

- In case the cancelled cheque does not have a pre-printed name, or account number, or a new account is mentioned on the cheque, then the passbook copy/bank statement having the pre-printed name and the account number is required for review.

- ID proof (PAN Card, Aadhar Card, Passport, Driving License, Voters ID)

- Policy surrender or cancellation form

- Contact details

Conclusion

SBI Life Smart Privilege plan is an attractive ULIP policy for an uninformed investor.

But as a good investor, you should be skeptical about everything before choosing your investment product.

The purpose of this SBI Life Smart Privilege plan review is to help you find that conviction before you make any investment decision.

The illustration of the SBI Life Smart Privilege plan benefits and the illustration of the returns from the alternate options is evidence enough.

Think twice and again before you invest in any ULIP product and consult a financial advisor before you make that final call.

Please don’t conclude your review of the SBI Life Smart Privilege Plan by just surfing through social media sites like Quora, Facebook, Twitter, etc. It is always wise to take the help of a professional financial planner.

If you have any comments or questions, write them in the comment box below.

Are you interested in creating a Comprehensive Financial Plan for your financial goals?

Skip the queue by registering for your 30-minute FREE Financial Plan Consultation. Click the ‘‘BOOK YOUR SLOT NOW!’’ button below.

Hi Sir,

Greetings

Is the assured amount fixed for payout after policy term completion if I change my Fund type from Balanced to Equity Fund and irrespective of the Fund value based on market at maturity Policy Term

I have taken smart privillege which gives you insurance and a return assurance, whereas term insurance with no return on investments, also MF don’t give insurance. So if you don’t have insurance than what is good. Further u can partial withdraw from 6th year but ppf can you withdraw without reason. Pls reply

in this plan you invest only for 5 years, and in PPF you invest for 14 years, how can you compare ???

Hi, there are various PPT options available. And we have taken 15 years of PPT as an example in this policy. That’s why we used PPF for comparison.

Dear sir,

I have taken sbi life smart privilege policy plan of 20 years policy term with 5 years policy payment term of 10lakhs each year for 5 years and they kept it on sbi life balanced fund. Sun assured is 1 cr. But as per them it will generate funds in 20 years and provide me 2.5 crore at the end.

Can I continue this policy or not as per your suggestion I want to decide for my second policy term payment.

Since you have already taken this insurance plan, then you have two options.

Option: 1 You can surrender and encash the policy. And reinvest the surrender value and future premium money with better investment plans like PPF or MF.

Option: 2 You can continue with the insurance plan until the policy matures.

It is advisable to work out the outcome of both options and proceed with the better option.

80% of the times, option 1 is better.

You can consult a financial planner to choose the better option.

Or

You can take advantage of our free complimentary financial plan consultation and talk to our financial planners.

Get your appointment here: https://www.holisticinvestment.in/complimentary-financial-plan-consultation/

You can switch to Equity or Midcap fund and wait for 5-6 years ,it will give you good returns above 10% .Don’t get panic with PREJUDICED COMPARISONS