HDFC Life Sanchay Plus: Review-Should You Buy It?

Is this HDFC Life’s Sanchay Plus any different from the previous one?

If this Sanchay Plus is good r if at all, is this worth considering as an investment or insurance option? What are the advantages and disadvantages of HDFC Life Sanchay Plus?

This review article will help you conclude whether the new HDFC Life Sanchay Plus is good or bad for you.

Table Of Content

1.)Review of HDFC Life: Company Overview

2.)Basic Features of HDFC Life Sanchay Plus

3.)HDFC Life Sanchay Plus: Review of Death Benefit

4.)Practical Review of HDFC Life Sanchay Plus Benefit’s 4 Variants

- Variant No.1: Guaranteed Maturity Benefit – Analysis and Review

- Variant No.2: Guaranteed Income Benefit – Analysis and Review

- Variant No.3: Guaranteed Life-Long Income Benefit – Analysis and Review

- Variant No.4: Guaranteed Long-Term Income Benefit – Analysis and Review

5.)HDFC Life Sanchay Plus: Pros & Cons Overall Analysis and Review

6.)HDFC Life Sanchay Plus: How to surrender/cancel the policy?

7.)Is HDFC Life Sanchay Plus Good?

HDFC launched the HDFC Life Sanchay Plus, following the HDFC Life Sanchay endowment insurance plan.

Being the next version, it sure does have some better features and options than the previous one. It is crafted to be appealing and attractive for every single investor to “invest”.

Are these appeals and attractiveness just a perception created or a reality?

We’ll discover that in this article after we look into the basic features of HDFC Life Sanchay Plus and the small overview of the company “HDFC Life”.

HDFC Life: Company Overview

HDFC Life is providing its services since the year 2000. Now, it’s almost 21 years since its inception.

The company has been an average player in terms of its Claim Settlement Ratio when compared to its other counterparts. But, over the years its Claim Settlement Ratio has experienced a consistent rise.

Still, a long way to go!

For more details on various Term Insurance, you should read the detailed article on “Cheat Sheet to select the best Term Insurance”.

Is HDFC Life Sanchay Plus good or bad? Let us review by diving into a deeper analysis of HDFC Life Sanchay Plus to validate if it is a pro or a con.

HDFC Life Sanchay Plus: Basic Features

Is HDFC Life Sanchay plus a Ulip?

HDFC Sanchay Plus is a non-linked savings endowment insurance plan. HDFC Sanchay Plus is not a ULIP.

It offers four different policy benefit options to choose from. They are,

- Guaranteed Maturity

- Guaranteed Income

- Life-Long Income

- Long Term Income

HDFC Life Sanchay plus minimum premium:

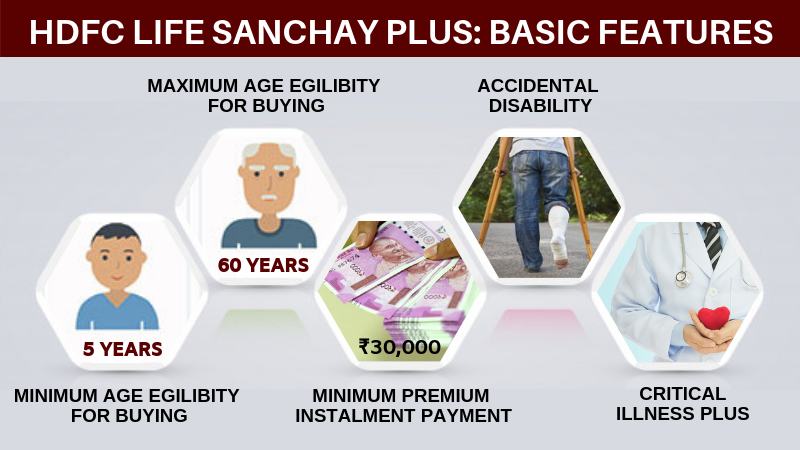

The minimum age eligibility for buying HDFC Life Sanchay Plus policy is 5 years and the maximum age is 60 years.

The minimum age to be eligible for the maturity benefit is 18 years and the maximum age starts from 71 years.

This HDFC Life Sanchay Plus requires a minimum premium installment payment of ₹30,000 a year.

The HDFC Life Sanchay Plus also offers rider options for ‘Accidental Disability’ and ‘Critical Illness Plus’ which is a great advantage

To know about these Features in detail, download – HDFC Life Sanchay Plus Product Brochure

Source – hdfclife.com

These features look attractive, the “Guaranteed” Maturity and Income benefit options in particular.

Of course, the benefit is “Guaranteed”, but you must look into how much is guaranteed. This HDFC Life Sanchay Plus is marketed as a savings insurance plan and hence must offer a return rate on maturity.

Source – hdfclife.com

The video shown below will give you a brief idea of and a review of various aspects of the HDFC Life Sanchay Plus Plan. Let’s have a look

Let’s see how much they have to offer in return with their four different benefit options with practical examples.

HDFC Life Sanchay Plus: Review of Death Benefit

If the policyholder dies within the policy term, the nominee will receive a death benefit equal to the Sum Assured on Death.

Sum Assured on death is the highest of the following:

- 105% of the total premiums paid

- 10 times the annualized premium / 1.25 times the single premium

- Guaranteed Sum Assured on Maturity (total premiums payable under the policy)

- Premiums paid accumulated at an interest of 5% p.a. compounded annually

- Sum Assured (Death Multiple times Annualized premium). Death multiple depends on your entry age.

