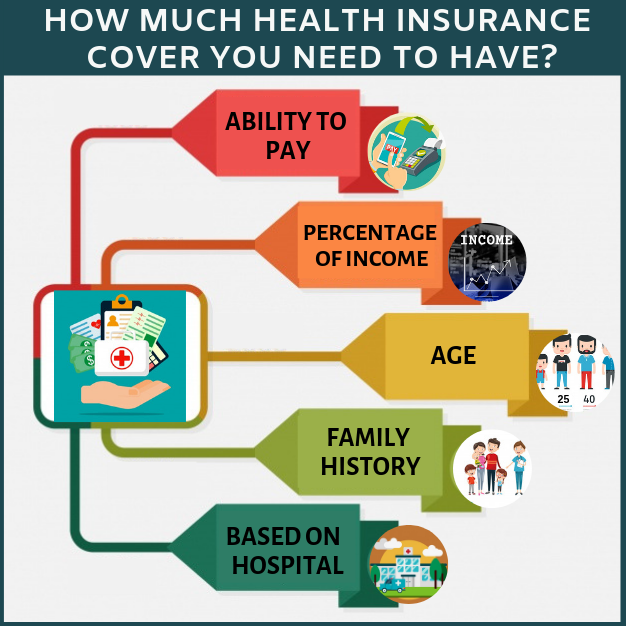

“How much mediclaim should I have or one should have?” These 5 points in this article will give you answer for it.

Exactly how much health insurance / mediclaimone should have for self and family?

Does it have any formula to calculate it?

Should it depend on job profile, city and income level?

These are the most common questions which pop up when a person starts thinking about health insurance/mediclaim. So let us try and find out the most appropriate answers.

1) Ability to Pay

First important factor in deciding the health insurance/mediclaim cover is your ability to spend on premium. Because premium is directly, proportionate to the insurance amount.

Depending upon the insurance amount, Insurance Company, type of the insurance and other additional taxes you will have to pay the premium. You need to work out on your affordability to pay the premium. And after assessing that capability, you should choose your health insurance type.

Because not everyone can pay the premium for Rs 20 lacs cover, as it will be very huge.

In order to answer the question “How much Mediclaim should I have?”, you need to know how much mediclaim premium you can pay.

However, a person can pay some amount, which fits within his expenses- affordability. Let us say 2% of yearly income. If a person is earning Rs 6 lacs a year, he might be able to pay an amount that is up-to 2% of that yearly – Rs 12,000, which will give him decent cover from today’s standard. Therefore, a person with 3 lacs salary can pay for health insurance up-to Rs 6,000

So If you are facing cash crunch, go ahead and buy a health insurance or mediclaim policy with a small coverage amount, it will act as a boon at the time of a medical emergency and will help you offset the hospital bill. Do not wait for your financial situation to change, remember you can always increase the coverage amount later.

2) Percentage of income

Practically, you should have health insurance, which has a cover between 50 to 100 % of your annual income. More to that if, someone has spent 2 lac on medical expenses over 3 years, then he should add those 2 lac also to his health insurance cover as shown:

Health Insurance cover = 50% of Income + 100% of last 3 yrs. expenses on Health (hospitals)

So if your annual income is 6 lac rupees then above formula becomes:

Health Insurance cover =3 lac + 2lac=5 lac

In short, either your 100% annual income or 50% annual income + medical expenses during last 3 years should be your basis while buying health insurance plan.

This formula will answer, How much Mediclaim should I have.

3) Family history

If you have a family history of lifestyle diseases, the probability of it being passed on to the next generation is higher. Any individual who is in a genetically high-risk category should buy wider health insurance coverage when he is young and healthy.

How much Mediclaim should I have, depends on the family history as well.

4) Age

Age is an important factor that must be considered while deciding the amount of coverage. For instance if you start at age 25 you can buy health insurance worth Rs 5- 10 lakhs and then increase it by 10- 15 % every year. Buying a health insurance in early life ensures a lower premium as you would have fewer pre exiting diseases.

A middle-aged person or any individual who has crossed 45 years needs to buy a higher coverage amount as with growing age the options of buying health insurance decreases. Secondly, the cost of the coverage increase and if the individual develops health issues, the health insurance provider tends to exclude pre-existing diseases, which defeats the true reason for buying a health insurance policy.

The mediclaim coverage, I should have, needs to increase with age.

5) Based on the Hospital

There are different grades of hospital. For a similar kind of treatment, hospital A may be charging Rs.x wheras hospital B will be charging 3x.

Depending on what kind of hospital or grade of hospital or class of hospital you would generally choose to be hospitalised, will determine the amount of health cover required.

Verdict: How much health insurance/mediclaim coverage do you need?

There is no thumb rule to it. Each individual is different and hence his health insurance coverage or mediclaim need is different, it is important to meet a dedicated financial advisor who understands your personal and family requirement and helps you make a wise decision.

If you are REALLY inclined to make asolid difference in achieving your financial goals by creating a financial plan, then I would suggest you to test-drive our services by opting for

Skip the queue by registering for your 30-Minute FREE Financial Plan Consultation. Click the ‘BOOK YOUR SLOT NOW!’ button below.

Leave a Reply