The Death Benefits Multiples applicable for all plans are specified below:

| Age* | Death Benefit Multiple | Age* | Death Benefit Multiple | Age* | Death Benefit Multiple | Age* | Death Benefit Multiple |

| 5 | 15.00 | 19 | 13.60 | 33 | 12.20 | 47 | 10.80 |

| 6 | 14.90 | 20 | 13.50 | 34 | 12.10 | 48 | 10.70 |

| 7 | 14.80 | 21 | 13.40 | 35 | 12.00 | 49 | 10.60 |

| 8 | 14.70 | 22 | 13.30 | 36 | 11.90 | 50 | 10.50 |

| 9 | 14.60 | 23 | 13.20 | 37 | 11.80 | 51 | 10.45 |

| 10 | 14.50 | 24 | 13.10 | 38 | 11.70 | 52 | 10.40 |

| 11 | 14.40 | 25 | 13.00 | 39 | 11.60 | 53 | 10.35 |

| 12 | 14.30 | 26 | 12.90 | 40 | 11.50 | 54 | 10.30 |

| 13 | 14.20 | 27 | 12.80 | 41 | 11.40 | 55 | 10.25 |

| 14 | 14.10 | 28 | 12.70 | 42 | 11.30 | 56 | 10.20 |

| 15 | 14.00 | 29 | 12.60 | 43 | 11.20 | 57 | 10.15 |

| 16 | 13.90 | 30 | 12.50 | 44 | 11.10 | 58 | 10.10 |

| 17 | 13.80 | 31 | 12.40 | 45 | 11.00 | 59 | 10.05 |

| 18 | 13.70 | 32 | 12.30 | 46 | 10.90 | 60 | 10.00 |

The Sum Assured is determined considering your entry age and the Annualized Premium you agree to pay in a policy year.

Let’s see how much they have to offer in return with their four different benefit options with practical examples.

HDFC Life Sanchay Plus: Review of Maturity Options

Sample Illustration:

To enable the illustration of HDFC Sanchay Plus plan consider an average person who is 30 years old—let’s call him Madhan.

Illustration of benefit for a healthy male aged 30 years(50 years for Life Long immediate Income plan ), who pays ₹1lac+Taxes per annum Throughout the premium paying term and survives the policy

|

Plan Option |

Sum Assured |

Death Benefit at Inception* |

Policy Term (years) |

Premium Paying Term (years) |

Maturity Benefit (INR) |

|

Guaranteed Maturity |

12,50,000 |

12,50,000 |

20 |

10 |

₹22,27,460 paid as a lump sum at Maturity |

|

Guaranteed Income |

12,50,000 |

14,51,837 |

13 |

12 |

Guaranteed income^ of ₹2,02,750 p.a. from 14th year to 25th year(payout period of 12 years) |

|

Long-term Income |

12,50,000 |

12,50,000 |

11 |

10 |

Guaranteed income of ₹ 87,000 p.a. from 12th year to 36th year(payout period of 25 years) + ₹10,00,000 at the end of payout period(36th year) |

|

Life-Long Income |

10,50,000 |

10,64,141 |

11 |

10 |

Guaranteed income of ₹ 80,250 p.a. from 12th year to 99 year(38 years) + ₹10,00,000 at the end of payout period |

| Plan Option |

Benefit

Guaranteed MaturityGuaranteed IncomeLong Term IncomeLife Long IncomeGuaranteed Lumpsum Amount ✔𝙓✔

(In the form of Return of Premiums)

✔

(In the form of Return of Premiums)

Guaranteed Additions✔𝙓𝙓𝙓Guaranteed Income𝙓✔

(For 10/12 yrs)

✔

(For 10/12 yrs)

✔

(For 10/12 yrs)

Death Benefit✔✔✔✔

4.)Practical Review of HDFC Life Sanchay Plus Benefit’s 4 Variants

1. Guaranteed Maturity Benefit: Review

Under this Guaranteed Maturity benefit option, the HDFC Life Sanchay Plus maturity benefit is paid as a lump sum amount at the end of the policy term.

Among the three different policy terms as defined below, let’s choose the 20 years policy term, which is the longest. This policy option has a premium payment term of 10 years.

| Guaranteed |

Maturity

Premium Paying Term(PPT)Policy TermPayout Period5 year10 yearMaturity Benefit is paid as a lump sum at the end of 10 years6 year12 yearMaturity Benefit is paid as a lump sum at the end of 12 years10 year20 yearMaturity Benefit is paid as a lump sum at the end of 20 years

When the policy matures, Madhan will receive the “Guaranteed Maturity” benefit. The guaranteed maturity benefit is the sum of the Guaranteed Sum Assured and the Guaranteed Addition.

The Guaranteed Addition differs with different groups of age. It is higher for the younger age group than the older age group.

|

|

|

Guaranteed Maturity |

|

|

Age |

Year |

Annualised premium / Maturity benefit |

Death benefit |

|

30 |

1 |

-1,00,000 |

12,50,000 |

|

31 |

2 |

-1,00,000 |

12,50,000 |

|

32 |

3 |

-1,00,000 |

12,50,000 |

|

33 |

4 |

-1,00,000 |

12,50,000 |

|

34 |

5 |

-1,00,000 |

12,50,000 |

|

35 |

6 |

-1,00,000 |

12,50,000 |

|

36 |

7 |

-1,00,000 |

12,50,000 |

|

37 |

8 |

-1,00,000 |

12,50,000 |

|

38 |

9 |

-1,00,000 |

12,50,000 |

|

39 |

10 |

-1,00,000 |

12,50,000 |

|

40 |

11 |

0 |

12,50,000 |

|

41 |

12 |

0 |

12,50,000 |

|

42 |

13 |

0 |

12,50,000 |

|

43 |

14 |

0 |

12,50,000 |

|

44 |

15 |

0 |

12,50,000 |

|

45 |

16 |

0 |

12,50,000 |

|

46 |

17 |

0 |

12,50,000 |

|

47 |

18 |

0 |

12,50,000 |

|

48 |

19 |

0 |

12,50,000 |

|

49 |

20 |

0 |

12,50,000 |

|

50 |

21 |

22,27,460 |

12,50,000 |

|

|

|

||

|

IRR |

5.23% |

|

|

The IRR(Internal Rate of Return) is calculated at 5.23% in the above illustration.

The Catch: If you think it is not bad, keep in mind that you have to pay the GST in addition to the premium you are paying. If we consider that too, the return rate will be even lesser than 5.2%.

Hence HDFC Life Sanchay plus guaranteed maturity good or bad?

Guaranteed Maturity is not a wise option at all.

Let’s see whether the other benefit options have better returns to offer.

2. Guaranteed Income Benefit: Review

The Guaranteed Income benefit option of the HDFC Life Sanchay Plus will pay you the maturity benefit as a guaranteed income for a select number of years in arrears. In this example let us choose the policy plan with 13 years policy term.

In this example let us choose the policy plan with 13 years policy term.

| Premium Paying Term(PPT) | Policy Term | Payout Period |

| 10 year | 11 year | Maturity Benefit is paid as a guaranteed income from the 12th year to the 21st year in arrears |

| 12 year | 13 year | Maturity Benefit is paid as a guaranteed income from the 14th year to the 25th year in arrears. |

It requires a premium payment term of 12 years. The maturity benefits will be paid as Guaranteed Income in arrears.

Madhan will receive this “Guaranteed Income” for 12 subsequent years after the successful completion of the policy term, i.e. from the 14th year to the 25th year.

See the illustration image of the plan from the HDFC Life Sanchay Plus Calculator below.

HDFC Life Sanchay Plus Calculator:

What is the Interest rate or Rate of Return you get out of HDFC Sanchay Plus?

|

|

|

Guaranteed Income |

|

|

Age |

Year |

Annualised premium / Maturity benefit |

Death benefit |

|

30 |

1 |

-1,00,000 |

14,51,837 |

|

31 |

2 |

-1,00,000 |

14,51,837 |

|

32 |

3 |

-1,00,000 |

14,51,837 |

|

33 |

4 |

-1,00,000 |

14,51,837 |

|

34 |

5 |

-1,00,000 |

14,51,837 |

|

35 |

6 |

-1,00,000 |

14,51,837 |

|

36 |

7 |

-1,00,000 |

14,51,837 |

|

37 |

8 |

-1,00,000 |

14,51,837 |

|

38 |

9 |

-1,00,000 |

14,51,837 |

|

39 |

10 |

-1,00,000 |

14,51,837 |

|

40 |

11 |

-1,00,000 |

14,51,837 |

|

41 |

12 |

-1,00,000 |

14,51,837 |

|

42 |

13 |

0 |

14,51,837 |

|

43 |

14 |

0 |

|

|

44 |

15 |

2,02,750 |

|

|

45 |

16 |

2,02,750 |

|

|

46 |

17 |

2,02,750 |

|

|

47 |

18 |

2,02,750 |

|

|

48 |

19 |

2,02,750 |

|

|

49 |

20 |

2,02,750 |

|

|

50 |

21 |

2,02,750 |

|

|

51 |

22 |

2,02,750 |

|

|

52 |

23 |

2,02,750 |

|

|

53 |

24 |

2,02,750 |

|

|

54 |

25 |

2,02,750 |

|

|

55 |

26 |

2,02,750 |

|

|

|

|

||

|

IRR |

5.18% |

|

|

In the Guaranteed Income option, you will get an calculated IRR of 5.18%%.

If you choose the policy term for 13 years and the Premium Paying term for 12 years, then you will start to get your guaranteed payout from the 14th policy term onwards.

The Catch: If you think it’s fair enough to consider buying this policy plan, remember. We did not include the GST which you will be paying along with the payment of the annual insurance premium. If you weigh that in, the IRR must be only a little over 5%.

In addition, your benefit will be the same throughout the payout period as inflation increases during the payout period. Today’s ₹2,02,750 will not have the same value after 10 years in the payout period.

Therefore, this “Guaranteed Income” option is not an advantage either. Can the other two benefit options reward you better? See it for yourself below.

3. Guaranteed Life-Long Income Benefit: Review

The HDFC Life Sanchay Plus’ Life-Long Income benefit option will attract the masses for sure.

The maturity benefit is paid as guaranteed income from the end of the policy term in arrears until the insured attains 99 years of age. Guaranteed Life-Long Income looks attractive. But, you can buy it only if your age is between 50 years and 60 years old.

Guaranteed Life-Long Income looks attractive. But, you can buy it only if your age is between 50 years and 60 years old.

| Premium Paying Term(PPT) | Policy Term | Payout Period |

| 5 year | 6 year | Maturity Benefit is paid as a guaranteed income from 7th year in arrears till the individual attains the age of 99 years. |

| 10 year | 11 year | Maturity Benefit is paid as a guaranteed income from the 12th year in arrears till the individual attains the age of 99 years. |

|

|

|

Guaranteed Income |

|

|

Age |

Year |

Annualised premium / Maturity benefit |

Death benefit |

|

30 |

1 |

-1,00,000 |

14,51,837 |

|

31 |

2 |

-1,00,000 |

14,51,837 |

|

32 |

3 |

-1,00,000 |

14,51,837 |

|

33 |

4 |

-1,00,000 |

14,51,837 |

|

34 |

5 |

-1,00,000 |

14,51,837 |

|

35 |

6 |

-1,00,000 |

14,51,837 |

|

36 |

7 |

-1,00,000 |

14,51,837 |

|

37 |

8 |

-1,00,000 |

14,51,837 |

|

38 |

9 |

-1,00,000 |

14,51,837 |

|

39 |

10 |

-1,00,000 |

14,51,837 |

|

40 |

11 |

-1,00,000 |

14,51,837 |

|

41 |

12 |

-1,00,000 |

14,51,837 |

|

42 |

13 |

0 |

14,51,837 |

|

43 |

14 |

0 |

|

|

44 |

15 |

2,02,750 |

|

|

45 |

16 |

2,02,750 |

|

|

46 |

17 |

2,02,750 |

|

|

47 |

18 |

2,02,750 |

|

|

48 |

19 |

2,02,750 |

|

|

49 |

20 |

2,02,750 |

|

|

50 |

21 |

2,02,750 |

|

|

51 |

22 |

2,02,750 |

|

|

97 |

48 |

80,250 |

|

|

98 |

49 |

80,250 |

|

|

99 |

50 |

1080250 |

|

|

|

IRR |

|

|

|

|

|

5.39% |

|

We have calculated the IRR(Internal Rate of Return) at 5.39%

Let’s say that Madhan is purchasing the Life Long Income option. Here, he is choosing the Premium Payment Term for 10 years, and he will get his guaranteed payout from the 12th policy term onwards for 99 years.

Then, at the end of the policy term, he will get an IRR of 5.39%.

“Life Long Guaranteed Income”

Did they just sell the “Financial Independence” in a single insurance policy?

It’s terrifying how words are used to manipulate investors’ decisions to sell products.

Whatever they do, don’t let yourself be fooled.

( An interesting fact is that “HDFC Life Sanchay Par” has an option of a cash bonus at the end of every year ( if declared) for the policyholder. while “HDFC Life Sanchay Plus” does not.)

The Catch: The return on this “Life-Long Income” policy is shy of 5.39%. But think about it, a maximum of 5.39% interest return(IRR) for a period of almost 50 years is ridiculous.

As we have seen in the above reviews, you’re going to pay more as GST. And inflation will keep reducing the value of your “income” exponentially.

It may appear good in contrast with the previous options. But from a money-smart investor’s perspective, it is also a big let-down.

The last remaining benefit option claims to have some flexibility. Let’s review what it has under its hood.

4. Guaranteed Long-Term Income: Review

The Long Term Income benefit option of HDFC Life’s Sanchay Plus policy promises to pay the maturity benefit in arrears for a select period of time.

The payout period of the policy varies based on the policy term. However, it ends on the 36th year from the starting year of the policy term.

| Premium Paying Term(PPT) | Policy Term | Payout Period |

| 5 year | 6 year | Maturity Benefit is paid as a guaranteed income from the 7th year to the 36th year in arrears |

| 10 year | 11 year | Maturity Benefit is paid as a guaranteed income from the 12th year to the 36th year in arrears. |

|

|

|

Long term Income |

|

|

Age |

Year |

Annualised premium / Maturity benefit |

Death benefit |

|

30 |

1 |

-1,00,000 |

12,50,000 |

|

31 |

2 |

-1,00,000 |

12,50,000 |

|

32 |

3 |

-1,00,000 |

12,50,000 |

|

33 |

4 |

-1,00,000 |

12,50,000 |

|

34 |

5 |

-1,00,000 |

12,50,000 |

|

35 |

6 |

-1,00,000 |

12,50,000 |

|

36 |

7 |

-1,00,000 |

12,50,000 |

|

37 |

8 |

-1,00,000 |

12,50,000 |

|

38 |

9 |

-1,00,000 |

12,50,000 |

|

39 |

10 |

-1,00,000 |

12,50,000 |

|

40 |

11 |

0 |

12,50,000 |

|

41 |

12 |

0 |

|

|

42 |

13 |

87,000 |

|

|

43 |

14 |

87,000 |

|

|

44 |

15 |

87,000 |

|

|

45 |

16 |

87,000 |

|

|

46 |

17 |

87,000 |

|

|

47 |

18 |

87,000 |

|

|

48 |

19 |

87,000 |

|

|

49 |

20 |

87,000 |

|

|

50 |

21 |

87,000 |

|

|

51 |

22 |

87,000 |

|

|

52 |

23 |

87,000 |

|

|

53 |

24 |

87,000 |

|

|

54 |

25 |

87,000 |

|

|

55 |

26 |

87,000 |

|

|

56 |

27 |

87,000 |

|

|

57 |

28 |

87,000 |

|

|

58 |

29 |

87,000 |

|

|

59 |

30 |

87,000 |

|

|

60 |

31 |

87,000 |

|

|

61 |

32 |

87,000 |

|

|

62 |

33 |

87,000 |

|

|

63 |

34 |

87,000 |

|

|

64 |

35 |

87,000 |

|

|

65 |

36 |

87,000 |

|

|

66 |

|

10,87,000 |

|

|

|

|

||

|

IRR |

5.49% |

|

|

Let’s assume Madhan buys the 11-year policy term for which he will be paying 10 years of the policy plan. His plan would look like this, the above calculation

At the end of the policy term, he will get an IRR of 5.49% and a Guaranteed income of Rs.87,000 p.a from the 12th policy term onwards for 25 years

The Catch: Even a minimum assumption of just 5.50% inflation will reduce your ₹5 lakhs by 4.3 times.

Overall, this “Guaranteed Long Term Income” is capable of providing only 5.50% at the most.

A 5.50% IRR(Internal Rate of Return) for a period of 30 years should not even be an option to consider. And the obvious, you will be paying the GST for your premium payment—reducing the return rate even more.

I must say, this benefit option too is only the same thing in a different wrapper.

Do these plans have anything at all to offer an investor?

Is HDFC Sanchay Plus a definite Con for investors?

HDFC Life Sanchay Plus: Pros & Cons – Analysis and Review

Hdfc Life Sanchay Plus Advantages:

As you might have noticed from the above analysis that all 4 variants have some catch in their offerings.

Though they use catchy words like “Guaranteed” or “Life-long Income”, their ROI is less than 6%, which can’t even beat the inflation rate!

|

Policy Option |

IRR |

|

Guaranteed Maturity |

5.23% |

|

Guaranteed Income Benefit |

5.18% |

|

Life-Long Income |

5.39% |

|

Long-term Income |

5.49% |

Hdfc Life Sanchay Plus Disadvantages:

So BEWARE, If your Financial Advisor recommends you this plan, it’s because they may get 30-40% as commission. for example: If your premium is 1 lakh, your advisor may get 30,000 to 40,000 as commission out of your premium.

A Bank Relationship Manager may also try selling you this product. This is because the bank also gets a commission to do so. Relationship managers also have pressure to sell these kinds of products and meet targets, hence there is also a lot of misselling happening.

The misselling is that these products give around 8 to 9% returns. So before you buy the product, verify the truth on the HDFClife website as to what the actual returns are.

The HDFC Life Sanchay Plan has a potential disadvantage of high agent commissions paid to their brokers and banks.

Many think that as the product looks complicated, it must be a good plan, but it is not the case. PPF, Mutual Funds, and Term Insurance though are old, simple, and boring, and have no marketing gimmicks. They are easy to understand and also fulfill their purpose.

Complexity kills transparency. Less transparency makes it easier to mis-sell.

Avoid complicated investment products like HDFC Life Sanchay Plus.

How much is really guaranteed in HDFC Life Sanchay Plus?

Returns are guaranteed only if you stay the course: The policy benefits will reduce if you surrender the policy or miss the premium payment.

They portray it as guaranteed and lifelong, but how much is guaranteed?

See what is your final returns. Only 5 to 6% is guaranteed.

GST: You will also have to pay the GST on the premium, after that the returns will become even lower.

What should be your next wise step as an investor?

If you are looking for wealth creation, then this is not the right product: PPF would give higher returns.

Liquidity: Investment is locked in this plan until the income period starts.

In life long option, you will receive the same amount throughout your life. How will this even benefit you?

And moreover, HDFC Life is an insurance company and not an investment company.

So, if you want higher returns on your investment you should invest in investment vehicles, such as Stocks or Mutual Funds.

Though they have risk factors, they will reward you suitably through their higher returns of 12% – 15% if you keep yourself invested in the long term. (or even equivalent to the HDFC Life Sanchay Plus’ term!!)

And, if you are a risk-averse then it is better to invest in PPF, which will give you guaranteed returns of around 7.10%! Even FD returns are more respectable than HDFC Life Sanchay Plus.

Always, look for higher returns and less complexity, if you invest any amount of money into any policy.

Therefore, our advice to you is: if you are investing your money for 20 long years, you must consider investing in Mutual Funds. Have a look at the obvious advantages of Mutual Funds as compared to HDFC Life Sanchay Plus:

1. Returns on Investment: HDFC Life Sanchay Plus Vs. Mutual Fund

As we have already discussed different aspects. Now, let’s look at an example and calculate the returns of HDFC Life Sanchay Plus.

In Mutual Funds, the longer you invest, the more power of compounding you will experience!

For example, let us say you invest Rs.1,00,000 p.a. in Mutual Funds for the duration of 10. This means you have invested Rs.10,00,000 Lacs in 10 years.

Your returns will become greater than Rs. 19 Lacs, with a modest interest rate of 12% in Mutual Funds. And, you can withdraw your amount in the 11th year.

And, if you want to invest for 20 years, that is a total of Rs.20 Lacs in 20 years; your returns will become Rs. 80 Lacs, which is approximately 4 times your initial investment with a 12% interest rate!

Whereas with HDFC Life Sanchay Plus as you already saw, its return is even lesser than 6% after the 20-year long term!

2. Lock-in Period: HDFC Life Sanchay Plus Vs. Mutual Funds

Mutual Funds do not have any Lock-in period. If you want to cancel your investment SIPs in the first year, there will be an exit load charge of 1%. After 1 year, there will be no charge, you can cancel your scheme anytime.

HDFC Life Sanchay Plus requires you to pay all your annual premiums on time for 10 years in the first variant and so on. Otherwise, you will not receive the benefits of this policy. So, you are locked in for 10 years for paying your premiums.

There is a free look-in period of 15 days, but even if you cancel within 15 days, you will be charged fees and tax towards Stamp duty, medical examination, and proportionate risk premium.

3. Who is more goal focused? HDFC Life Sanchay Plus Vs. Mutual Funds

Mutual Funds allow you to list your short-term (2-5 years) and long-term (7+ years) goals and invest accordingly in the right scheme, where you will be benefitted from Higher Returns as compared to any other policy, including HDFC Life Sanchay Plus.

HDFC Life Sanchay Plus is designed to keep you in your comfort zone towards the expectation of future income security. Truth is, you are only receiving the amount that you have given them over a period of 10 years or so. All the added benefits get automatically leve led by the inflation rate!!

Therefore, there is absolutely no point in achieving any major/minor financial goal with HDFC Life Sanchay Plus.

4. Regulatory Authority: HDFC Life Sanchay Plus Vs. Mutual Funds

Mutual Funds are regulated by a reputed agency called SEBI. Whereas, HDFC Life Sanchay Plus is regulated by IRDA, which regulates insurance policies.

SEBI ensures greater security and safeguards against all frauds in Mutual Funds or Stock investments. Whereas, SEBI has no such role to play in such income schemes by HDFC Life or other such companies.

The regulation of IRDA is predominantly focused on Insurance regulation and not on investment regulation. SEBI’s regulation is well-evolved in regulating investments, protecting investors’ interests, and proactively taking measures to stop mis-spelling.

So, if you are investing your money in the long term, your first priority is to achieve higher returns. Therefore, it is advisable you should invest in SEBI-regulated platforms, such as Mutual Funds or Stock Markets.

We hope this information helps you choose whether H If you have any queries until this point, you can ask them in the comment section.

Also, read Is it worthwhile to invest in HDFC Sanchay Plus?

HDFC Life Sanchay Plus Vs. LIC Jeevan Umang

LIC Jeevan Umang promises to protect you for a period of 100 years with guaranteed income.

HDFC Life Sanchay Plus & LIC Jeevan Umang gives you rider options.

Read the detailed review of LIC Jeevan Umang for IRR analysis and calculations with illustrations.

LIC Jeevan Umang: Review (2023) – Should You Buy It?

HDFC Life Sanchay Plus Vs. ICICI Pru Guaranteed Income For Tomorrow (GIFT)

The ICICI GIFT plan allows you to take a loan against policy if you are caught up in an emergency.

To read the complete review of ICICI Pru Guaranteed Income For Tomorrow (GIFT) click below.

ICICI Pru Guaranteed Income For Tomorrow Review [2023]: Worth Buying Or Not?

HDFC Life Sanchay Plus Vs Other Investment Choices – Comparison Review

After a thorough analysis, it seems that Term Insurance + ELSS or PPF is a better option.

Instead of falling for the glitz and glamour of new plans in the market we should always review and compare it with the other investment choices.

This will help us to evaluate the pros and cons of the new plan effectively.

How to surrender/cancel HDFC Life Sanchay Plus Policy?

Hdfc life Sanchay plus cancellation charges:

Cancellation during the free look-in period:

You can cancel the plan within the free look in the period of 15/30 days from the day of your receipt. Please note:

The free-look period is 15 days from the date of receipt of the policy in case of face-to-face selling.

The Free-look period for the policies purchased through Distance Marketing will be 30 Days from the date of the receipt.

Where Distance marketing refers to the policies sold through telephone or online or any other method which do not involve face-to-face selling.

Your premium will be refunded but they are subject to deduction of the:

- The proportionate risk premium for the period on cover,

- The expenses incurred by the company on medical examination (if any) and Stamp duty(if any).

Cancellation after the free-Look In Period:

You can cancel HDFC life Sanchay Plus after 1-year Policy Termination or Surrender Benefit: Policyholder is allowed to surrender the policy after 2 or 3 full years’ premiums have been paid.

The Surrender Value will be higher than the Guaranteed Surrender Value or the Special Surrender Value.

You can submit your cancellation or complaint request in an Online or Offline Format. A written request or an email with the registered email id is mandatory. You can send your e-mail to service@hdfclife.com.

For more details, you should read this current official document of HDFC Life Sanchay Plus.

All grievances (Service and sales) received by the Company will be responded to within the prescribed regulatory Turn Around Time (TAT) of 14 days.

A policy once returned shall not be revived, reinstated, or restored at any point in time and a new proposal will have to be made for a new policy.

In case, you are not satisfied with the company’s response, within 14 days, you may approach the Grievance Cell of the Insurance Regulatory and Development Authority of India (IRDAI) at the following contact details:

IRDAI Grievance Call Centre (IGCC)

TOLL-FREE NO:155255

Email ID: complaints@irda.gov.in

Online- You can register your complaint online at https://irda.gov.in/

Address for communication for complaints by fax/paper:

Consumer Affairs Department Insurance Regulatory and Development Authority of India

9th floor, United India Towers, Basheerbagh

Hyderabad – 500 029,

Telangana State (India).

More more updated details you can refer to this Official policy document of HDFC Life Sanchay Plus.

HDFC Life Sanchay Plus Tax Benefits:

Tax Benefits may be available as per prevailing tax laws. You are requested to consult your tax advisor.

Is Sanchay plus payout tax-free?

HDFC Life Sanchay Plus offers the benefit of tax exemption to the insured. The maturity process and premium paid towards the policy up to the maximum limit of Rs. 1.5 lakh are eligible for tax exemption under section 10(10D) and 80C of Income Tax Act 1961.You can learn the Tax benefits here.

Is HDFC Life Sanchay Plus Good or Bad?

What is our view observation on HDFC Life’s Sanchay Plus endowment plan?

The term “Guaranteed” ultimately seems to be only a marketing plan than a policy plan. A return of 5%-6% in these policy options can never be an investors’ delight but misery.

Such returns can’t even beat inflation for a long duration of 20+ years!!

Instead, you can buy term insurance for life cover at a much lesser price—while you invest the rest of the “premium” in instruments that give better returns.

But still, why do insurance agents try to sell you this HDFC Life Sanchay Plus plan? Like many policies in the bazaar, they get a high agent commission by selling this to you!

PPF is also a triple tax Exempt investment instrument that gives returns above 8% quarterly.

Or if you are willing to manage risks, there are even better options. You can invest in equity mutual funds for even higher returns, an average of 12% return.

Be money smart and stay away from such low-return “savings insurance” plans.

We hope this review helps you choose whether HDFC Life Sanchay Plus is a good or bad investment for your financial needs.

Please don’t conclude about the HDFC Life Sanchay Plus plan by just surfing on social media sites like Quora, Twitter, Facebook, etc. It is always advisable to get the help of a professional financial planner.

You can also book a FREE Complimentary Consultation Call with us to get advice on the best investment and insurance policy for your needs by clicking the link below:

I got into trap of my RM by purchasing most shit policy on the planet. When I buy this policy during pre COVID-19 period my yearly earning was such that I could easily pay annual premium of over 500K.

Since 2020 after COVID-19 and loss of financially sound job it is becoming difficult to pay premium.

Most Miserable part of this policy is one didn’t receive even equal amount of what is paid as premiums.

This is simply white collar daylight robbery.

Please suggest solution including legal, approaching regulator or government.

Thanks

Nice work!…..all these bank manager useless fellows selling these products to people and wasting the peoples money.

This product is useless

PPF is also a triple tax Exempt investment instrument that gives return above 8% quarterly.

Is that 24% Annually is what it means?

No, the 8% quarterly return on PPF does not mean 24% annually. PPF returns are compounded annually. An 8% annual interest rate means the interest is calculated and compounded annually, not quarterly. So, you get approximately 8% per year, not 24%. The present PPF rate is 7.1%

Thanks for such an amazing review. I also had suspicion regarding it. HDFC Life representative said that, at the end of maturity, the entire amount can be withdrawn by deduction of 9% mentioning below points in the brochure:

On the maturity date, you shall have an option to receive the Guaranteed Sum Assured on Maturity, which under this option, shall be the present value of future payouts, discounted at a rate of 9% p.a. This interest rate is not guaranteed.

However, any change in the interest rate will be subject to prior approval of the Authority and will be applicable only to the policies sold after the date of change.

At any point of time during the Payout Period, you shall have an option to receive the future income as a lump sum, which shall be the present value of future payouts, discounted at a rate which is computed using the prevailing interest rates described below.

Could you please clarify that?

They said that the payout is not guaranteed and can be changed anytime during the policy term. Also, the policy holder has the option to receive this payout as a lumpsum at the discounted rate.

My RM told me that the returns are tax free. If thats the case, then 5.5% will become the post tax rate (equivalent of about 8.5% pre tax rate). Is that correct (this tax free part)? Because 8.5% guaranteed for a long term does look attractive.

Yes, the return you earn from the insurance plan is tax free. But the bonus you earn from the plan is not a guaranteed one. PPF returns are also tax-free. The post-tax returns from Mutual Fund ELSS will be higher.

Thanx a ton for this review. We otherwise would have been taken for a rough ride. They paint pretty picture of returns instead of the reality which pathetic.

My SBI agent was pushing me to buy this one. You saved me.

Thanks much.

Read it but you are hiding some points

The return in this is income tax free while in mutual funds it’s taxable

There are many mutual funds which don’t give returns even 5-6 % even fir long term

Everyone cannot choose funds and even if advisor does return is not guaranteed

Yes, the return you earn from the insurance plan is tax free. PPF returns are also tax-free.

The post-tax returns from Mutual Fund ELSS will be higher, if the investor is comfortable with taking risk and selecting good funds are in his / her circle of competence.

If MF ELSS is not suitable for the investor, he can always choose PPF.

Great detail review, very helpful

Thank you

This was an eye opener for me.

One request, if you can explain how/where to invest in mutual funds that will be really helpful.

Thanks a lot.

Please check with your financial planner.

You can also book a slot with our financial planner for an initial complimentary consultation.

https://www.holisticinvestment.in/complimentary-financial-plan-consultation/

But which is a good pension plan?

Hi!

For a personalised investment plan, you can contact our certified financial planner. Please click the link and fill out the 30-minute complimentary consultation form to book your appointment.

https://www.holisticinvestment.in/complimentary-financial-plan-consultation/

Thank you so much. I read your article today, you had saved me from putting my hard earned money into a trap. Your article is an eyeopener not to get carried away by the gimmicks used by agents.

Your welcome.

I have bought it yesterday but now I am unhappy with the policy. Kindly guide me to to cancel it. I have not got policy number yet.

Hi, Please watch the video to know how to cancel your HDFC insurance policy.

https://youtu.be/K8rFZLwHjcc

Can you give a comparison between LIC’s Jeevan Umang Vs Sanchay Plus Guaranteed Income Benefit

We have already published a review article on LIC Jeevan Umang. Please read the article here: https://www.holisticinvestment.in/lic-jeevan-umang-review-2022-should-you-buy-it/

That was a superb review. Saved me a lot of time from calculations. Svaed me from my confusions too. Now that there is no confusion I have decided not to go for it. Thanks a million.

You are welcome

Thanks you opened my eyes. I oTHERWISE I WAS NOT GOING IN MUCH DETAILS. IT LOOKS ATTRACTIVE N POLICYBAZAAR IS SAYING IT IS GIVING 3.27 TIMES YOUR MONEY. BTW THANKS

Your welcome

Hi Team,

Very good review of this. I was actually offered similar MAx Life Smart wealth plan scheme and was looking for review.

You gave a very good detailed evaluation of th variants and helped me to skip this plan (being sold by my BRM)..

Appreciate your time for this blog.

I am told there are tax benefits, the payout is completely tax free

Yes, the payout is tax free. PPF returns are also tax-free. The post-tax returns from Mutual Fund ELSS will be higher.

But the returns are tax exempted. So for a guy in highest tax brackets returns would be like 9 to 10% and guaranteed. Is it not good.

If you are looking for tax benefits then there are other better investment plans available for you. PPF returns are also tax-free. The post-tax returns from Mutual Fund ELSS will be higher.

Thanks for your valuable suggestion and feedback.. I suppose to invest sanchay plus yearly 150000 but now change my mindset after review yours

. Can you suggest where I need to invest for gurrented retirement plan as my age now 48

.CaI I go ppf .. thanks

Hi!

For a personalised investment plan, you can contact our certified financial planner. Please click the link and fill out the 30-minute complimentary consultation form to book your appointment.

https://www.holisticinvestment.in/complimentary-financial-plan-consultation/

Very detailed review….superb….you saved me from this plan..Thanks for your efforts.

You are welcome.

Appreciate your honest review. RBL Bank representatives are calling frequently to take this plan using 100% returns. I have already invested in Mutual Funds getting good returns.

Glad to hear that

Good to know

Argument put forward in favor of the plan is: the returns are Tax free. So IRR of 6.5 % is close to 8.75% before tax. I.e. comparing with fixed interest FDs. This plan is much better and FD rates are expected to go down or stay in same range for near future.

For high networth individual, this argument is appealing as his tax exposure is still high even after using other venues like ppf etc.

Do you see any merit or lacuna in this sales pitch? Pl advise.

Hi!

As you said, the return is tax free. Also, the return is not guaranteed.

PPF returns are also tax-free. The post-tax returns from Mutual Fund ELSS will be higher.

Is icici guaranteed income plan as bad pl advise

Hi! For now, we have not analysed the plan. Once we publish the review article, we will let you know.

Your article is an eye opener. I have unfortunately invested in both the hdfc sanchay plus and sanchay par advantage plans. Its been almost a year since I invested in both, is there any way I can get out of them without losing much of my initial worth?

Since you have already taken this insurance plan, then you have two options.

Option: 1 You can surrender and encash the policy. And reinvest the surrender value and future premium money with better investment plans like PPF or MF.

Option: 2 You can continue with the insurance plan until the policy matures.

It is advisable to work out the outcome of both options and proceed with the better option.

80% of the times, option 1 is better.

You can consult a financial planner to choose the better option.

Or

You can take advantage of our free complimentary financial plan consultation and talk to our financial planners.

Get your appointment here: https://www.holisticinvestment.in/complimentary-financial-plan-consultation/

Good technical inputs

Thank you.

Thank you

Many thanks for your valuable review

You are welcome.

Many thanks to your much valuable advice.

You are welcome

A Great review. Appreciate your efforts in making people like us to know the reality. Thanks

You are welcome

Thanks for the review. It was an eye opener. What about SBI’s pension plans like SBI Smart retire plan.

I am 53 yrs old. I’am an NRI . I can invest 10 Lacks per annum for next 5 years.

I need a income of 30,000 per month thereafter for around 20-years.

What do you suggest ??

Please click the link and read, SBI Life Retire Smart Plan Review.

https://www.holisticinvestment.in/sbi-life-retire-smart-plan-review/

As for investment suggestions, you can contact our certified financial planner. Please click the link and fill out the 30-minute complimentary consultation form to book your appointment.

https://www.holisticinvestment.in/complimentary-financial-plan-consultation/

Thanks for providing better insight & understanding. I am 42 years, with investment plan of. Rs 30K PY. If I just keep it aside every year for 10 years it will like 3 Lakhs + some nominal appreciation (Age 52 years). now I invest that 3 Lakhs in Mf for 8 years (my age post 8 years = 60 years) then invest the amount in Senior saving scheme will definitely will give more returns. Or before SSC i can deposit in PPF for 15 years and enjoy more benefits too.. isn’t it.

Hi, for personalized investment suggestions, you can contact our certified financial planner. Please click the link and fill out the 30-minute complimentary consultation form to book your appointment.

https://www.holisticinvestment.in/complimentary-financial-plan-consultation/

Hey Pranab, Would this plan be good for someone who might retire in 11 years and currently aged 50 ?

Specifically , would this plan help in retirement planning , instead of waiting for investing the super superannuation amount at what ever prevailing rates are available at the retirement age ( 10 years from now )

Hi, for personalized investment suggestions, you can contact our certified financial planner. Please click the link and fill out the 30-minute complimentary consultation form to book your appointment.

https://www.holisticinvestment.in/complimentary-financial-plan-consultation/

SAVED ME FROM EDUCATED HONEST BURGLAR

Thanks Pranab.

We are happy that it helped you.

THANKS FOR HONEST REVIEW. I WAS CONFUSED WHETHER I SHOULD GO FOR IT OR NOT. BUT NOW ITS CLEAR. I SHOULD NOT GO FOR IT.

We are glad that, the article gave you clarity.

is this a good plan considering the income tax benefits, and the fact that market product return for fixed income are now around 5%

If you are looking for tax benefits then there are other better investment plans available for you. Whereas the return earned from the insurance plan is not a guaranteed one.

PPF returns are also tax-free. The post-tax returns from Mutual Fund ELSS will be higher.

But considering the reducing bank fixed deposit interest rates, isnt it worth investing in sanchay plus, which gives an IRR of 6.2% over a period of 36years. May be this is not comparable MF, but comparing to fixed deposit and reducing post office interest rates, i find this a relatively better option over a period of 36 years. Look forward to our comment and suggesstions based on the above feedback

Hi! The return earned from the insurance plan is not guaranteed.

As for investment suggestions, you can contact our certified financial planner. Please click the link and fill out the 30-minute complimentary consultation form to book your appointment.

https://www.holisticinvestment.in/complimentary-financial-plan-consultation/

so, among the traditional insurance policy which product gives at least 7 % IRR. KINDLY GUIDE ME ACCORDINGLY. Im willing to invest atleast a 1 lac/annum for a periof 10-12 years. Kindly help me by sugesting some genuine products which would fulfil my requirements

Hi,

For personalized investment suggestions, you can sign up with our 30-minute Complimentary Financial Plan Consultaion.

Please click the below link to get your appointment to talk with our Certified Financial Planners.

https://www.holisticinvestment.in/complimentary-financial-plan-consultation/

Eye opening!

Thank you